To download this letter as a PDF, click here.

For most recent Fund Holdings and Fund Performance, please visit the Fund website.

Dear Shareholders,

For over a decade, our team’s core philosophy has been to identify the most transformative secular and technological trends shaping the future—and invest in the companies with the most compelling value propositions. It began with e-commerce and cloud (AMZN), digital streaming (NFLX), and continues now with AI-driven autonomy (TSLA, GOOGL).

In this letter, we will present our view that autonomous transportation represents one of humanity’s most pivotal shifts in technological achievements.

It is a change in computing paradigms that could rival the introduction of the railroad, aviation, automobiles, and the Internet. These revolutionary innovations didn’t just disrupt industries; they redefined global economies, unlocked unprecedented efficiencies (and profits), and transformed the way we live.

And perhaps most importantly: we do not believe the market is accurately pricing this opportunity. Yet.

This is a “pound-the-table” moment for us. We believe we mustbe positioned for the rise of autonomy; sitting on the sidelines would amount to professional malpractice. Our portfolios and The Nightview Fund ETF (NYSE: NITE) express this theme as a cornerstone of our current positioning.

Sign up for our weekly insights below.

In the past 12 months, our research leads us to believe—with a high degree of confidence—that self-driving cars have reached a major turning point. It’s no longer just another R&D line-item on an income statement. It’s real. For long-term investors looking to capitalize on artificial intelligence, the biggest opportunity lies in autonomy: self-driving vehicles (and humanoid robots) could transform industries like transportation, logistics, healthcare, real estate, and insurance.

Tesla (which has been a core holding since 2016) represents a significantly larger weighting in our portfolios due to our belief of its immense market opportunity—especially relative to Waymo. With its scalable, vision-based Full Self-Driving (FSD) system, Tesla, in our opinion, has created a vast, proprietary technological edge—which has now resulted in a significant relative unit economic edge.

Tesla is a divisive company led by an even more divisive leader. But beyond the headlines, we believe Tesla has quietly produced one of the most unassailable and lucrative moats of the modern business era. The proprietary nature of their FSD computer and neural net architecture—combined with their global fleet collecting real-world data—has created a self-reinforcing product development cycle. We believe the nature of this dynamic could keep Tesla ahead indefinitely on an exponential curve: today in transportation—and in the future with robotics. These developments could catapult Tesla’s market value over time.

If their execution proves successful—and we anticipate it will—today’s valuation (at roughly $800 billion) offers a compelling risk/reward for investors with (1) a long-term outlook and (2) an appetite to participate in perhaps the most consequential business and technology story of the late 2020s and early 2030s.

The trillion-dollar answer to AI’s biggest question

As we recently discussed in The Trillion-Dollar Answer to AI’s Biggest Question, we believe self-driving vehicles will be the first major real-world application of AI. Many still think widespread adoption is years, if not decades, away, but we see signs that it’s much closer than many expect.

The history of autonomous vehicles helps explain some of this underestimation—and the accompanying disappointment. Like many breakthrough technologies, AVs got an early push from DARPA, specifically through the DARPA Grand Challenge. This spurred rapid development, and within a few years, teams completed fully autonomous drives. By the mid-2010s, some thought autonomy would be widely adopted relatively quickly.

However, the final “edge cases” proved hard to solve, leading to fading market optimism. As long-time Tesla shareholders, we recognize that Elon Musk has consistently missed his ambitious deadlines for achieving full autonomy, which has fueled skepticism in the market. Yet, we see this as a distinctive opportunity. Despite the missed timelines, Musk has a track record of delivering.

And we believe the long-awaited breakthrough is finally within reach.

Slowly, then suddenly

Over the past year, we’ve seen both Tesla and Waymo make significant strides, each using very different technical approaches. Waymo relies on a sophisticated sensor suite, most notably using expensive LIDAR and detailed mapping. In contrast, Tesla has focused on a vision-based system with end-to-end neural processing instead of hardcoded mapping.

Two major milestones were reached this year in the autonomous vehicle market.

- Waymo achieved meaningful market penetration with its full-scale autonomous ride-hailing service, successfully overcoming regulatory, consumer, and technical barriers.

- At the same time, Tesla developed a fully scalable, end-to-end AI system featuring an economical hardware solution, which we believe has the potential for broader adoption.

Notably, Waymo has now completed a key proof of concept that the industry previously lacked: paying customers for a robotaxi ride-hailing system.

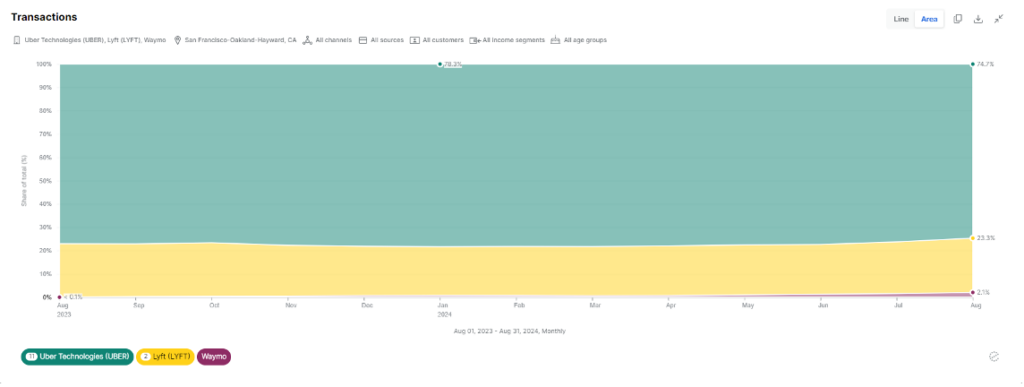

It operates a fully autonomous ride-hailing service in San Francisco (and 2 other major U.S. cities), providing 100,000 rides per week. The demand has been strong, with Waymo’s market share in the city’s ride-hailing sector increasing from 0.1% to 2.1% in just one year, a testament to growing consumer confidence in autonomous technology, according to data provider Earnest.

Source: Earnest

We have reached proof of concept, and the three major concerns—technological viability, regulatory hurdles, and consumer demand—have been addressed. As investors, this is an exciting time. The technology is proven, adoption is underway, and we are still in the early stages before we may see growth and full market value realization.

Tesla’s approach, on the other hand, could be even more transformative to the global economy, in our opinion: an opportunity set that is several orders of magnitude greater than Waymo’s more niche approach.

Tesla’s AI edge: scaling FSD through comprehensive learning and simple hardware

Some context is important to understand Tesla’s approach to autonomy.

Unlike virtually all of their competitors, Tesla chose to pursue an innovative path: simple hardware—paired with more complex software. The ultimate premise was that to create a truly scalable system, the cars simply needed to mimic a human driver.

Tesla initially made rapid progress. After introducing “Autopilot” in 2014, the company rolled out features like autosteer and traffic-aware cruise control in 2015, powered by Mobileye hardware and software. The early sensor suite included a camera, forward-facing radar, and 12 ultrasonic sensors, which worked reasonably well on highways.

However, Tesla soon realized that this approach had limitations, especially as complexity increased with edge cases. In 2016, the company parted ways with Mobileye and began developing its own system in-house. This marked a pivotal shift away from sensors and towards a vision-only future. It also demonstrated Tesla’s early faith in emerging artificial intelligence technologies.

Over the next few years, Tesla introduced new features, such as Navigate on Autopilot, but also entered what some have called the “boy who cried FSD” era, characterized by overly optimistic timelines and unfulfilled promises from CEO Elon Musk. This period damaged the market’s belief in both Musk—and Tesla’s FSD project.

This is where it gets interesting. Despite the overpromising, and increasing skepticism, real progress was being made. At Tesla’s 2019 Autonomy Day, Pete Bannon revealed Tesla’s significant commitment to developing its own inference computer processors (Hardware 3.0), a crucial step toward solving hardware challenges for autonomous driving.

This shift was overshadowed by yet another round of unrealistic timelines, but the revelation, in our view, was monumental.

In 2020, Tesla launched the FSD Beta program, which opened the flood-gate of real-world data. A year later, in 2021, Tesla engineers transitioned the system to a vision-only architecture when it removed radar from its Model Y and Model 3 vehicles. Again, these decisions were broadly met with market skepticism. But they were propelled by Musk’s belief that artificial intelligence-based autonomy would ultimately be superior to sensor-based approaches.

With Hardware 4 released in January 2023—which offered more computing power than previous iterations—we believe Tesla set the stage for rapid future improvements in the quality of its FSD software. In 2024, Tesla released version 12 of its FSD Beta, marking a dramatic shift from hard-coded heuristics to an end-to-end neural network-based system. In our personal testing of FSD, our team noted a significant increase in the quality of the overall driving experience over the last six months.

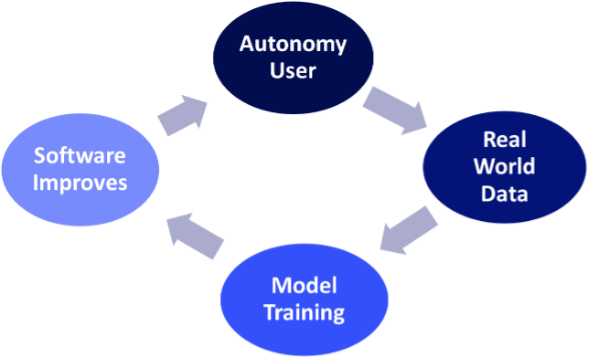

We believe this quality could improve exponentially. Every Tesla equipped with FSD hardware functions as a data-gathering node, continuously sending back high-fidelity information on driving conditions, edge cases, and vehicle performance. This system gathers billions of miles of real-world driving data, which we believe is more valuable than simulation data.

The more cars on the road, the more these scenarios are captured, creating an endless feedback loop of constant improvement.

Tesla’s use of this vast data set is core to its lead in the race towards autonomy, in our view. Its system is a learning machine. These models continuously learn from new data and improve their predictions and responses in real-world conditions. Since Tesla’s fleet is constantly expanding, the system is continuously fed with an exponentially growing set of data.

As long as there are no fundamental constraints in compute power—namely the availability of GPUs or advanced custom chips like Tesla’s Dojo supercomputer—the system’s predictive capabilities can theoretically scale exponentially.

More simply: we believe that the more data the FSD system consumes, the better it becomes, iterating and improving with each additional mile driven. With scalable GPU resources, Tesla’s architecture can train increasingly sophisticated neural networks, allowing for a potentially infinite amount of improvement. This creates a self-reinforcing cycle where more data drives better models, which in turn leads to even more data being collected as the cars operate in more autonomous conditions.

Source: Nightview Capital

In our view, this is what positions Tesla to scale its autonomous driving technology far beyond current competitors, who may lack both the data and the compute resources to keep up.

To recap, here is our broad perspective on Tesla’s large—and growing—moat:

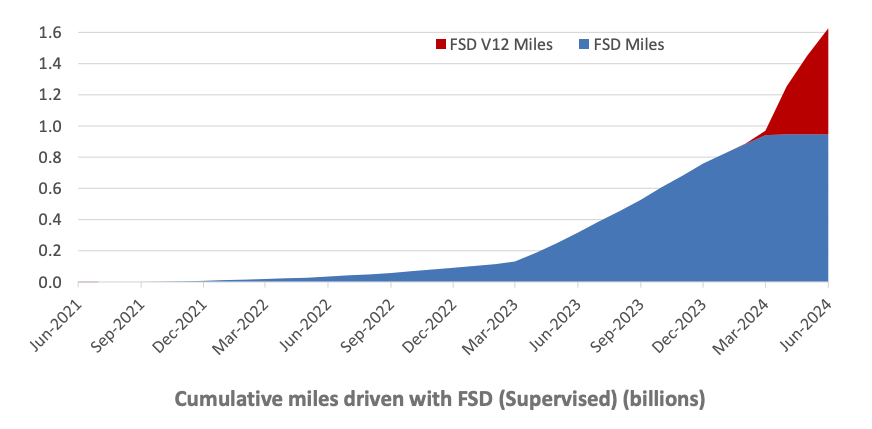

- A large and ever-growing fleet of FSD enabled vehicles to capture a large and ever-growing amount of real-world data. At the end of Q2 2024 the cumulative FSD miles driven was around 1.6 billion.

Most importantly, the pace of growth has accelerated since the advent of FSD V12 (the first end-to-end AI FSD version from Tesla). Real world data is paramount, and Tesla can have an advantage in this regard.

Source: Tesla Q2 2024

- Tesla’s data is fed into its software model training. This is likely operating at roughly 65,000 H100 GPU equivalents and growing, based on Tesla’s roadmap for compute capability (see below). This gives Tesla a significant advantage over legacy OEMs, whose expertise and access to cutting-edge compute power are far behind.

Currently, most of Tesla’s training capacity relies on off-the-shelf NVIDIA GPUs. However, Tesla’s DOJO architecture could change this dynamic in the future. Though it remains to be seen whether DOJO will outperform other AI training computers, DOJO is at the very least an attractive asset by way of diversifying Tesla’s compute supply.

The key takeaway is that Tesla has rapidly increased its AI training capacity, allowing it to process and refine vast amounts of real-world driving data. This approach is highly scalable and allows Tesla to continually improve its autonomous systems with exponential growth in data and compute power.

Source: Tesla Q2 2024

- The software model is then deployed to Tesla’s proprietary inference computers in the fleet. We expect Tesla to begin installing its next generation purpose-built inference computers in its vehicles in 2025, aiming to provide a leg up in on-device AI processing.

As with many elements of Tesla’s autonomy strategy, the vehicle-based inference compute has evolved over several years. Since 2019, all Tesla vehicles have been equipped with at least Hardware 3 (HW3), ensuring they are capable of processing advanced autonomy workloads.

Source: Nightview Capital / Company reports

This has produced our favorite kind of moat: High capital expenditures (i.e. CapEx) + Long Implementation Time: an advantage we believe no legacy OEM or upstart can achieve.

The market’s reaction to Tesla’s missed deadlines has lulled many into a trough of disillusionment, assuming full autonomy is still far off. In our view, Tesla’s progress is much closer to completion than widely anticipated.

In our opinion, this looming technological certainty will likely lead to a rapid surge in value as the breakthroughs become undeniable.

Waymo’s approach to autonomy: reliable but limited

While we believe Tesla will ultimately capture significantly more market share in autonomy than its peers, Waymo’s success should not be ignored.

First, a quick overview of Waymo’s technical approach: Waymo vehicles rely on a high-tech sensor suite to map and perceive their surroundings. The latest sixth-generation Waymo vehicle features 13 digital cameras, 4 lidar sensors, 6 radar sensors, and an array of microphones mounted externally to collect data for processing by the onboard computer. This sensor suite offers overlapping, redundant coverage with up to 500 meters of visibility.

The onboard computer processes these sensor inputs and localizes the vehicle within a highly detailed map of the surrounding urban environment. This map, constantly updated by Waymo vehicles and Google Cloud servers, anchors Waymo vehicles in their environments, enabling them to navigate roads and lanes.

This approach requires Waymo to first map an urban area before launching its autonomous service, resulting in a slower rollout in geofenced cities. It requires months or even years of learning, testing, and training before driverless vehicles are publicly deployed.

Currently, Waymo offers fully autonomous ride-hailing in Phoenix, San Francisco, and Los Angeles. After millions of rider-only miles, Waymo’s system has proven to be safer than human drivers. According to company reports, Waymo vehicles have contributed to 84% fewer airbag deployments, 73% fewer injury-causing crashes, and 48% fewer police-reported crashes compared to the average human driver in the four cities where 22 million rider-only miles were logged.

Waymo has demonstrated technology that is significantly safer than the average human driver—and will, in our view, only continue to improve. It’s a true proof of concept that cars will drive without humans.

The opportunity: unlocking new revenue streams

So, practically speaking, what does this mean in terms of economic opportunity?

In particular, we envision three key revenue streams for providers of autonomous software:

- Revenue from Direct Software Sales to Consumers: As the utility of autonomous driving features increases, direct software sales to consumers could increase dramatically. These sales could encompass one-time purchases, subscriptions, or pay-per-use models for autonomous capabilities and continuous software updates.

- Revenue from Licensing Fees to Other OEMs / Fleet Operators: OEMs with proprietary autonomous technologies—especially Tesla, in our view—stand to gain substantial revenues through licensing these technologies to other manufacturers and/or fleet operators. Our view is that Tesla, specifically, has a ripe business opportunity through licensing its FSD software—a subject we covered in depth here. At a high level, we believe Tesla is the ultimate real-world AI robotics company.

- Revenue from Ride-Hailing Services: By eliminating driver costs and optimizing fleet operations, autonomous ride-hailing services could drastically reduce operating costs—and increase profitability of AV ride-sharing services, which we believe could generate multiple trillions in revenue annually.

All of these changes have the potential to increase the productivity component of GDP and thus increase overall wealth. The Internet revolutionized how information is transferred by dramatically lowering the frictions involved in moving data from A to B.

Autonomy has the ability to similarly revolutionize how people and things move around the world, reducing friction.

The next computing paradigm

The market, in our view, has yet to fully price in the scale of this opportunity.

This is an important moment for investors. We want to stay positioned ahead of the curve.

Autonomy is not a far-off dream—it is here, and the growth potential is massive.

Sincerely,

The Nightview Capital Team

—

See below for a brief overview of each portfolio company in The Nightview Fund (NITE).

Positions below are listed alphabetically and reflect NITE holdings as of October 01, 2024.

The most recent holdings information and weighting can be found on the NITE website.

Current and future holdings are subject to risk. Fund holdings are subject to change without notice and are not buy/sell recommendations.

Weightings in NITE as of 10/01/2024

ABNB (Airbnb) — 5.5%

Why we own it: As the leader in home-sharing and travel experiences, Airbnb is well-positioned to capitalize on a decentralized world, with strong management driving future growth.

Overview: While the business has some cyclicality, particularly following top-line growth and margin expansion driven by post-COVID fiscal discipline, we believe Airbnb has a long runway for growth. In Q2, gross nights booked in expansion markets outpaced core markets, which we view as a critical trend. We’re bullish on increased international travel throughout the decade and the continued ‘shrinking’ of the world. As travel markets evolve, we anticipate cheaper and more exotic destinations will grow in popularity, creating opportunities for arbitrage. The Experiences segment also offers additional revenue potential, and we are closely monitoring its progress. We anticipate re-accelerated growth in FY 2025. With strong free cash flow generation, we find Airbnb’s valuation highly compelling.

AMZN (Amazon) — 12.0%

Why we own it: We believe the company offers strong compounding potential for years to come. Amazon’s e-commerce platform is undervalued in our opinion and poised for margin expansion. AWS remains a key asset, benefiting from the growing consumption of data.

Overview: AWS posted a re-acceleration in top-line growth, up 19% in Q2 2024, while maintaining stable margins. There’s strong demand for cloud services, and Amazon’s ‘land grab’ approach through aggressive investment is something we support. We also believe in the long-term potential of Amazon’s advertising segment, which grew by 20% in Q2. As logistics evolves with AI advancements like autonomous delivery and humanoid robots, Amazon is well-positioned. Cloud services, though requiring capital investment, will continue to benefit in this environment. For more insights, see our Q2 2024 letter.

AAPL (Apple) — 4.7%

Why we own it: Apple’s device and software ecosystem is uniquely positioned to capture new computing platforms, such as on-device AI and extended reality. AI features could catalyze a delayed upgrade cycle and further embed users in the Apple ecosystem.

Overview: Over time, we believe new functionalities from “Apple Intelligence” will encourage iPhone and iOS users to upgrade to newer hardware. We expect Apple’s AI features to follow a similar trajectory. Our approach aligns with investing in companies that have dominant platform positions.

BLK (BlackRock) — 4.7%

Why we own it: BlackRock holds an unrivaled position in the global asset management industry, making it a leader among its peers. With $10.6 trillion in assets under management (AUM), BlackRock possesses significant advantages in terms of economies of scale, pricing power, and its ability to influence the market.

Overview: We believe the reallocation of assets from money market funds to equities will present growth opportunities as the new interest rate cycle begins. BlackRock’s industry-leading position in ETFs, its Bitcoin ETF’s rapid success, and the integration of Preqin offer significant potential. We believe Preqin will help unlock private market opportunities that were previously fragmented and difficult to access, setting the stage for long-term revenue growth and diversification.

DKNG (DraftKings) — 4.7%

Why we own it: DraftKings is a pure-play on the U.S. online sports betting (OSB) market, with significant growth potential as legalization expands. The company has a proven track record of entering new markets successfully and increasing profitability in mature ones.

Overview: DraftKings continues to show impressive growth in mature markets, while maintaining strong potential for organic expansion as OSB legalization expands to more U.S. states. While half of the U.S. population is still without access to OSB, we expect this to change, providing tailwinds for growth. Monthly unique players (MUPs) reached 3.1 million this quarter, up from 2.1 million last year. New OSB and iGaming customers have grown 80% year-over-year, while customer acquisition costs have decreased by 40%.

GS (Goldman Sachs) — 4.3%

Why we own it: In our view, Goldman is the preeminent leader in investment banking and is well-positioned to capitalize on increased M&A activity. We expect long-term cost reductions as the firm incorporates more technology into its processes.

Overview: After an extended period of investment banking inactivity, Goldman’s profits grew by 1.5x in Q2, aligning with our thesis of an upcoming M&A cycle. Strategic moves like exiting consumer banking and refocusing on wealth management are encouraging, as deal flow continues to improve. The wealth management division is a stable complement to investment banking, providing a strong platform for long-term growth.

GOOGL (Alphabet) — 3.4%

Why we own it: Google’s dominance in search has created an historically valuable asset. Despite recent concerns about generative AI taking market share from Search, we believe Google’s AI efforts are accelerating. In addition, Google Cloud, YouTube, and Waymo provide diverse, high-quality growth avenues. In particular, we believe the market underestimates the long-term opportunity for Waymo (see analysis above).

Overview: Google posted 14% year-over-year revenue growth in Q2, driven by Search. Early signs of AI’s impact on the business are promising. Gemini, Google’s AI platform, is now integrated across nearly all of Google’s key services, including Search, YouTube, Play, and Chrome. With Google Cloud growing 29% year-over-year and Waymo delivering 100,000 rides per week in 3 major U.S. cities, Google continues to diversify its business. We view Waymo as a high-potential growth driver beyond Google’s core.

H (Hyatt) — 6.2%

Why we own it: Hyatt is a key player in our global travel theme, boasting a strong brand and an asset-light business model. This agility makes Hyatt well-positioned to capitalize on a favorable post-pandemic acceleration of travel.

Overview: Hyatt is transitioning fully to an asset-light model, with 76% of its earnings now coming from franchising and management. This shift provides more predictable revenue and growth opportunities. The global travel market remains strong, and Hyatt’s robust pipeline of new rooms positions the company for industry-leading growth. The sale of assets has improved revenue predictability and strengthened the balance sheet.

LVS (Las Vegas Sands) — 5.6%

Why we own it: We believe in the growth potential of the Macao and Singapore gaming markets, with Las Vegas Sands focused entirely on these regions. The company is well-positioned to benefit from an extended growth cycle, fueled by increasing wealth in Asia.

Overview: While Singapore has performed impressively, Macao’s recovery has been slower. However, we are confident in the long-term potential of Macao as property upgrades and room availability return to normal. With a strong cash position and ongoing growth in Singapore, we see LVS as an attractive value play.

META (Meta) — 2.5%

Why we own it: Meta’s apps—Instagram, Facebook, WhatsApp, and Messenger—reach nearly half of the world’s population daily, making it one of the most powerful advertising platforms globally. Meta’s long-term investments in AR and AI also create significant long-term optionality for a resurgence of top-line growth.

Overview: Meta’s core platforms are thriving. In Q2, ad pricing increased 10%, and Meta continues to deliver growth. Whatsapp and Threads are showing strong user engagement, with 100 million U.S. DAUs for Whatsapp and 200 million global users for Threads. Meta’s AI capabilities, including PyTorch and the Llama AI model, often go underappreciated. Additionally, Meta’s Ray Ban AI glasses have been a surprise hit, and Project Orion represents its future in smart wearables, where we believe Meta could lead.

MGM (MGM Resorts) — 4.0%

Why we own it: We remain bullish on Las Vegas’s growth potential, with MGM as a key player. MGM’s premium Macao properties also provide long-term upside.

Overview: MGM’s revenues continue to grow, and we are encouraged by developments such as The Sphere and high-speed rail in Las Vegas. The company has reduced its share float by 40%, and its Macao properties, while not fully recovered, are performing well. We’re optimistic about long-term growth in both markets.

MS (Morgan Stanley) — 4.4%

Why we own it: We believe a lower interest rate cycle will lead to a more favorable borrowing environment, driving up M&A activity and financial transactions. Broadly speaking, we believe that MS is positioned to benefit from global financialization.

Overview: Morgan Stanley has seen a notable increase in M&A deal flow, with investment banking fees up 51% year-over-year in Q2. We expect further growth in wealth management, and long-term gains through the firm’s use of technology to reduce expenses. International growth, particularly in Asia and the Middle East, is also promising.

NFLX (Netflix) — 2.1%

Why we own it: Netflix remains the dominant global streaming platform with strong growth potential, particularly in diversifying revenue streams through advertising.

Overview: Netflix’s focus is shifting to advertising monetization, with ad-tier membership growing 34% quarter-over-quarter. The company is working to enhance its in-house ad-tech to address demand constraints. Operating leverage remains strong, and the NFL slate is expected to boost ad potential. With subscriber growth continuing and margins improving, we believe Netflix is well-positioned for long-term growth.

QCOM (Qualcomm) — 5.5%

Why we own it: Qualcomm is a leader in mobile processors and communications modems, making it a critical player in the smartphone market and poised to capitalize on IoT, automotive, and PC growth.

Overview: Qualcomm’s core smartphone business remains vital, though growth opportunities in IoT and automotive are increasingly important. Qualcomm’s chips, known for power efficiency, are in high demand across industries. We are particularly excited about Qualcomm’s role in Meta’s Orion AR glasses and the growing automotive compute platform.

TSM (Taiwan Semiconductor) — 4.7%

Why we own it: Taiwan Semiconductor is the global leader in advanced chip manufacturing, producing the most power-efficient transistors needed for AI and rearchitected data centers.

Overview: TSMC’s unmatched engineering talent and capital-intensive operations create a deep moat in the semiconductor industry. Demand for its 5nm and 3nm chips remains robust, with Apple and Nvidia securing much of its production capacity. TSMC’s ability to produce the world’s most advanced chips gives it significant pricing power in the global semiconductor supply chain.

SCHW (Charles Schwab) — 4.2%

Why we own it: Charles Schwab is the largest retail broker in the U.S. by active accounts. As the Fed begins a rate-easing cycle, Schwab’s asset-gathering business is set to thrive.

Overview: Schwab’s recent decision to wind down banking operations will reduce capital requirements and allow the company to focus on its core brokerage business. Concerns around cash sorting should ease as rate-easing encourages more investor capital to flow into equity and credit markets. Despite some executive changes, Schwab remains well-positioned for a financial rebound.

Tesla – 16.0%

Why We Own It: We have long believed Tesla retains strong first-mover advantages in transportation electrification, real-world artificial intelligence, and battery energy storage deployments. As we explored in this Q3 Letter, we believe that Tesla’s innovative approach to autonomous driving—leveraging its Full Self-Driving (FSD) system—positions the company at the forefront of one of the most significant technological shifts in modern history. With a growing fleet of vehicles collecting real-world data and scalable AI capabilities, we believe Tesla is positioned to lead the race in autonomy, providing a compelling long-term investment opportunity. Our conviction lies in Tesla’s potential to dominate this transformative space that has the potential to deliver substantial returns over an extended period of time.

Overview: Our thesis on Tesla centers around its technological leadership in AI-driven autonomy, which we believe has now reached a critical inflection point. We believe that Tesla’s vision-based FSD system, combined with its data-driven neural network architecture, creates a significant competitive edge over traditional sensor-heavy approaches. The real-world data collected by Tesla’s global fleet enables continuous improvements to its autonomous driving software, resulting in a powerful feedback loop that accelerates its learning and capabilities. We see this as a pivotal opportunity that could transform industries and unlock massive economic value, making Tesla a cornerstone in our long-term portfolio strategy.

Wynn (Wynn Resorts)—5.1%

Why we own it: Wynn’s premium properties in Las Vegas and Macao are undervalued, and we believe they will benefit from long-term growth in global gaming.

Overview: Wynn’s Las Vegas properties continue to perform well, while Macao’s recovery remains slow. However, we’re optimistic about Wynn Al Marjan in the UAE, which can present a game-changing opportunity. Overall, Wynn’s revenue is up 9% year-over-year, and we remain confident in the long-term growth of both the Las Vegas and Macao markets.

The Nightview Fund (NITE) Top 10 Holdings:

| Company | Ticker | Percentage % |

| TESLA INC | TSLA US | 16.0 |

| AMAZON.COM INC | AMZN | 12.0 |

| HYATT HOTELS-A | H | 6.2 |

| LAS VEGAS SANDS | LVS | 5.6 |

| AIRBNB INC-A | ABNB | 5.5 |

| QUALCOMM INC | QCOM | 5.5 |

| WYNN RESORTS LTD | WYNN | 5.1 |

| BLACKROCK INC | BLK | 4.7 |

| DRAFTKINGS INC | DKNG | 4.7 |

| TAIWAN SEMIC-ADR | TSM | 4.7 |

Disclosures

Investors should consider the investment objectives, risks, and charges and expenses of the Fund(s) before investing. The prospectus contains this and other information about the Fund and should be read carefully before investing. The prospectus may be obtained at (866) 666-7156.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

Past performance is no guarantee of future results.

Investing involves risk, including loss of principal. There is no guarantee the fund will achieve its investment objective. As an actively-managed ETF, the fund is subject to management risk, Equity Securities Risk, Market Risk, Mid-Cap Company Risk, New Fund Risk, Operational Risk, Sector Risk, Small- Cap Company Risk, Smaller Fund Risk, Trading Risk, Value Investing Risk.

Non-Diversification Risk. Investment in the securities of a limited number of issuers or sectors exposes the Fund to greater market risk and potentially greater market losses than if its investments were diversified in securities and sectors. Issuer-Specific Risk -changes in the financial condition or market perception of an issuer may have a negative impact on the value of the Fund, and this risk may be exacerbated but by the relatively small number of positions that the Fund holds.

Secondary Market Liquidity Risk. Shares of the Fund may trade at prices other than NAV. As with all exchange traded funds (“ETFs”), Fund shares may be bought and sold in the secondary market at market prices. The trading prices of the Fund’s shares in the secondary market generally differ from the Fund’s daily NAV and there may be times when the market price of the shares is more than the NAV (premium) or less than the NAV (discount). This risk is heightened in times of market volatility or periods of steep market declines. Additionally, in stressed market conditions, the market for the Fund’s shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings. When an ETF is first launched, it is unlikely to have immediate secondary market liquidity. There is likely to be a lead market maker making markets of significant size, but it is unlikely there will be many market participants on day one of trading. This lack of secondary market liquidity may make it difficult for investors to transact in Fund shares in the market, and the market price consequently may deviate from the Fund’s NAV. As the Fund begins to trade and as client interest increases, more and more market participants buy or sell shares of the Fund and secondary market liquidity will grow. While all ETFs can be held for prolonged periods or intraday, some ETFs experience more secondary market trading than others.

New Fund Risk. The Fund is newly formed, which may result in additional risk. There can be no assurance that the Fund will grow to an economically viable size, in which case the Fund may cease operations. The Fund may be liquidated by the Board of Trustees (the “Board”) without a shareholder vote. In such an event, investors may be required to liquidate or transfer their investments at an inopportune time.

Early Close/Trading Halt Risk. Growth Investing Risk. To the extent that the Fund invests in growth- oriented securities, the Adviser’s perception of the underlying companies’ growth potentials may be wrong, or the securities purchased may not perform as expected.

Large or Mega-Cap Company Risk. The Fund will invest a relatively large percentage of its assets in the securities of large-capitalization and/or mega-capitalization companies. As a result, the Fund’s Nightview Capital, LLC | info@nightviewcapital.com | (866) 666-7156 Q3 2024– The Nightview Fund (NITE) performance may be adversely affected if securities of large capitalization companies and/or mega- capitalization companies underperform securities of smaller-capitalization companies or the market as a whole. The securities of large-capitalization companies may be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. Limited Authorized Participants, Market Makers and Liquidity Providers Risk. Because the Fund is an ETF, only a limited number of institutional investors (known as “Authorized Participants”) are authorized to purchase and redeem shares directly from the Fund. In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occurs, the risk of which is higher during periods of market stress, the Fund’s shares may trade at a material discount to net asset value (“NAV”) and possibly face delisting: (i) Authorized Participants exit the business or otherwise become unable to process creation and/or redemption orders and no other Authorized Participants step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Nightview Capital, LLC | info@nightviewcapital.com | (866) 666-7156

20241003-3901411