Long-Term Investing

Dear Investors,

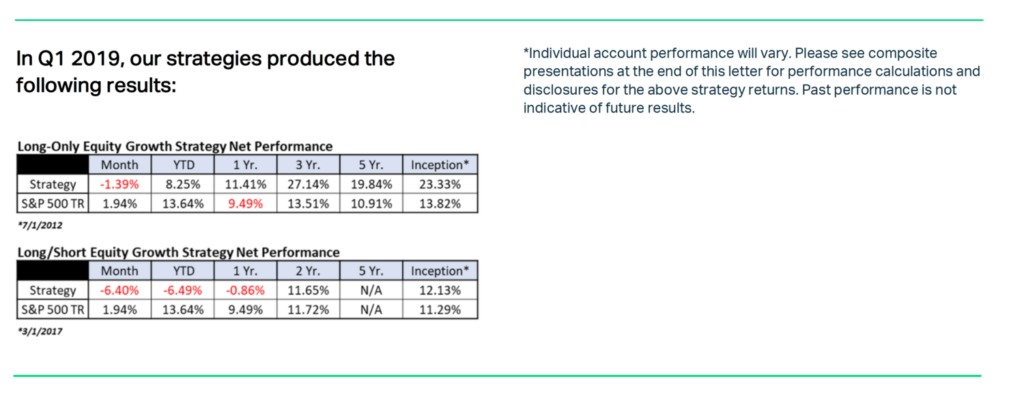

I launched our first strategy almost seven years ago seeking to capitalize on a new era of emerging, disruptive technologies. We launched our second a little over two years ago. I’ve said it before, and I’ll say it again: I believe it’s a fantastic time be an investor. With entire industries are up-for-grabs, innovative upstarts with vision and execution have the potential to capture market share at alarming speeds.

The pace of change is accelerating, presenting what we believe to be enormous opportunities—but also entirely new challenges for old guard incumbents. It is, quite simply, a great time to be a stock picker from our perspective. It is our firm’s mission to capitalize on this massive redistribution of wealth, well into the 2020’s and the decades to come.

Please see here for composite presentations for additional information and disclosures.

All that said, it’s worth remembering that this is a long-term marathon—not a sprint. Our strategies will not grow linearly month after month—and that’s okay. We don’t expect it to. Put simply: We are willing to accept short-term volatility and fluctuations in monthly market prices in exchange for the potential to achieve superior long-term absolute returns. That’s the goal—to beat the market over a sustained period of time. This quarter, the businesses that we own continued to grow exceptionally fast, even if the market has not always adjusted its valuation in step. Our fundamental strategy remains intact: I’m proud to say the portfolio has changed very little. When we make a significant investment, it is intended to be for the long term.

Part of the difficulty in these environments is that the future is definitively unlike the past. How does one project out non-linear growth while the velocity of change and uncertainty is increasing? It is a complicated process that does not lend itself very easily to short-hand valuations, backward-looking metrics, or muted volatility. Also, as the rate of change accelerates (and there is increasingly dominant market share concentrated in select companies) it is necessary to think about the long-term viability of companies—and their future business prospects, if any.

Today, a company might look cheap based on historical cash flow and earnings, but what if their business—as currently constituted—ceases to exist in a couple of years? We have already seen this happen with a company like Sears. It’s increasingly looking true at a company like General Electric. When the economics of a vertical change, especially for large capital equipment manufacturers, the resulting downward pressure on a business and its share price can happen at breakneck speed. As investors, it is critical to remain vigilant for not only opportunity, but also potential value traps as well.

So, how does an investor seek to ensure that in a rapidly-changing environment, they are positioned well for long-term success? We start with two questions, which we ask every day. One: Which company’s product offers a superior “value proposition” in a given vertical? And two: “Who is winning at the customer level?” You’d be surprised how much analysis out there completely ignores these two fundamental questions.

When we review an investment opportunity, it all begins with a first principles approach of asking simple questions centered on the customer in each industry we study. For example, does cloud computing offer a better experience for customers? Do customers prefer streaming online content or bundled cable TV? Will self-driving, electric vehicles provide a better value for customers? The customer always determines outcomes. And the customer is always right. Always.

This does not produce a successful investment on its own, of course, as there needs to be a sufficient gap between the current market price and a firm’s intrinsic value (also, to state the obvious, the company must be profitable over the long-term). That being said, we believe it is a necessary and helpful framework when evaluating an overall portfolio. If a company is losing at the customer level in a disrupted vertical, they are in serious trouble. Conversely, if a company is dominating its competition—and acquiring massive market share—it is possible and necessary to value that on a go-forward basis. To put simply: In our view, if a company isn’t innovating and seeking to please the customer, it isn’t a safe investment, no matter how “cheap” it may appear.

•••••

Long-term investing

One of the more common phrases uttered by asset managers is their desire to “unlock” value. This can take the form of pressuring CEOs and/or Board of Directors to increase corporate buybacks, increase the dividend payout to shareholders, or to potentially sell off an “undervalued asset.” What this ultimately means, in our view at least, is that the asset manager most likely has limited faith in their portfolio company’s ability to reinvest capital in its business at a high enough ROE. Thus, they push management to return capital directly. We generally look for companies where we can take an opposite view. These are companies that, in contrast to require some sort of value “unlocking”, are value creators.

In our view, an ideal company should possess a management with the vision and discipline to reinvest capital into their businesses at a significantly high expected ROE. Then, we’re able to see compound growth internally for years to come. This may seem obvious to some, but traditional Wall Street analysts generally have a hard time accepting this process. Amazon, for instance, was criticized for many years for weak to non-existent bottom line production while it invested heavily in its cloud computing division. Ultimately, AWS was the correct capital allocation—and a benefit to us as shareholders. Amazon incubated and grew AWS to a giant. Last year AWS produced $25.7 billion in revenue, representing a growth of 47% over 2017.

AWS was able to grow at a weighted average cost of capital that would have been seemingly impossible outside of the Amazon ecosystem. Could they have succeeded independently? Most likely, but their stranglehold and ability to continually compete on both price and innovation would have been far more difficult.

We believe our game plan—or our “edge” as others may call it—lies in our ability to model out expectations of this type of innovation process across several verticals. In the short-term, we almost always expect some portion of our portfolio be misunderstood, volatile, or underperforming. That’s okay with us. As Warren Buffett once remarked, “Investing is simple, but not easy.” As we progress with an investment, we consistently benchmark against expectations, and constantly reevaluate and challenge our original hypotheses.

And sometimes, inaction is the most difficult action.

Owning and truly understanding a great business allows one to have more clarity of thought and conviction through turbulent times. It also allows selective trading around depreciated prices with confidence. And, conversely, reallocations as a price moves closer to its calculated intrinsic value.

All we can do is worry about the underlying value of the business. We have the utmost conviction that the businesses we own are growing their intrinsic values—steadily—and we believe our valuations reflect this growth. Ultimately, we are confident there will be a convergence between their intrinsic values and the quotes offered in the marketplace. Given the areas we invest, this of course can take time and include volatility along the way.

If you look at an annual private market valuation, there is often a consistent step change growth YoY. Alternatively, there are certain asset classes perceived as having little to no volatility. However, liquidity is at a premium. (What discount would one need to secure a daily price and buyer of a commercial real estate property? While the answer may be hard to define, it is certainly not zero.)

Within this strategy, we seek to generate private equity-like returns with public market liquidity. It also provides us with the flexibility to react and trade accordingly as the environment changes. The price for this flexibility is sometimes encountering volatility—and while volatility may be dreaded by ivory tower economists, we believe it provides us with long-term opportunity. Disagreement creates opportunity for the diligent.

To beat the market, one must hold assets that are different from the market. More frequently than not, we see many money managers holding dozens of positions. If one is attempting to mirror the market, this makes sense. The problem is that, as active managers, it is very difficult to identify significant asset mispricing over thirty, or even fifty names. And if you’re going to own 50 names, you are honestly better off owning the index.

We believe our approach is different. By being incredibly selective with capital allocations, understanding street level value propositions, and looking for multi-year redistributions of hundreds of billions (if not trillions) of dollars in market cap, we believe the opportunity remains solid going forward. And even as we encountered short-term volatility in Q1 2019, I believe the long-term vision is as exciting as ever.

•••••

Disruption cycle progress

The surprising aspect of disruption cycles, really, is their relative level of predictability. They tend to follow a fairly similar timeline: Dismissal of new technology à Tacit Acknowledgement -> Begrudging Acceptance -> Delayed Commitment -> Commitment.

One would think that this is a relatively new phenomenon, but while the products have changed, the perceptions and underlying dismissals by incumbent leaders have remained remarkably stable:

- 1876: “This ‘telephone’ has too many shortcomings to be seriously considered as a means of communication.” — William Orton, President of Western Union.

- 1977: “There is no reason for any individual to have a computer in his home.” — Ken Olsen, founder of Digital Equipment Corp.

- 1997: “In short, Amazon.com has thrived as the only game in town, but its fortunes may soon be challenged by gatecrashers such as Barnes & Noble, Simon & Schuster, and Borders, who are enhancing their online presence. Barnes & Noble opened its first online bookstore on America Online last week and plans a presence on the Web later this year.” – Wired Magazine

- 2007: “The development of mobile phones will be similar in PCs. Even with the Mac, Apple has attracted much attention at first, but they have still remained a niche manufacturer. That will be in mobile phones as well,” Nokia chief strategist Anssi Vanjok

- 2017: “We still don’t have a viable economic model for delivering an electric car.” Sergio Marchionne, former CEO of Chrysler and Ferrari.

We have seen this pattern play out consistently in our investment themes and see no reason why this will change going into the future. If we look at electric cars for example (supplement to follow) there was an initial curiosity factor without a fear of it being a real threat. Then, companies had their hands forced, and now have (half-heartedly, we believe) committed to producing mass market electric cars.

The problem is that head starts matter. A lot.

Rearranging massive organizations is a very difficult proposition. Employee and CEO incentive programs also govern much of a corporation’s behavior, and short-term metrics for pay lead to short-term thinking and action. With legacy organizations, many employees are incentivized to push their companies where they have historically excelled. While this does not make them evil—or even incompetent—it provides a consistent impediment to legacy competitors attempting to adapt to a new playing field.

In hindsight, many things appear obvious, but in order to fully capitalize on seismic changes, a deep understanding of business and technological dynamics are necessary to overcome the difficulty of going against the grain in the earlier stages of an investment.

While far from easy, it is crucial to be in position in anticipation of significant growth to truly reap the benefits of transformative businesses. Our returns are our scorecard and we continue to work committedly towards our ultimate goal of providing our partners with superior returns in what we believe is a unique and fantastic stock pickers market.

The ability to secure an immediate price for your asset at any given moment is a tremendous advantage. Does the value of a business change on a minute to minute basis, barring some release of new information? The answer is almost certainly no.

In terms of risk management, we believe in this environment it is better to own companies whose business value is growing at a steady rate and whose products offer differentiation and superiority in the marketplace. This does not preclude us from short-term quote risk, but ultimately, we are investing in businesses over sustained periods of time.

We believe this provides us with some flexibility in terms of top down economic risk. (We would be more concerned if we heard our portfolio Managers speaking in terms of bad weather or tax refunds having material impacts on quarterly results.)

Again, volatility provides us with opportunity—and we could not be more excited about this market. We see a massive transfer of wealth ahead, well into the 2020s. Our entire strategy is designed around capturing the resulting change from these disruptions for our partners—and we thank you for joining us in this mission.

Sincerely,

Arne Aslin

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request. This material is not financial advice or an offer to sell any product. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income.

Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-19-05