April 15, 2024

Dear Investors,

We hope your year has been off to a happy and healthy start. In this letter, we’ll offer some commentary on current positions and where we see potential for growth.

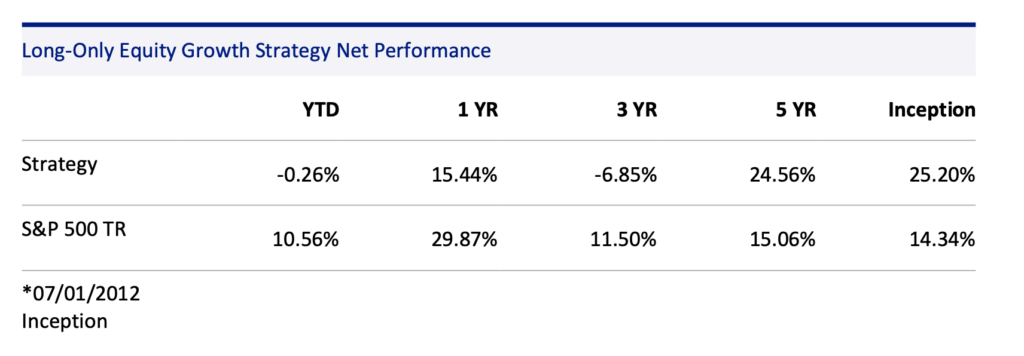

Please see below for performance results for each strategy since inception:

Individual investor performance will vary. Past performance is not indicative of future results. Performance shown is based on monthly net returns for each strategy since inception. Please see Composite Presentations for additional information and disclosures.

Reviewing Tesla and the transformative potential of FSD software

While the auto business transitions between two waves of growth, we are pleased to see what we believe is the true beginning of end-to-end neural networks with Full Self Driving (FSD). Our team has long been proponents of this solution, and we’ve been encouraged by recent significant progress of the technology across our research. The timing is challenging to predict. But we are increasingly bullish that the market will recognize the potential of the intrinsic value that Tesla is building with its real-word AI software solutions. In our view, the exponential rise in FSD’s progress will continue to be the most important catalyst for Tesla’s growth.

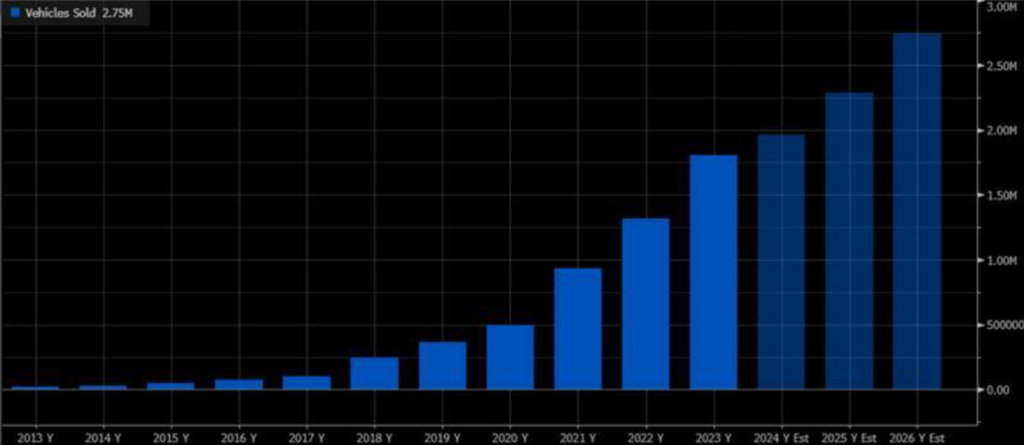

We’ll discuss more of our impressions of Tesla FSD below, but it’s worth examining Tesla’s underwhelming production and delivery report from earlier this month, especially because it received so much media attention. For long-term shareholders of transformational companies, it’s our view that temporary declines in growth are a natural course of business. All iconic companies in the early innings of a technological paradigm shift will have growth spurts. Growth is rarely linear.

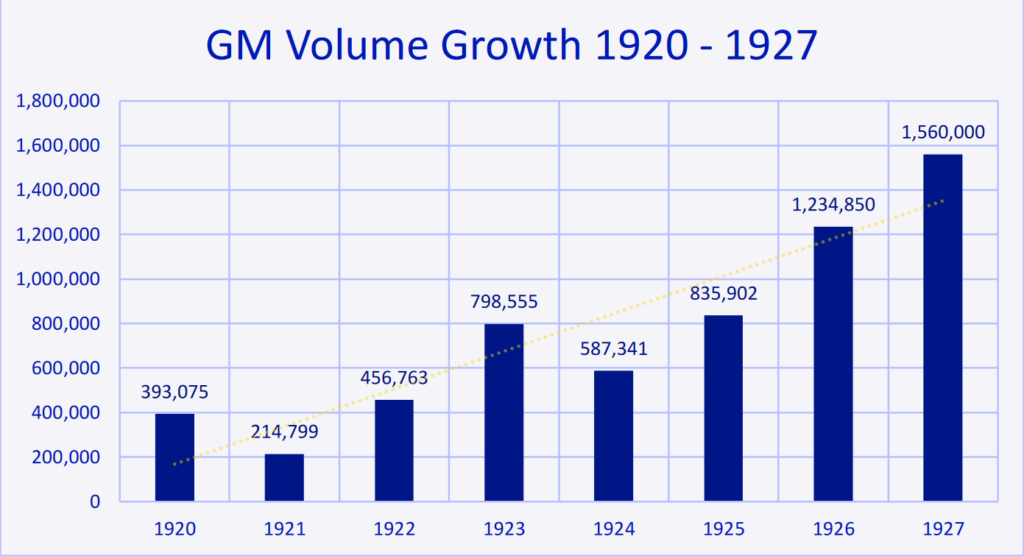

For instance, in the early days of the automotive business, one might be tempted to believe that General Motors saw consistent year-over-year growth throughout the 1910s and 1920s. After all, adoption of the combustion engine vehicle was at the beginning of a massive secular growth trend, and new auto sales would continue in an S-curve for decades into the 1930s, 40s, and 50s.

And yet, the actual history indicates otherwise. Even the initial commercialization of the automobile was met with ardent skepticism and lumpy growth. In fact, GM reported negative volume growth in not just one, but three years, during its exponential early days: 1918, 1921, and 1924. Further, data pulled by the equity analyst MBI Deep Dives showed that GM volume growth contracted by a remarkable (45%) in 1921 alone, before re-accelerating in the subsequent two years.

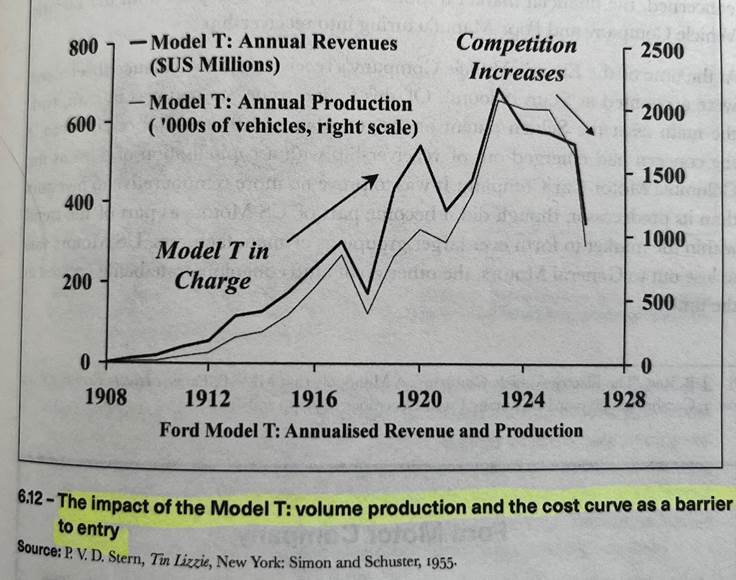

Ford faced a similar trajectory its early days of production of the Model T. While consumer adoption of gas-powered vehicles was on an exponential rise, the growth experienced intermittent volatility as a function of several factors: macroeconomic headwinds, production issues, and so on. In other words, growth is lumpy for a variety of idiosyncratic reasons.

It’s our belief that platform shifts—whether from horses to ICE vehicles, or ICE vehicles to EVs—will exhibit ebbs and flows in acceptance and public opinion throughout its adoption curve. Initially, early adopters (who are excited about the promise of the new technology) will bid up prices while production volumes are still low. A decade from now, however, we believe these minor fluctuations in growth could be a footnote to the overall Tesla story.

In short, it’s not surprising to us that Tesla may see periods of rapid growth followed by periods of relative short-term slowdowns. Periodic volatility in volume growth is just part of the game. If you believe battery electric vehicles will be the primary mode of transport in the future—and we do—then accepting occasional dips in growth is a natural consequence of industry sea change. As we wrote about in our January letter, the company is between two major growth waves: right now, Tesla is prioritizing focus on developing the next generation platform as quickly as possible, aiming for a production release in late 2025. Once this product is on-line, we expect growth to re-accelerate. Zoom out a few years, and the outlook looks promising indeed.

Above all, we maintain our conviction about Tesla’s long-term prospects and the potential for shareholders to achieve very attractive returns. While earnings estimates are trending down in the short-term and delivery numbers may continue to be revised downward, there are a couple of specific factors that signal optimism ahead—potentially even in the near-term.

As we previously touched on, one of these factors has been the company’s significant progress in autonomous driving capabilities over the last few months. In our view, the short-term blip in automotive growth has been overshadowed by a much larger, more material development that shareholders should be watching closely: the roll-out of Tesla’s V12 FSD.

The progress of FSD, driven by innovations in Tesla’s approach to artificial intelligence, underscores Tesla’s potential to revolutionize transportation and robotics. With a global network of 6 million cars, Tesla’s training models draw on vastly wider database than any other competitor in the market.

For years, we’ve written that Tesla’s vision-only approach to autonomy is the correct path. Finally, it appears that we could be seeing a step-change in improvement since the company’s roll-out of V12 in recent months.

The rapid advances we’re seeing in this software development boils down to a shift in architecture: V12 shifts the prediction models away from hand-coded programming techniques and moves towards a neural network model based on end-to-end imitation learning. What’s interesting to see recently has been new investors, who had previously ignored Tesla, suddenly become very interested in the opportunity. “It was mind-boggling,” Brad Gerstner, the founder of Altimeter Capital, said recently. “I think this is going to be a bit of a ChatGPT moment for Full Self-Driving.”

The FSD roll-out will be an iterative process, but we are more optimistic now than ever before on Tesla’s road to achieving autonomy, which could have a profound effect on the ability to generate future cash flows and provide near-term accretive margins with an uptick in FSD attach-rates. The market works as a forward discounting mechanism, and it is not necessary for cash flows to be directly derived from the technology—or full autonomy to be achieved—for the market to begin incorporating the prospect of significant future cash flows.

We also continue to be excited about Tesla’s energy division, and while this growth will likely be lumpy as well, we foresee a significant amount of untapped growth still ahead. Last year saw a rapid increase in energy gross margins over the previous year, up to roughly ~19% for the year.

The energy business segment is a great example of operating leverage as the business scales up, and the potential for an inflection point in margins. We also continue to monitor the Shanghai battery plant and are strong believers that this solid-margin business has years of runway ahead.

Broader market commentary: Identifying Leaders in the AI Landscape

Beyond Tesla, our investment strategy continues to emphasize identifying AI leaders with robust distribution networks and the potential to leverage their scale. We believe portfolio companies like Amazon and Google exemplify this approach—and are under-appreciated beneficiaries of the current AI boom.

We believe Amazon, in particular, has established itself as an AI powerhouse through strategic investments (e.g. Anthropic), its services offered via Amazon Web Services, and through consumer-facing Amazon products like Alexa and Amazon Prime. “While we’re building a substantial number of GenAI applications ourselves, the vast majority will ultimately be built by other companies,” said Andy Jassy in his April 2024 shareholder letter. “However, what we’re building in AWS is not just a compelling app or foundation model. These AWS services, at all three layers of the stack, comprise a set of primitives that democratize this next seminal phase of AI, and will empower internal and external builders to transform virtually every customer experience that we know (and invent altogether new ones as well). We’re optimistic that much of this world-changing AI will be built on

top of AWS.”

To echo Jassy’s comments, we view AWS, in particular, as a leader in AI applications: the segment provides a comprehensive suite of AI and machine learning services, including Amazon SageMaker for building, training, and deploying machine learning models, Amazon Rekognition for image and video analysis, and Amazon Polly for text-to-speech conversion. In other words, while AWS is technically a cloud offering, we view this division as a foundational layer of the next wave of AI applications across the broader ecosystem that will power thousands of companies and products around the globe. We believe demand for Amazon’s AI offerings will continue to mount, which could benefit both top-line and bottom-line growth for the company.

In Q1, we published a deep-dive research report on this subject specifically, detailing how AI could fuel hyperscaler profits for a decade (or more). In the report, we explore how a convergence of factors are setting up the major cloud providers (especially AWS and Google’s GCP) for continued growth, and why we believe they remain increasingly attractive opportunities for investors—even at >$1 trillion valuations.

Importantly, we’ve recently begun studying how both Amazon and Google are proactively using AI applications to reduce costs and become more efficient at scale, which could yield significant shareholder value and boost operating margins (and net income) in the years to come, all while maintaining attractive growth rates. Amazon, in particular, is getting aggressive with cost efficiencies across multiple segments of the business, including its retail operations. In its February 2024 earnings call, Andy Jassy noted:

“Our regionalization efforts have also brought transportation distances down, which has helped lower

our cost to serve. In 2023, for the first time since 2018, we reduced our cost to serve on a per unit basis globally. In the U.S. alone, cost to serve was down by more than $0.45 per unit compared to the prior year. Lowering cost to serve allows us not only to invest in speed improvements but also afford adding more selection at lower average selling prices, or “ASPs,” and profitably.”

As you can see in the above chart, this cost optimization regime has enabled operating margins to inflect upwards since the nadir of the pandemic era, a trend we believe could continue in the near-term, making Amazon one of our highest conviction ideas at the moment.

Lastly, we continue to believe Amazon’s advertising business is an unsung hero that could materially contribute to margins over time. The advertising business is growing at a robust 26% YoY, and does not seem to show any signs of slowing in the near-term.

Google: Navigating Challenges, Embracing Innovation

In Q1, Google faced challenges with its Gemini release, which was followed by market skepticism that the company could successfully compete with Microsoft-backed ChatGPT. In reality, we think the opposite may be true: despite the messy release of Gemini, we believe Google’s long-held advanced capabilities in generative AI may give rise to a far superior multi-modal AI, relative to its peers.

Interestingly, Gemini Ultra’s performance “exceeds current state-of-the-art results on 30 of the 32 widely-used academic benchmarks used in large language model (LLM) research and development,” per Google. In other words, Gemini outperformed ChatGPT in multiple tests.

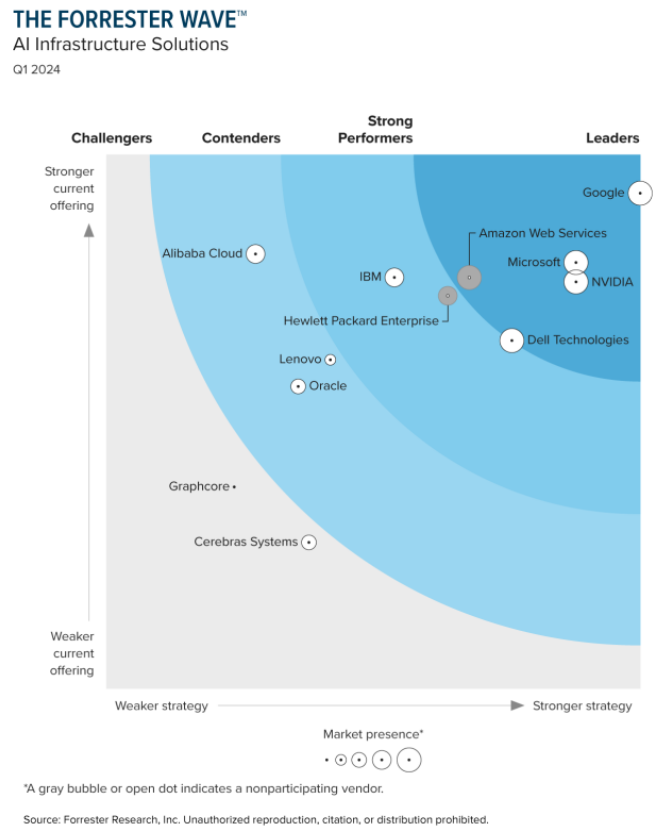

We also continue to have a high degree of conviction in Google’s advanced lead in AI infrastructure. Right now, organizations around the world are in a scramble to re-architect their internal infrastructure that can capitalize on the promise of generative AI applications. As Google noted in Q1:

The rise of generative AI marks the start of a new AI transformation era. The larger, more complex models powering this transformation feature hundreds of billions (or even trillions) of parameters, require extensive training periods, sometimes spanning months — even on the most specialized systems…

Google Cloud’s AI infrastructure excels in this area, with a decade of cutting-edge AI advancement built into its foundation. This integrated solution of optimized hardware, software, frameworks, and flexible consumption models allows businesses to rapidly and cost-effectively scale their AI workloads from start to finish, across training, fine tuning, and inferencing/serving use-cases.

In our view, Google is one of the most attractive risk/reward investments in the market today: its valuation is attractive, its value proposition is improving, and the market is, in our view, underappreciating the potential for sustained growth—while over-emphasizing some minor softness in the company’s core advertising business.

Ultimately, Google also has many structural advantages that give us confidence for the long-term: massive distribution for deployment of new AI features across its several billion+ user apps (Search, YouTube, and Maps), product ubiquity (Gmail, Chrome) and a core SaaS business (GCP) that we anticipate could generate close to $40 billion in high margin revenue in 2024.

The road ahead

In conclusion, while Tesla’s current stock performance may raise concerns, we remain optimistic about its long- term trajectory—and increasingly bullish on the prospects of FSD. Our investment philosophy, centered on staying concentrated on our best ideas over the long-term, continues to guide our approach.

Companies like Tesla, Amazon, and Google exemplify the potential of AI-driven innovations to shape the future of various industries, and we remain patient to see our investment theses play out. As we navigate the evolving landscape of AI and technology, we remain committed to our investment strategy, poised to capitalize on emerging opportunities and navigate challenges with resilience and foresight.

Sincerely,

Nightview Capital

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intendedrecipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Nightview Capital, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request.