Long-Term Investing in Disruption

Dear Investors,

While it was a tough quarter on paper, we continue to like our positioning for the long-term and have made no major changes. I think we’re no longer simply entering—but accelerating into—a period of massive technological shifts and upheaval, and we believe that our portfolio continues to position us on the cutting edge of the innovation and growth curve. We view our companies—from Amazon to Netflix to Tesla, as well as a new company added to the portfolio this quarter, Zillow—as innovative leaders in their respective categories and expect them to force incumbent competitors into organizational and structural chaos (if they haven’t already).

Please see here for composite presentations for additional information and disclosures.

The recent downturn in performance was principally attributed to the avalanche of attacks on TSLA that have deflated the company’s share price. I’ll dive deeply into Tesla in a moment, but in terms of intrinsic, long-term business value, competitive advantages, and customer approval— we see our companies (and especially TSLA) performing incredibly well on the ground level. There is no change in our view from the beginning of this year regarding Tesla, or any of our core positions, including AMZN and NFLX, which we plan to hold as we have since our initial investments in 2012 and 2014 respectively.

Stock quotes can diverge from reality for a period of time and we believe Tesla is a perfect example of this: In our view, the company is worth far more than the stock quote currently suggests. As long-term investors, we have the advantage of time and patience. Despite the decline in the stock price, we are steadfast in our conviction. We see no reason why we can’t make several multiples on our Tesla investment over the next five years from current levels. According to my valuation analysis, right now TSLA should be worth several multiples of its current share price. The company competes in massive, trillion-dollar end markets, and it has an unbelievable technology-enabled lead on the competition. The value proposition they provide in the automotive space is truly unprecedented from our perspective.

Frankly, our position in TSLA today reminds me of AMZN five years ago. In January 2014, AMZN was trading at roughly $400. By May 2014—after AMZN missed Wall Street earnings targets by a few points—some investors began to panic that the company would never turn a profit—and AMZN’s stock price slid to the $280s. This divergence represented a decline of nearly 30% in market value in a span of less than six months. Was the company “worth” 30% less because of a couple of missed EPS targets? Of course not. (Imagine the criticism you would have received if you suggested you could make ~5x in just 5 years at January 2014 AMZN prices? Probably the same backlash that comes from making the same statements about Tesla today)

And yet, the groupthink logic among many on Wall Street in 2014 became a self-fulfilling prophecy—that Amazon was structurally unprofitable and was overvalued. Naturally, the financial media, which goes wide on stocks but not terribly deep, ran a series of negative stories (e.g. “NYTimes: Amazon’s Shrinking Profit Sets Off a Seismic Shock to Its Shares), which only helped fuel further decline in the share price as panic metastasized among retail investors.

By spring of 2014, some money managers, notably David Einhorn (who was short AMZN then—and short TSLA now), jumped on the Amazon-bashing bandwagon, and famously called AMZN a “bubble” stock in mid-2014. “We are witnessing our second tech bubble in 15 years,” he famously declared.

Well, that didn’t happen. Since Einhorn’s bubble call, AMZN shares are up roughly 600%. And ultimately, that period would come to be known as a relatively small blip on an otherwise incredible growth trajectory. Most couldn’t see the forest through the trees or look beneath the surface and recognize what Amazon was doing – setting itself up for future profitability by investing for the long-term. Since then, they have been consistently beating earnings estimates and in Q1 2019 AMZN recorded a $3.6 billion profit, and they have become a clear category leader in cloud computing and e-commerce. That number shouldn’t be a surprise for those who eschewed surface level analytics and took a deep dive into what they were doing.

Patience—and a thorough understanding of the underlying intrinsic business value, competitive advantage, and moat—was key to holding shares in a downturn. As Jeff Bezos later said in his 2014 shareholder letter: “We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions.” This kind of talk from CEOs is music to my ears and should be for all long-term investors.

The situation of TSLA in 2019 is remarkably similar to AMZN in 2014: Profitability concerns, considerable short-seller pressure, panicked media reports, and a general short-sighted approach to long-term business valuation have all led to a slide in share price of roughly 30% in the first half of the year.

I view Tesla as a freight train traveling 5 miles ahead of the competition—and accelerating. In my opinion, it’s a must-own for the next 3 to 5 years at least, and I expect great things from this company. I believe they’re far ahead in battery (almost 2x better in our view with the gap increasing), software, microprocessors, Superchargers, and we have an installed base of roughly 500,000 cars.

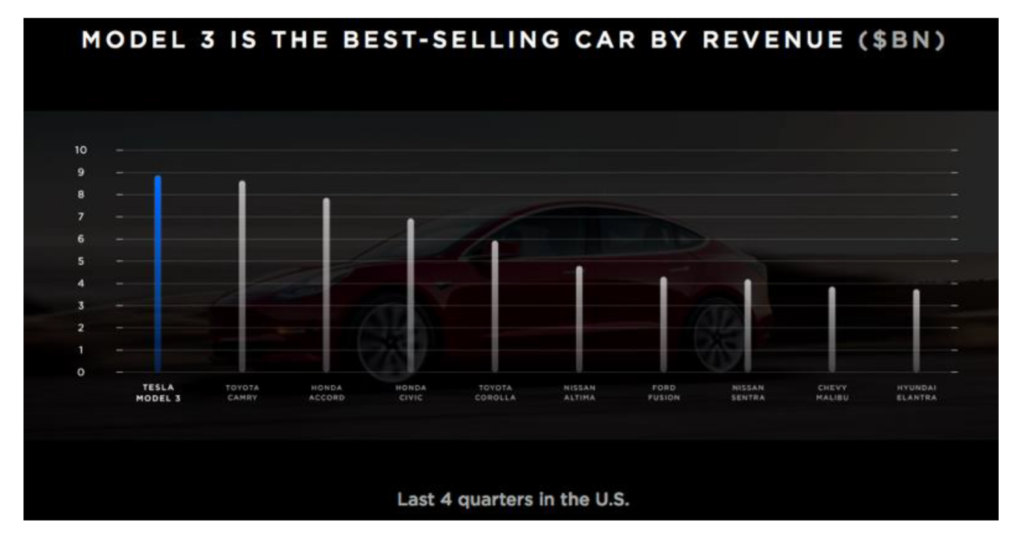

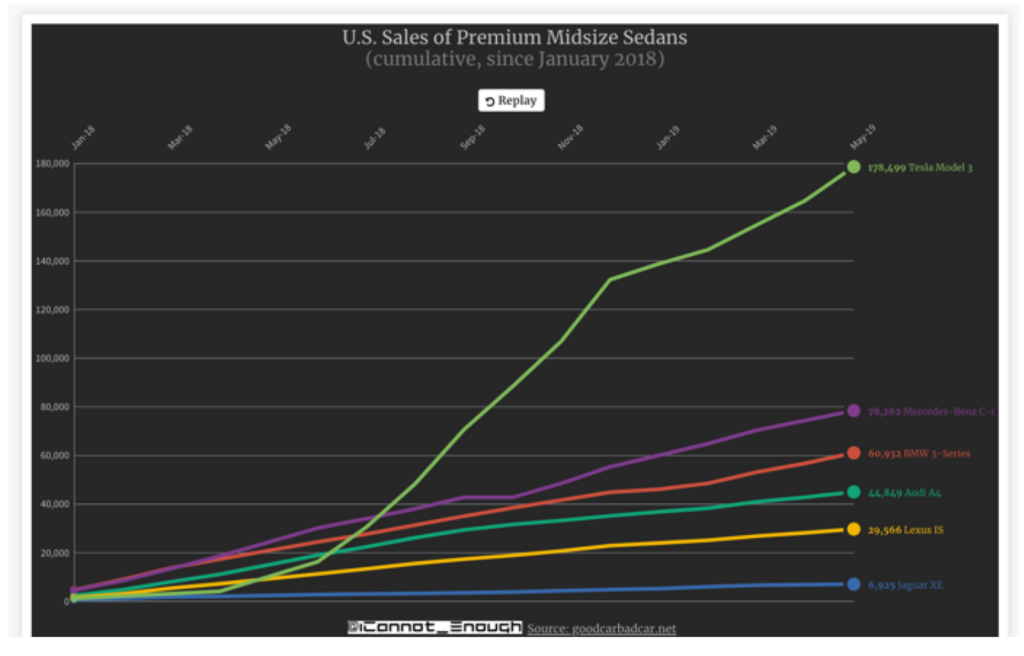

If you ignore the stock price and simply look at the business, Tesla is a clear category leader and crushing the competition. Not only does Tesla clearly dominate the fast-growing EV market, but the Model 3 is starting to eat competitors in the more traditional segments of the car business. In terms of U.S. revenue, the Model 3 has outsold the Toyota Camry, Honda Accord, the Honda Civic and many other gas-engine models over the last 4 quarters.

This is a remarkable achievement and, contrary to what you may read in the press, Tesla’s competitors are in awe. Just ask Porsche North America CEO Klaus Zellmer. “If you look at what Tesla has done, if you look at their volume and look at their price level, it’s truly astonishing,” Zellmer told The LA Times in an interview. “If you can do that with one brand and a sales network that is not comprised of dealers and a real sales organization, it’s even more astonishing.”

We believe this is likely just the beginning and expect Tesla to reinvest all available capital into further product development, and we have no problem with them maintaining smaller product margins in order to keep prices lower, taking a page out of the AMZN playbook. This strategy can help expand the company’s customer base, fuel growth, and continue to delight consumers. Ultimately from a business perspective, we’d rather make 20% margins on 5 million units versus 50% margins on 1 million units of something.

Throughout the next few quarters, we also expect Tesla to run its business at cash-flow breakeven as the company expands into new geographies and builds out its network of Supercharger stations, among other initiatives, further solidifying its moat and “network” among consumers.

In my view, we’re entering the “iPhone moment” for Tesla. With any product that provides a superior value proposition to a consumer, those who can afford it will generally buy it. But it doesn’t happen overnight. Tesla can’t provide a product pamphlet and test drive to every potential customer right away. True demand may take time to develop, but as more and more Tesla vehicles cruise around the roadways, we believe it will create a positive feedback loop leading to more demand of all models. We already see it happening everywhere—it seems like every Tesla owner we speak to has a story of at least one person, whether it be a family member, friend, or co-worker who has purchased or plans to purchase a Tesla because of their car and experience.

From what we’re researching on the ground level, we believe the competitors are terribly out of position. In the shadow of Tesla’s boom—and very likely a consequence of that boom—the automotive business is suffering. U.S. auto sales have declined in recent months and automakers are scrambling to come up with electric vehicles that can compete with Tesla.

Nearly every major automaker reported weak U.S. sales in the first quarter of 2019. GM saw first-quarter sales fall 7 percent, while Ford’s sales fell 2 percent in the quarter and 5 percent in March. BMW, which is revving up cost-cutting after warning of profit decline in 2019, may even face a shareholder revolt as the company has been unable to adequately pivot to electric. At a recent shareholder’s meetings, one shareholder said: “Where is this [electric] model offensive? Sure, you’ve got the iNEXT, but I was expecting something that blows Tesla out of the water!”

Many commentators in the mainstream press—and even analysts on Wall Street—have earnestly complained of “demand problems” at Tesla. Take a look at the graph above. The idea of a “demand issue” would be laughable if it wasn’t so abundantly and absolutely silly. Tesla is the best-selling luxury car in America, in addition to being the best-selling electric car. Keep in mind this is all while Tesla isn’t even allowed to sell their vehicles in many states – dealer unions are fighting tooth and nail, finding loopholes in legislation to keep Tesla out5. (I guess free markets don’t apply to Tesla products!)

The other notion we often see suggested is that incumbent automakers are on the verge of launching the next “Tesla e-killer,” whether it’s Audi or Jaguar or Porsche. Well, the Audi e-Tron and Jaguar I-PACE are already facing product recalls, while the Porsche Taycan has been delayed. The Chevy Bolt sales are anemic compared to the explosive Model 3 growth—and same with Nissan Leaf sales. Not to mention the fact that these are cars with inferior battery packs, shorter ranges, no installed base of Supercharger networks, and no clear path towards autonomous viability. It is somewhat fascinating how “professionals” think traditional ICE manufacturers could relatively easily re-tool entire manufacturing processes and supply chains and pivot to producing EVs at scale if they wanted to.

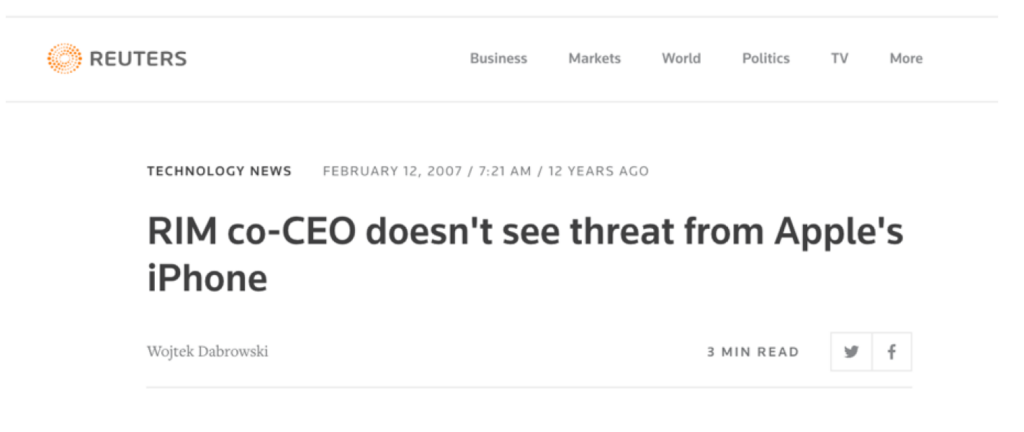

The situation also reminds me of 2007, when BlackBerry’s CEO went on record saying he doesn’t see a threat from the iPhone. “It’s kind of one more entrant into an already very busy space with lots of choice for consumers,” Jim Balsillie said of Apple in 2007. “But in terms of a sort of a sea-change for BlackBerry, I would think that’s overstating it.” For whatever reason, many can’t comprehend that any “busy space” can be disrupted by a truly revolutionary product. It has happened before and it will happen again.

Even though the stock price has moved sideways over the past 5+ years, the business value of Tesla has grown immensely, and we believe it will continue to grow at exceptional speeds: Tesla’s Model 3 enjoys roughly 60% market share in the USA for EVs. The Model 3 has now entered China, the world’s largest EV market. In Q2 2019, the company broke records both on deliveries and production. And, with the Shanghai Gigafactory set to open later this year, we expect TSLA to start producing Model 3s in China at scale in the not too distant future, becoming a competitive player to Chinese EV incumbents like BYD or the BJEV division of Chinese-owned BAIC. Based on our research, we also expect considerable demand for the Model Y, pickup-truck and Semi commercial truck.

Longer-term, we anticipate that TSLA’s battery development will enable the firm to meaningfully compete with utilities for grid-level energy storage and distribution. Once they are no longer cell constrained, we see exponential growth in their energy business.

On that note: One area that Tesla does not nearly get enough positive attention in mainstream financial press its lead in battery technology. Put simply: we believe Tesla has a roughly five-year lead on battery technologies. Not only have they been able to drive down costs by scaling up their output, but they have also been continuously refining and improving cell chemistry to augment energy density, which in turn improves the vehicle’s battery range and long-term durability. Even more exciting is the company’s recently completed acquisition of Maxwell Technologies, a company that has developed considerable technologies in the dry electrode realm of electric powertrains.

There has been much speculation about increased competition in the electric vehicle category, but our research and analysis tells us that, in reality, Tesla holds the goods: we have concluded they produce the most energy-and-cost efficient batteries and given additional improvements to cell chemistry we anticipate coming, we believe it is very possible that Tesla may enable vehicle range of up to 500 miles within the next year. Compared to its competitors, that would be a roughly 2x advantage. In other words, their lead is potentially off the charts.

Then, of course, there is TSLA’s scalable approach to autonomy and self-driving. Private market valuations of beta-level experiments in autonomy (i.e. Waymo) have reached $250 billion. Our models suggest TSLA’s software-based ride-hailing network could achieve higher levels of value.

Remember, Model 3s have the potential to be appreciating assets that eventually generate income if/when Tesla’s robotaxi network goes live. Instantly, these cars would be worth more—a dynamic that’s never existed before in the legacy OEM automaker business. This can become an immensely profitable royalty stream that goes directly to Tesla. Even at 30% markup, our models suggest tremendous value for Tesla from the cannibalization of existing ride-hailing networks (i.e. Uber/Lyft) and creates a revenue multiple upwards of 3-4X from existing frameworks. Put more simply, the robotaxi network could trigger a massive additional catalyst for shareholder value.

So, what’s the disconnect right now between market prices and long-term valuation? Unfortunately, the answer is a few things in our view—one, a very unconventional yet charismatic CEO who attracts an amazing level of publicity (and scrutiny). Second, a wave of biased reporting and negativity, whether from short-sellers who profit from spreading fear and doubt or news outlets looking to drum up traffic with often misleading headlines. And third, there appears to be a generalized fear of the unknown that’s creating a considerable level of discomfort among many incumbent Wall Street firms, many of whom struggle with long-term business valuation when forced to abandon traditional short-term metrics.

Thankfully, there are some talented money managers out there who have a strong desire to speak out publicly about their views on TSLA, such as famed investor Ron Baron (who believes Tesla could be a $1 trillion opportunity) and the intensely bright Cathie Wood of Ark Invest (who has a $4,000 TSLA price target by 2023).

Of course, valuation methods are challenging, but our strategy is built for disruption. In times of disruptive growth, my focus is higher up on the income statement: Rather than focus on earnings per share or P/E ratios in the short term, I instead choose to focus on revenue and gross profit growth, and how that translates to future earnings once scale and market dominance are achieved. It was true with AMZN and it’s certainly true with TSLA now—there is a land-grab for market share, and the most important strategy when entering a new vertical (i.e. electric, self-driving transportation) is explosive growth and improving the customer value proposition.

We believe multi-trillion dollars of market cap will be redistributed in the global convergence to renewable technologies and autonomous transportation systems and that Tesla is leading that redistribution. In our view, we’re only in the first or second inning of the game.

Again, it must be said: we believe the transportation industry is facing the largest disruption in human history—by 2025, we believe a majority of all new vehicles manufactured and sold will be electric, which will have cascading effects down the value chain. The proliferation of electric vehicles sold in direct-to-consumer models could upend not just the Internal Combustion Engine (ICE) industry, but also auto parts manufacturers, traditional brick and mortar car retailers, and ICE-dependent service centers. We continue to be short several of these businesses, including auto dealers. The thesis remains intact, even if we’re not getting favorable quotes right now.

With new car sales declining and inventories at multi-year highs, many dealers have grown through acquisitions and in our view, become overly reliant on profit generation in areas like additional service and financing fees. If they were to sell EVs, given their minimal maintenance, a huge chunk of dealer profits would disappear. Needlessly to say, dealers are not inclined to push EVs and it’s in their interest to fight their adoption. At the end of the day, dealerships want the customer to spend as much as possible as fast as possible, and have their cars serviced as frequent as possible. Whether companies like Carvana are ultimately successful or not, they will be stealing market share from dealers if they make the car buying experience more pleasant than the experience of a traditional dealer.

In certain geographical markets, I expect this channel shift towards electric, ride-sharing systems will likely exhibit winner-take-most tendencies. Network effects, cost efficiencies, regulatory dynamics, and consumer demand may yield one—not several—likely winners. I see a likely scenario where incumbent firms with anemic growth, shrinking profits, and minimal innovation processes will consolidate, merge, and, in many cases, die off. We’re already seeing signs of consolidation in the auto industry, and we continue to hold short positions in companies like General Motors (GM) and Ford (F) among several ICE-related businesses.

Ultimately, there is much more to be said, but the most important nugget is this: we believe Tesla stands ahead of the competition in nearly every category driving massive changes in the auto industry. As for the short-sellers and short-term FUD, while it is not enjoyable, it also can’t last forever. I see the potential for a “rubber band” effect—a snap back in the stock price as truth wins out and shorts cover their positions. While the short term is hard to predict, I see several tremendous catalysts over the next six months or less, and certainly over the next year, and expect to be back on track in relatively short order.

Other corners of our portfolio continued to perform well. In Q2, NFLX added 1.74 million domestic paid subscribers and 7.86 million internationally. We’re now in close to 200 countries but still plenty of room to grow. There’s been some recent speculation about the introduction of Disney Plus, but the fact is, Disney is far behind on a subscribership basis, and it could be tough for them to catch up—the moat is significant and daunting and consumers may be getting fatigued with many subscription platforms. On a revenue basis, NFLX is growing at 20% YoY and we continue to see a lot of upside potential there. Same with AMZN: Bezos and Co. continue to surpass expectations and we expect AWS could be spinning off in the not-too-distant future.

One new long position for us that we entered this quarter is Zillow (Z). Perhaps some of you have used this service in your own lives. It’s a relatively small position from an exposure basis for us, but I’m excited about the company’s prospects. One of the core observations I’ve made over the last several years is what I’ll call “The death of the middleman.” Middlemen used to be everywhere—i.e. shopping malls/brick and mortar retail, etc.—but the Internet disrupted this model and enabled new companies to expand rapidly by offering direct-to-consumer models with lower prices—and lower operating costs. Every middleman is just another layer looking to make a profit, and that ultimately comes via higher prices to the end consumer. As a consumer, the more middlemen you can cut out, the better.

Now, Zillow is attempting to apply this model on the real estate market, albeit with a unique and compelling twist: Zillow Offers. The business of home buying is still relatively analog and, in many cases, challenging. To sell a home involves a considerable amount of stress and expense. Zillow Offers is attempting to disrupt this dynamic: The company offers a home-selling option for sellers who want to just sell their home to Zillow directly. It’s a compelling operating model and the early signs are motivating for us. By end of Q1 2020, Zillow Offers will be operating in 20 markets. This past quarter, Rich Barton, the company’s founder and CEO announced that they received more than 35,000 seller requests and that demand is rapidly accelerating. The company now receives one request every two minutes, which is nearly $200 million in potential transaction value per day.

It’s an impressive model with smart, visionary management. The leaders there are leaning towards disruptive growth models— and I really like that they are unafraid to commit considerable capital to scale the home-buying business, all while continuing to build a powerhouse operating platform. Again, it’s early days and a relatively small position, but the size of the professionally managed global real estate investment market is roughly $8.5 trillion—so it’s a market worth attacking for us with the right business.

As I’ve said before, technological change is accelerating, creating massive winners—and equally massive losers. The core investment themes that we focus on (cloud computing, the shift to electric transportation and renewable energies, the explosion of e-commerce, etc.) has not changed. We have many catalysts to look forward to, especially some exciting developments within Tesla’s core battery advancements, that we believe position us extremely well for success in the back half of 2019.

Taking a step back, it’s important to remember that especially in periods of great disruptions, in hindsight there’s often a huge degree of variance between the underlying value of a business and the quote you get in the market. That’s okay—it’s just a quote. We don’t need to sell, and we won’t unless our long-term fundamental view has changed. Our advantage as long-term investors is two-fold: strategy + time. For specific securities, the volatility can be intense at times but I’m unaware of any tremendous growth stock that has not gone through volatile times. For any investor, an extensive and deep research process, long time horizon, and thorough understanding of businesses and their value propositions should provide the conviction and confidence to hold positions through tough times – and this is how we have structured our research and investment process.

The big picture here is that our playbook is designed around massive changes to our society that will unfold over the next several years. As investors, this creates abundant opportunities for wealth creation—but patience is necessary. The path to long-term outperformance inevitably comes with bouts of short-term pain along the way – that’s just the nature of the stock market. But what comes fast doesn’t last and we remain keenly focused on the enduring, long-term drivers of value and the future opportunities in front of us, and that future looks bright.

Thank you all for your continued faith in myself and the team at Nightview Capital.

Sincerely,

Arne Alsin

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request. This material is not financial advice or an offer to sell any product. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income.

Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-19-07