The Coming Decade of Disruption

Dear Investors,

We closed out 2019 on a strong note, and that strength has continued into 2020.

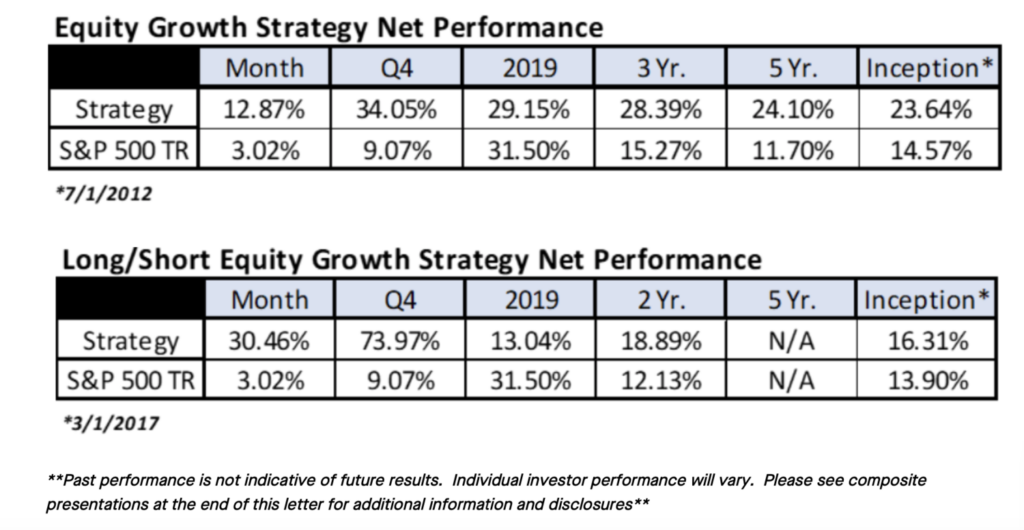

In Q4, our long-only equity growth strategy returned 34.05% (net of fees), vs the S&P 500 total return of 9.07%. Since inception in 2012, the long-only growth strategy has returned 23.64% on an annualized basis (net of fees), vs. the S&P total return of 14.57% over the same period.

Our long/short equity growth strategy returned 73.97% (net of fees) in Q4, versus the S&P 500 total return 9.07%. Since inception in 2017, the long/short strategy has returned 16.31% on an annualized basis (net of fees), vs. the S&P total return of 13.90% over the same period.

Please see here for composite presentations for additional information and disclosures.

As I’ve said before, I believe we’re living though a Cambrian moment. Innovation and new technologies are upending legacy business models, causing significant disruption across several industries. I’m pleased with our performance so far, but I believe the next couple of years are even more ripe with opportunity. Many secular trends are still in the very early innings: Transportation is going all-electric. The oil and gas industry is being displaced by renewable technologies. Legacy IT mainframes are being ripped out and replaced by cloud networks. The pace of technological change is accelerating, creating big winners—but perhaps even bigger losers.

In this paradigm, our firm’s strategy continues to be relatively straightforward: We spend thousands of hours researching these technological shifts, seeking to capitalize on the redistribution of market share by investing in what we believe to be the most innovative disruptors with durable long-term advantages—and, in the case of the long/short fund—taking strategic short positions on those laggard firms whose business models are being disrupted, and whom we believe are poorly positioned for the future.

We do this in a concentrated manner with an understanding that our investments are made for the long-term, and that it may take many months, if not years, for certain themes to play out. We essentially view our strategy like private equity, but utilizing publicly traded securities. We believe our strategy and research process will continue to perform very well over the long-term, however, bouts of volatility should be expected from time to time. It has enabled our strategies to outperform their benchmarks since inception, and allow for you, our investors, to take satisfaction in knowing that you are participating technological revolutions driving towards a more sustainable planet.

But here I will be direct: The next few years are very exciting to me. Based on what I’m seeing on the ground level, certain disruptors are heating up, and I anticipate massive industrial upheaval will begin to play out over the next 1-3 years. Years from now, I anticipate we will look back at the early 2020s as the industrial pivot-point of the 21st century: A time when storied, legacy incumbents began to stumble and fall—and a time when savvy, technological upstarts captured immense market share at an accelerated rate.

That may sound like hyperbole, but I do not think it is. The most consequential of the possible disruptions, and the one I will discuss at length below, is in the automotive industry. It is my strong belief that we are moving to a fully electric transportation system, and Tesla, a core holding, is leading the vanguard. Over the last couple of years, Tesla has become a polarizing investment name on Wall Street. (It has also become one of the most shorted stocks, leading to an avalanche of what we believe to be misinformation—at best—put out by certain elements of the investment community). None of this, however, shocks me. For many years, I watched from a distance as investment analysts and short sellers crowed about Amazon, until many finally capitulated. All the while, I accumulated stock in AMZN—just as we have done with TSLA.

While the growth trajectory will most likely not be linear, we believe over the next few years Tesla’s stock price can grow to be multiples of where it currently stands. Tesla is the dominant leader in multiple industries with massive end markets. More importantly, they are winning on the ground with thousands of customers. I have been a money manager and stock picker for close to 30 years. In my view, Tesla is the best investment opportunity in the market today.

Now, to be clear, I believe this is just the beginning—the second or third inning, if you like. I view Tesla as a disruptor akin to the early days of AMZN or NFLX. The company has been laying the groundwork to turn itself into one of the top 5 most valuable American businesses by 2030. In 2019, Tesla delivered more than 367,000 vehicles—up from 245,240 in 2018, a 50% increase. There is an immense level of demand around the world for Tesla, especially in Asia, and a high level of consumer fidelity to the brand—similar to Apple. Meanwhile, the firm is just beginning its industrial expansion into additional industries (energy and autonomous rideshare among them) and multiple geographies (Europe, Asia) each worth several trillion dollars.

Heading into 2020, there are several potential catalysts that I believe will drive Tesla’s near-term valuation, including S&P 500 inclusion, immense demand in China, and the introduction of the Model Y crossover vehicle into multiple markets. Longer-term, we anticipate a significant valuation step-change once the broader market recognizes Tesla’s considerable lead in autonomy and the long-term viability of its Full-Self Driving robotaxi network.

I view the company as an undervalued growth firm with considerable room for upside in the near-term—and incredible prospects for the long-term. I prefer not to publicly disclose price targets, but my valuation is in line with a few other notable money managers who take a similar long-term view of Tesla’s dominance in the transportation and energy segments. Ron Baron, for instance, believes Tesla will be worth $1 trillion by 2030. Cathie Wood, chief investment officer for ARK Invest, believes Tesla is a $4,000 stock. Depending on certain factors that can play out in the next couple of years—from battery improvements to full-self-driving capabilities—it’s my view that it’s just a question of when, not if, Tesla achieves these valuations.

It is somewhat cliché for investment managers such as myself to castigate Wall Street in yearly letters like these for being overly focused on the short-term. But it does bear repeating that the Wall Street mentality consistently prioritizes short-term earnings over long-term innovation. By and large analyst price targets seem to be a lagging indicator and affected by groupthink – nobody wants to look stupid. After a good quarter, they often boost target prices. After a bad quarter, they often reduce target prices. It’s essentially a mark to market pricing service, in my view. Over time, the truth always wins—but the obsession with short-term performance metrics can lead to volatility in the public markets. In May and June of 2019, TSLA was hit with an avalanche of negative sentiment, leading to a considerable haircut in the stock price. While frustrating for our fund’s performance in the short term, during this period we were able to acquire certain TSLA assets at a significant discount to where they are priced today.

•••••

The auto industry in disruption—some views from the front lines

To put it bluntly: we believe the traditional car industry is in major trouble, and there will be major reckoning within the next 5 years, but possibly much sooner. We anticipate that many investors and shareholders could face immense damages in this transition, which is as significant (and potentially even bigger) than the transition from horse and buggy to cars.

We believe Tesla will not only capture market share lost from current OEM incumbents, but we believe Tesla has the potential to unlock massive new growth opportunities into new tech-enabled categories, from their robotaxi network to their energy storage business. Recently, Tesla became the world’s largest electric automaker based on cumulative sales as it surpassed China’s BYD—even when accounting for the latter’s plug-in hybrid sales. We view the dynamic as increasingly winner-take-most—just as the iPhone captured a significant chunk of the smartphone market within a couple of years after its introduction, we believe Tesla is entering a similar growth trajectory.

At the same time, our research indicates that the new products being offered by incumbent firms such as GM, Ford, and VW to luxury firms like Porsche, Audi, and Jaguar, are considerably inferior: They offer less range, can be more expensive, they do not enjoy the Supercharger network of charging stations, have limited software capabilities, their batteries degrade faster, and so on. The customer has recognized this, leading to incredible market share for Tesla. According to estimates, Tesla now has about 80% of the electric vehicle market share in the United States. Meanwhile, GM—a company that has spent a considerable amount of time in the media talking about its transition to electrification—sold just 16,418 Bolt EVs in 2019—just 4% of the total EVs Tesla sold. This was a major flop, and actually -9% decrease in sales from 2018.

Over my career, I have observed a pattern of incumbent behavior amidst disruption: Management talks publicly about a transition to a new technology while privately pleasing the short-term expectations of Wall Street and its wealthiest shareholders. Since 2015, GM spent over $10 billion on stock buybacks—a sum of money that momentarily increased the company’s EPS, but in our view has otherwise been squandered by management as they lay off employees and close factories amid a slowdown in car sales. We continue to be short GM, and we do not anticipate covering this position in the near-term.

Some individuals in the investment community, as well as the financial media, have spent considerable time and mental anguish speculating over Tesla’s finances, criticizing the company for being unable to generate consistent yearly profits. Eventually, I anticipate they will come to realize that Tesla is doing exactly what Amazon did in its early days: Wide consumer adoption and rapid growth in new markets overseas while improving its production processes, strengthening its automotive gross margins, and expanding its catalogue of higher-margin opportunities (energy storage, OTA updates, etc.). I believe trying to value Tesla on earnings per share at this stage in the company’s growth cycle is foolish and will not help one form a proper long-term financial model for this company. My valuation tools for an early stage growth company like Tesla prioritizes unit sales growth, revenue growth, and gross margins. In other words, we’re looking for top-line growth—and we have much to be pleased about.

Let me break down the Tesla thesis into a few digestible parts.

- Model 3 unit sales have grown at a compound annualized growth rate of 50%, which is truly unprecedented—and growth does not appear to be slowing based upon what we are seeing. Never in the history of this country have I witnessed an advanced manufacturing company (at a multi-billion-dollar scale) grow so quickly, with products at this price point, and without a single dollar spent on advertising. The Model 3 is not only by far the leading EV variant on the market today—it is beginning to outpace more traditional car sales. For example, Tesla sold more Model 3s than Honda sold Accords in the United States. Tesla is in pole position to capture a large chunk of the ~$2 trillion in OEM yearly revenue, and we believe their moat, advanced lead on battery advancements, and expanding production footprint (Giga 3 in Shanghai/Asia and Giga 4 in Berlin/EU) set them up extremely well for long-term production capacity. In many cases, we believe simply driving a Tesla completely changes one’s view on the company.

- As of this writing, TSLA is valued around $90 billion. Within several years, we believe a valuation that is multiples higher than this can be achieved. One of the underlying tenets of our TSLA thesis is our view that Tesla’s engineers’ approach to autonomy(using radar and cameras, not lidar – which is expensive and bulky) will result in them being first-to-market with a truly full-self-driving (FSD) framework that enables a multi-million-car fleet of Tesla Robotaxis, churning out (conservatively) ~$10,000 per year per car in yearly cash flows, and potentially most of the multi-trillion-dollar FSD market. We believe one of the more absurd developments in the autonomy sector is Tesla’s supposed #1 competitor, Google’s Waymo, receiving a private market valuation of $250 billion—before unveiling a fully-functioning, non-geo-fenced product. (More recently some of the banks have sobered up and reduced the Waymo valuation to $100 billion, but it’s still overvalued in our view). Tesla’s advantages in approaching full-autonomy is rather simple: They have hundreds of thousands of cars out in the world vacuuming up data through eight cameras, which is then fed back into Tesla’s neural net operating system that, much like machine learning, is teaching the Tesla FSD system to get better and smarter over time using computer vision. (If you’re curious, we recommend you read MIT’s Lex Fridman’s analysis of Tesla’s lead in autonomy). In our view, Tesla retains an insurmountable advantage.

- Advanced lead in battery chemistry. For the most part, 2170 cells are commoditized –the cylindrical cell casings that aren’t all that different than your average D-size Duracell battery. However, what’s inside those batteries is the key to everything, and from what we’ve seen, Tesla is by far head of the competition. Based on our research and analysis, in the relatively near future we believe their batteries will be free of Cobalt, capable of 1,000,000 miles of recharge capability, ranges up to 500 miles on a single charge, and a faster re-charge time than any other EV variant on the market. We’ll have more information on this after Battery Day in early 2020.

- Expanding energy business. The world is transitioning to renewable energies both because our planet needs to survive, but mostly because the costs of solar, wind, and battery storage have plummeted. On a recent earnings call, Elon Musk mentioned that he believed their energy storage division could one day eclipse automotive revenues. Most analysts in our experience seem to ignore Tesla’s energy business as a sideshow, but we believe that is a mistake. With Tesla’s advanced lead in battery production and design, they stand to capture enormous high-margin cash flows from the Megapack energy storage installations around the world. Already in South Australia, Tesla maintains the largest battery storage plant in the world, and we are tracking multiple utility-scale projects that are unfolding in 2020-2021 that Tesla appears to be primed for mega-contracts.

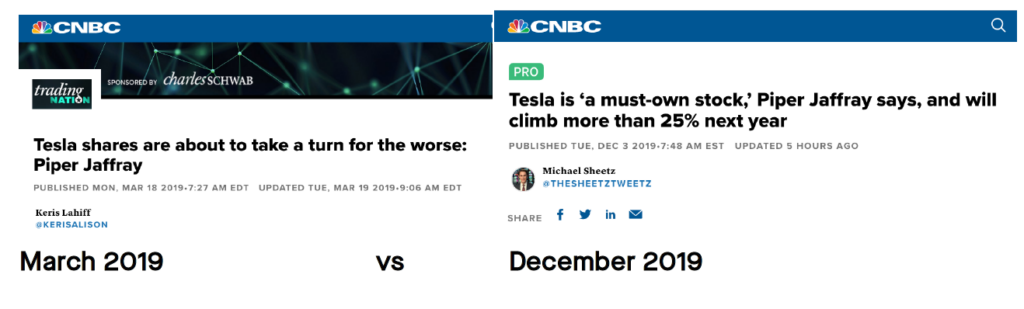

In our view, many Wall Street analysts and investment managers don’t do rigorous analysis, they’re spread thin, they try to utilize shortcuts or comparisons that may not be helpful or practical in reality, and change their targets month to month on Tesla. It’s frustrating, it creates confusion, but ultimately it has provided in 2019 an opportunity to get in at a discount. For example: see below. Goal posts are moved with little analysis, and create virtually no tangible value for actual investors.

•••••

Where else we see opportunity

After Tesla, Amazon continues to be our fund’s second-largest position. Amazon has been in a bit of holding pattern over the past year and a half as it reinvested its cash flows into building out its same-day delivery network, expanding its AWS service offerings, and continuing to reinvest a significant portion of its profits into R&D and serving its customers. That said, despite a slight miss on its earnings in Q3 which caused a bit in a pullback (~10%), I’m optimistic that AMZN can have a breakout year in 2020.

Amazon recently announced a record-breaking holiday sales numbers, which is a testament to the company’s enduring, and improving, customer value proposition. Still, there are several sleeper segments of Amazon’s business that we’re watching closely and that many analysts (in my opinion) have not yet priced into the company, especially Amazon Business – the company’s B2B marketplace. The total addressable market for e-commerce B2B of $1.4 trillion by 2021, according to Bank of America—about double the market for consumer e-commerce. This a lucrative industry that’s currently fragmented, but Amazon Business, in my view, is poised to grab and consolidate a significant chunk of market share in this vertical. To put the Amazon Business growth rate in context— AWS has grown at a 3-year compound growth rate of nearly 50%, but Business has grown at 115%. We are very excited about this long-term.

Netflix, our next largest holding, had a strong Q4 despite some negative sentiment regarding Disney+ and the increase of competition. Truthfully, much of the discussion around competition and Netflix is rather silly—Netflix has an installed base of some 160 million subscribers, with plenty of room left to grow overseas. The churn rate is industry-leading-low and the value proposition is unbeatable: Netflix will create more movies in 2019 than all the major studios combined. The key to winning in streaming content is new and diverse content with a focus on repeatability (such as recurring TV shows). This is what you really need to

“cut the cord.” Our analysis is simply that NFLX continues to do this better than other providers—and they continue to grow subscribers, impressively, at 20+% YoY.

Though smaller positions, we remain long BIDU, BABA, and SPOT. I am particularly enthusiastic about BABA’s growth prospects headed into the New Year. China is the world’s largest e-commerce market—half of all online retail transactions take place in China. BABA’s valuation significantly constrained in 2018, giving us a good opportunity to get in in 2019.

The short side of our long/short fund remained a challenge throughout 2019, in particularly our short positions in several car dealerships, including ABG, LAD, SAH, and PAG. We trimmed our exposure on these shorts, but we continue to have a high level of conviction that these firms will face significant challenges in both the near-term and long-term, with much of their recent valuation growth aided by short-term boosts from acquired revenue, buybacks, and an unsustainable level of subprime consumer finance packages that I anticipate will cause significant issues down the road. As we wrote about in our recent research report, The Big

(Auto) Short, American auto debt has increased by 75 percent since 2009. Worse, serious auto loan delinquencies are now at post-2008 crisis levels. A record 7 million Americans are behind on car payments, according to data released by the New York Fed earlier this year.

The fact is, auto dealers and lenders are behaving much like the mortgage companies leading up to the 2008 crisis—handing out financing to customers who cannot afford the cars and selling the loan packages to unsuspecting investors looking for yield. We initiated a short position in Q4 on Santander Consumer USA, perhaps the most egregious lender of subprime auto finance in our view—according to their filings, they recently verified income on just 3% of loan applicants. We would not be surprised to see some major blowups in 2020 or 2021. In fact, some of the major auto dealerships are now reporting that over 70% of their customers are coming in with negative equity on their vehicles—meaning that roughly three out of four of their customers owe more on their car than the car is worth. Often times, the money they owe on their current car is rolled into the loan for the new car. With little regulatory oversight, the dealers and lenders are simply extended loan cycles to 72 and 84-month loan terms and refinancing their next car with interest rates exceeding 25% — a rate that is illegal in several states.

Another short position we initiated in Q4 was in Arch Coal, the second largest coal company in the United States. We arrived at this short position after spending a significant amount of time researching the renewable energy transition and concluding that we have reached “peak coal”—the point at which the coal industry is facing a terminal decline. The catalyst for this disruption is clear: A precipitous decline in the cost of solar and wind energy, combined with cheaper and more long-lasting battery storage. Renewable energy solutions aren’t just better for the planet—they’re cheaper and more effective at energy creation and storage.

Big picture: I believe our strategy puts us on the vanguard of multiple economic and industrial shifts. It is even more satisfying to know that the companies we choose to own—especially Tesla—are solving global problems around climate change and accelerating the transition to renewable energies. We continue to focus on our core verticals (Energy, Media, Retail, Transportation, IT) but as we grow, we will look to expand our investment universe—we are currently researching utility-scale battery storage investments, as well as some interesting opportunities in space exploration and travel—but more on that in the second half of 2020.

As I’ve said before, it’s is an exciting time to be an investor, and I believe we are positioned extremely well for long-term growth. Thank you for your faith in me and my firm. I truly value your partnership—and I believe we are set up for significant returns heading into 2020 and the next few years.

Best,

Nightview Capital

Founder/CIO Arne Alsin

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index.

Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-20-01