Welcome to Nightpixels, a visual blog about investing, business, and technology.

Nightpixels is published each week by Nightview Capital Research Analyst Cameron Tierney. Follow him here on X and Linkedin.

Sign up to receive weekly Nightview Capital updates below.

Error: Contact form not found.

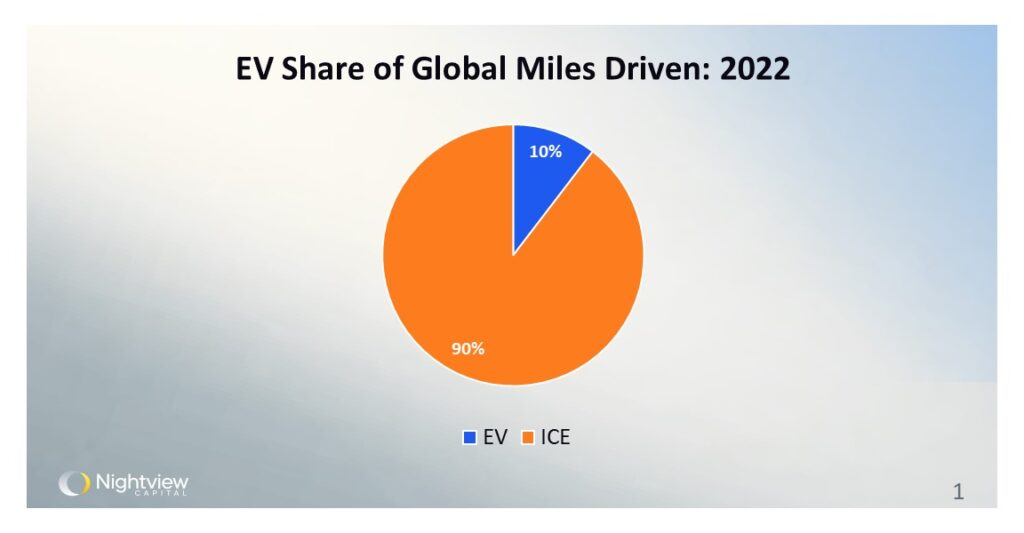

EV share of global miles driven was just 10% in 2022

Despite the rapid advancements in electric vehicle (EV) technology and adoption, traditional internal combustion engine (ICE) vehicles continue to dominate the global miles driven, holding a significant 90% share in 2022. This overwhelming figure suggests that EVs, with their mere 10% share, have a long way to go in making a substantial impact on total miles driven. This metric is critical in assessing the progress of the EV transition because it encapsulates the real-world use of the vehicles. It also accounts properly for the existing global fleet and the progress in electrifying it as compared to new car sales or similar metrics.

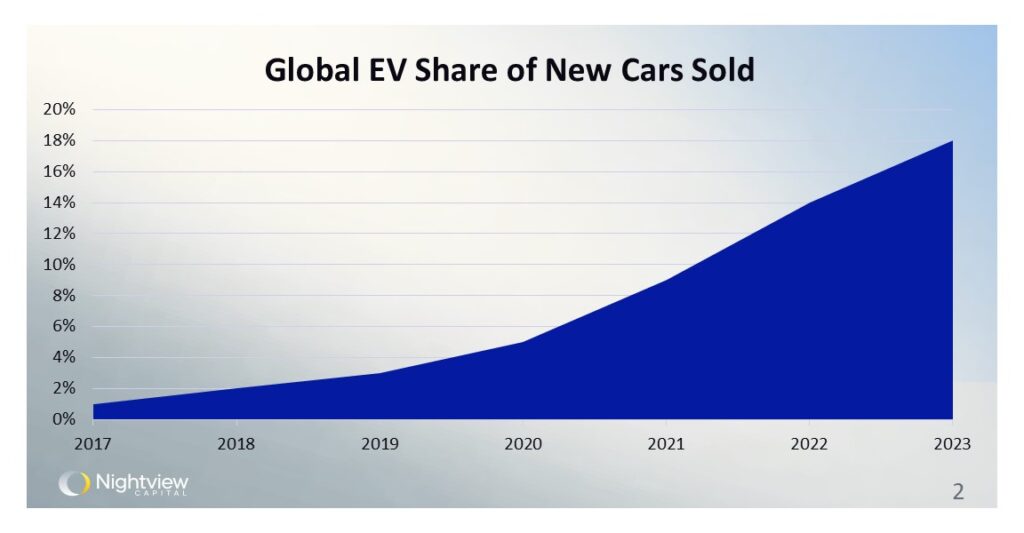

EV share of new cars sold has increased 18-fold from 2017 to 2023

However, a deeper look into the trend of global EV sales over the past six years paints a different picture. From 2017 to 2023, the share of new cars sold that are electric has surged from a modest 1% to an impressive 18%. This exponential growth indicates a strong shift in consumer preference and industry focus towards EVs. It also coincides with Tesla’s commercialization of its mass market Model 3/Y platform. If EVs continue to take share as a % of new cars sold, it’s conceivable that EVs could eventually account for over 50% of new car sales in the future, thereby accelerating the replacement of the global ICE fleet.

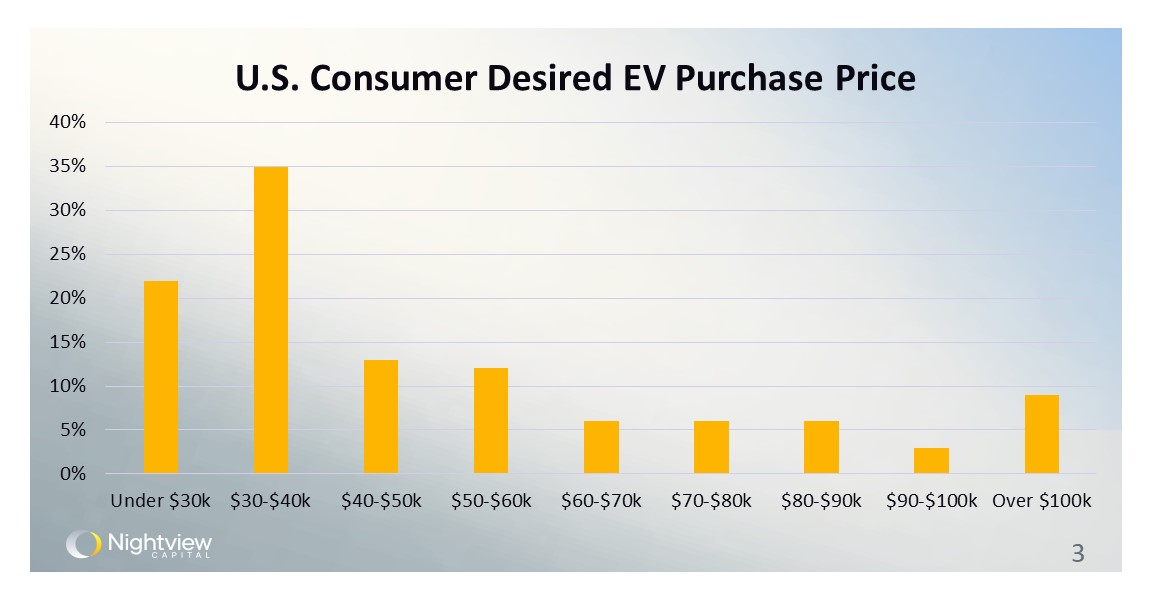

There’s a dislocation between consumer desires and EV selection

A critical factor in this transition is the price range of EVs that consumers find desirable. Surveys show that most consumers are interested in EVs priced between $30,000 and $40,000. Currently, the market lacks a diverse selection of EVs in this price range, with models like the Tesla Model 3 and Model Y standing largely on their own. Industry leaders, including Rivian’s CEO RJ Scaringe, acknowledge this gap. He recently said in an interview with The Verge, “the primary reason for the [EV] slowdown is there is an extreme, truly extreme, lack of choice. If you want to spend less than $50,000 for an EV, I’d say there’s a very, very small number of great products. Tesla Model 3 and Model Y are highly compelling, great products, but they don’t have a lot of competition.” Rivian is developing products such as the R2 and R3 platforms to cater to this market segment. Tesla is also working on more affordable models to meet demand.

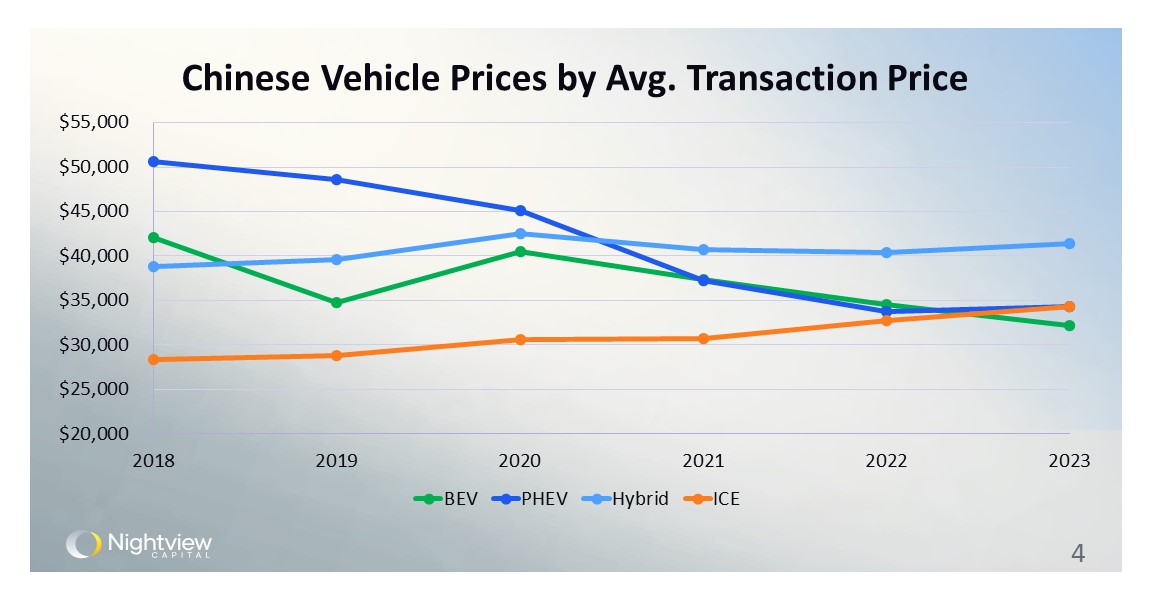

EVs in China are already cheaper than ICE cars

Taking a more global perspective, China provides a compelling case study. The Chinese government’s substantial subsidies and investments in the EV and battery supply chain have led to a remarkable outcome: battery electric vehicles (BEVs) are now cheaper than ICE vehicles on average in China as of 2023. While BEVs in China have not yet reached the under $30,000 mark in dollar terms, the downward trend in prices is promising. Should the United States follow a similar path of investment and scaling in the EV and battery supply chains, it could potentially lower EV costs significantly, helping to make them accessible to a broader range of consumers.

U.S. quarterly EV sales volumes

In the United States, EV sales have shown remarkable growth, roughly doubling from Q1 2022 to Q3 2023. Despite this growth, sales have plateaued with even some local troughs, underscoring the persistent demand for lower-cost EVs and the current market’s inability to adequately meet this need. Addressing this issue will be crucial for sustaining and accelerating the adoption of EVs in the future.