Dear Partners,

This year has started off with a familiar atmosphere. Macro news once again dominates the headlines, from the banking system beginning to show cracks—to persistent levels of inflation and tight labor markets.

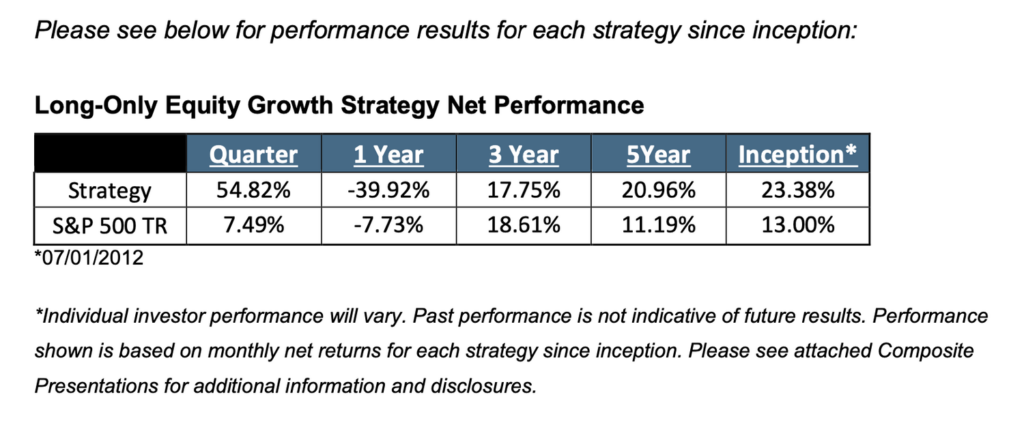

Please see here for composite presentations for additional information and disclosures.

We continue to believe that these problems are the “aftershocks” of unprecedented monetary and fiscal policy enacted during the pandemic. And while the possibility remains for additional disruptions, we believe we have already passed through a significant amount of difficulty. We remain confident that our patience will be rewarded, and that business fundamentals will once again rule the day—and drive valuations.

Most importantly, despite market fluctuations over the past year, we believe the intrinsic value of our holdings continues to steadily increase through internal compounding. On the ground, our companies are improving their value proposition for customers, expanding in territory, and investing in exciting future growth opportunities. Despite the negative sentiment we see across the market, we remain bullish on the next several years. Markets will always reward investors who remain focused on seeking out the most resilient companies with solid growth prospects, capable management, and reasonable valuations. Over time, this is what matters most for long- term investors looking to compound their capital.

One of the more difficult aspects of investing is having faith that this system will continue into an uncertain future. Concern over the end of economic growth is not a new phenomenon, and as Peter Lynch once said, “more money has been lost trying to time corrections than has been lost in all corrections themselves”.

There have, and always will be macro issues that dominate the headlines. However, what has mattered far more to investors like us is the ability to align with broad secular changes in the economy—and remain invested. We persist in our belief that the economy will grow over time, and that investing in companies with unique competitive advantages, long growth runways, and compelling fundamentals will yield attractive compounded returns.

Of course, in the short-term, the Fed directly drives market behavior. While we disagree with the hasty and somewhat blind approach of the Fed over the past year, we do believe that we are closer to the end than the beginning. We also believe that a significant portion of the discount we have been witnessing in the markets is due to the uncertainty around runaway inflation and the subsequent monetary policy which would follow. Markets hate uncertainty and this has represented a significant unknown. We believe this risk has come down dramatically over the past six months, and a re-pricing of assets higher is likely to emerge.

Despite all this upheaval—and perhaps because of it—we remain optimistic that this decade provides abundant opportunity for forward-looking investors. As the current broader macro events fade away, and the new macro headline de jour inevitably follows, we believe that the next generation of innovation and technology will continue to spur further economic growth and prosperity. It is our prime concern to stay focused on that future and ensure we participate in what we believe is a decade ripe with opportunity.

Portfolio construction

As we have previously communicated, we plan to move into a less concentrated portfolio, and it is something we have been working diligently on behind the scenes. We believed that Tesla was the strongest positioned firm to weather the storm in 2022. While this did not play out in price action, we still believe they exited the year in a historically unique position for growth and cash flow expansion for the coming years.

Our view remains that Tesla is a historical opportunity—and maintain our conviction. While it certainly has been a difficult period, we intend to see the investment through and ensure proper value for our partners. At the same time, over the past few months, we have been incorporating somewhat of a shadow portfolio behind the scenes which will allow us to diversify into new investments as Tesla reaches a more reasonable value in the following quarters and years. We are always attempting to position and strategize with a multi-year horizon into the future.

In this market and global economy, the name of the game is “survive and thrive”. In that light, we continue to spend our time researching companies that we would feel comfortable owning if the market shut down for several years. We are looking for solid cash flow with clear reinvestment opportunities, competent management, loyal customers, unique value propositions, expanding margins, and durable business prospects. In this market environment, many of these businesses are currently trading at 50 cents on the dollar or less in our opinion. To us, that’s exciting.

Towards that end, we are highly enthusiastic about several high-level themes, and we have begun to deploy small amounts of capital into these investments. Some of these investments include Google (GOOGL), Alibaba (BABA), and Panasonic (PCRFY), among others.

While these new positions are currently small, over time we intend to scale position sizes based on our relative conviction on each position and our opportunity to deploy more capital. While we are enthusiastic about many of these opportunities, we’re moving slowly and deliberately, putting a great deal of thought into the execution of each of these positions.

It is also important to emphasize that we believe it is still the early to middle innings of the Tesla thesis, and want to ensure that our investors are rewarded for their patience over the long-term, while we simultaneously work to diversify the portfolio and exploit new opportunities. With Tesla we believe that the market’s ultimate realization of their dominant position, competitive advantages, vast end market opportunities, and vast cash flow potential, may occur in a “step change” manner similar to what we have seen previously. It is always difficult to predict the exact timing of these events, but when they occur, they tend to move incredibly quickly. Remember, Tesla went sideways for about five years, and then from the end of 2019 into 2021, much of the business value that was built over several years was realized in short order. While we’d prefer stock appreciation to happen linearly, that is rarely the case with transformational companies like Tesla.

During this quarter, one new position to highlight is GOOGL, which we have high conviction on for a variety of reasons. While obviously well-known and well-researched, we believe the inherent benefits of Google’s cloud storage business are still underestimated by the market, particularly from a valuation perspective. With the company trading at relatively low multiples, we believe we found an attractive entry point to buy shares.

Also, worth mentioning on Google is how impressed we are with YouTube as a significant and dependable driver of revenue, now clocking in at an impressive run-rate of $30 billion annually. We expect this number to continue to grow at a healthy rate throughout the rest of the decade. Google’s moves into live television, their stranglehold on various demographics, and unique position make it a tremendous asset with plenty of growth runway ahead.

Finally, we believe much of the speculation around how AI will impact Google’s search business has been greatly exaggerated. This business unit, which functions as a high-margin advertising platform model, is tremendously resilient among its customers—and provides a beautiful cash flow machine, relatively unparalleled in the annals of business history. All told, we believe Google represents one of the better risk/reward investments in the market today.

Tesla

In our previous letter we pointed out that we were enthusiastic about Tesla’s ability to compress their COGS, allowing for expansion of addressable markets by reducing prices—all while maintaining industry leading margins. Recent price changes in their core products have enabled them to undercut competitors, keep factory utilization rates high, and continue to expand and grow market share. In the short-term these price cuts were not wholly offset by cost reductions, leading to lower margins. But we believe this is the correct strategic move that will pay off as Tesla continues to drive down costs in the manufacturing process as they ramp up volumes. Price cuts have a more immediate impact on margins than sustainable cost reductions given the latter requires time to implement, but over time we expect gross margins to tick back up into the mid-20s.

As explained in their investor day in March, Tesla will leverage a new manufacturing process in their next generation platform that will allow them to reduce overall costs dramatically, thus expanding their potential customer base even further. As we have explored in previous investor letters, the ability to attain significant year-over-year compound growth through the next decade necessitates a compression in both automotive and battery manufacturing costs. While Tesla has dominated the traditional luxury segment of the EV space, that represents only a finite number of potential customers. To achieve the levels of production proposed, a move down in cost is a necessity.

Over the past several years Tesla’s margins have been wildly impressive – both a function of their operating leverage, vertical integration, and their blank sheet approach to EV manufacturing. On a recent blended average, Tesla has been hovering around 25% gross margins and 17% operating margins for the entire company. And while these have temporarily dipped lower, this has all been achieved while scaling two factories around the world, and receiving limited, if any profit contribution from other areas of their business that are still in their infancy such as energy storage, autonomous driving, and energy generation.

The same cannot be said about their competitors. During a recent capital markets event, Ford outlined specific profitability metrics for their EV business last year. They are losing roughly $21,000 per EV they have sold. (On an EBIT basis, Tesla made roughly $8,500 per vehicle). And while Ford is certainly earlier on in their EV development than Tesla, their EV profitability target by the end of 2026 is also roughly half of Tesla’s EBIT today: 8%. Ford produced only 10,800 EVs in the first quarter, roughly a 40% CAGR over last year and a far cry from the 80% CAGR necessary to hit their 2 million target production level in 2026.

Our research also leads us to believe that other legacy OEMs, including GM and Toyota, are even further behind Ford. GM, at their investor day last November, announced a target of 1-5% EBIT margins for its EV business by 2025. If one believes in the broader transition to electric vehicles, the prospects for the “competitors” objectively look quite dire. On their recent earnings release GM announced their end to Bolt production. And while this probably makes sense for them, it shows how far head Tesla is, and how wide open the market is for an affordable EV in the $25-40k range.

There are roughly 70 million cars sold per year. With Tesla’s price cuts a broader expansion into the mass market segment while maintaining impressive margins is a potentially disastrous scenario for legacy OEMs. The incumbents will have an extremely difficult time competing as their cost structures today are uncompetitive—and these moves from Tesla only widen the gap. Most legacy OEMs have materially negative margins in their current EV segments, and significantly lower margins on their ICE lines than Tesla has on their entire EV business.

Additionally, we remain enthusiastic about Tesla’s ability to scale energy generation & storage, build out transformational autonomous products (both in transport & manufacturing), refine manufacturing processes, and improve on chemical and metallurgical applications. We continue to believe that this company has the potential to be a historical case of diversified manufacturing wherein the varied business lines are funded efficiently at low cost of capital with staggering cash flow potential for years to come.

It has undoubtedly been a stressful and frustrating past couple years as Tesla investors. And while we may have some choppy waters in the immediate-term, we are highly confident that all the pieces are in place for Tesla to continue to scale and grow market share, ultimately becoming recognized as a globally dominant brand in several historically large end markets, with a valuation that reflects that reality.

Additional Thoughts

Peering above the daily headlines, the fact remains that we are living through a period of profound change. Many old-line business models will be overtaken by new and transformative technologies. While much of the optimism for the future has faded over the past year and a half, we remain firm in our belief that there are exciting and better days to come. The possibilities, especially for investors, are as good as they’ve ever been in our view.

Transformational changes are rarely linear in public perception, but on a high level their march forward is relatively uninterrupted. Early on these changes are often met with skepticism however, in hindsight their effect is obvious. The iPhone, streaming audio/video, and cloud computing are all good recent examples of this. Additionally, these transitions tend to take a decade (or more), providing the potential for years of compound growth. For example, we initiated our AMZN position in 2012 in part to participate in the growth of cloud storage. Going into the second decade of the investment, we believe it continues to remain an attractive value and still in the middle innings of its long-term growth trajectory.

At a high level we believe we’re nearing the conclusion of the post-Covid economic disruptions that have rippled through the economy for the past few years. The short-term, as always, is uncertain, but on a longer time horizon, we believe the possibility for multi-year compounded growth remains strong. From here, the most important thing is to stay focused on where the rapidly changing global economy is heading and align ourselves properly.

As always, we appreciate your partnership and thank you for your continued faith in myself and the team. We remain diligent in our focus and commitment to capitalizing on the unique, exciting, and more importantly, attractive opportunities we believe lie ahead.

Thank you,

Arne Alsin & The Nightview Capital Team

Team Members:

Arne Alsin – Founder, CIO & Portfolio Manager

Eric Markowitz – Director of Research

Zak Lash, CFA – COO

Daniel Crowley, CFA – Director of Portfolio Management Philip Bland – Director of Investor Relations

Emily Bullock – Head of Compliance

Cam Tierney – Research Analyst

**Disclosures

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request. Past performance Is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index. Nightview Capital, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-22-02