Optimism for 2022 and beyond

Dear Partners,

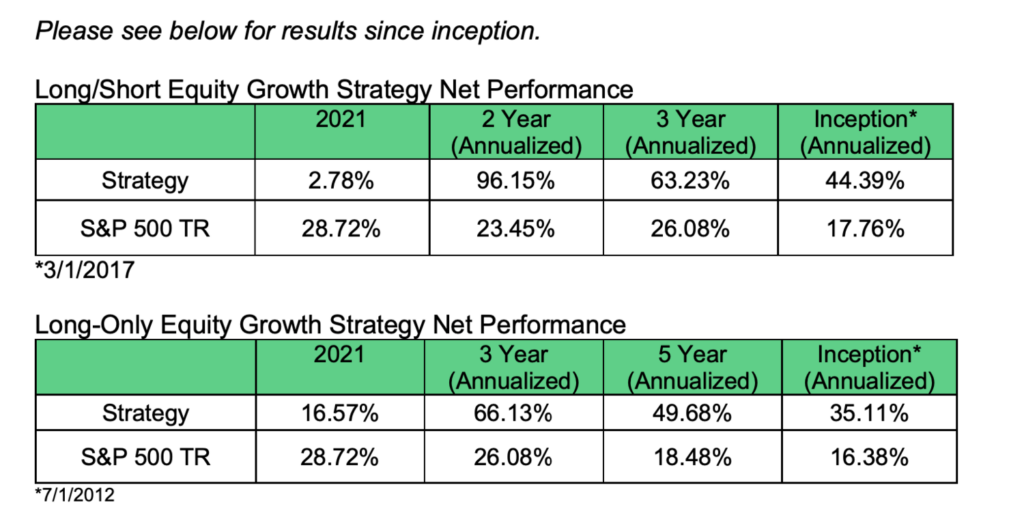

We are entering the 10th year of our long-only strategy, and the fifth year of our long/short strategy. Some of you have been with us for this entire journey; others may have joined more recently. Regardless of when you’ve joined, we are in the very early days of this journey together, and we are exceedingly optimistic about 2022 and beyond.

Below, we offer some thoughts about the future we’re headed into, and why we think the remainder of this decade—the 2020s—could prove to be one of the best decades for stock pickers.

Please see here for composite presentations for additional information and disclosures.

As we see it, the 2020s will be defined by industrial disruption, corporate dislocation, and some of the most profound technological shifts of the last two centuries. We are hurtling towards a cleaner, more efficient, more automated world—and only the fit organizations will survive.

These changes will bring risk and chaos—but also enormous opportunities.

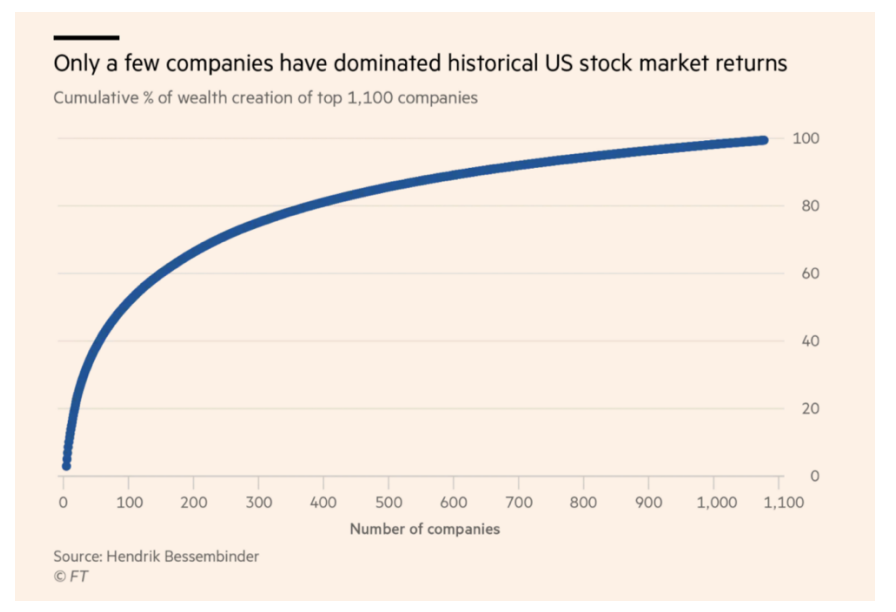

Big picture: We think this decade could yield a handful of huge winners—but perhaps many more losers. It’s increasingly becoming a winner-take-all game in business. Concentration in the absolute top stocks in this environment is not only the key for wealth creation: it’s our best defense. New business models and new technologies are emerging, threatening the old guard. It’s a Cambrian environment.

All investing is a game of strategy, and to win this game, especially in this fast-changing environment, we need well-developed theory—along with a well-defined research process. Internally, this is what we focus on, asking questions like: What’s next? How to position for tomorrow? What to own? What to avoid? How to approach valuation? What are our opponents saying? These questions are of critical, even existential, importance. This is especially true as performance attribution becomes increasingly consolidated in just a handful of names.

In the S&P 500 this year, just five stocks accounted for about one-third of the index’s 27% return, according to Goldman Sachs[1]. This trend is compounding off of an existing dynamic: A handful of winners drive returns. The researcher Henrik Bessembinder has found, for instance, that “just 86 stocks have accounted for $16 trillion in wealth creation, half of the stock market total, over the past 90 years.”[2]

Could this dynamic continue? In our view—yes, absolutely. In fact, over the next couple of decades, we think this dynamic could actually become even more extreme. Looking out over the next 20 years, we think there’s a good chance there may be a small number of enormously successful mega-stocks driving the indices—driven by power laws, scale, and network effects.

On the flipside, the death rate among companies within the S&P 500 is accelerating. In 1958, the average life-span of a company listed in the S&P 500 was 61 years. Today, it’s under 18 years.[3]

In our view, Wall Street analysis tends to place too much emphasis on looking backwards—especially in industries where the future looks fundamentally different than the past. Using shortcuts like P/E multiples makes sense in steady-state industries; the same can’t be said for industries undergoing rapid change, where value tends to appear more clearly in the future.

In this environment, our investment analysis is driven by a focus on the customer-level value proposition. In the game of business, we ask: Who is winning on the ground level? What are customers saying? Which organizations have customers lined up around the block? How big is the market? In a rip-and-replace economy, in industrial paradigm shifts, it’s the organizations that build the best value propositions for customers today that stand a chance to reap the financial rewards tomorrow.

These types of businesses are exceedingly rare, and their managers rarely prioritize short-term earnings. On their surface, these organizations often look “expensive” to traditional value investors. But in our view, they require discounting cash flows relatively far into the future. They also require the incorporation of compounding non-linear growth. As these numbers can get quite big, their validity is often dismissed by many investors. This provides tremendous opportunity for those bold enough to do accurate forecasting of potentially explosive growth.

Looking forward, this is where we will continue to search for value: The land-grabbers. The territory-seizers. The management teams who can look five years out and ask, “What are we doing today to create a better value proposition in the future?” The leaders who can inspire and motivate their employees—and ultimately execute their vision.

***

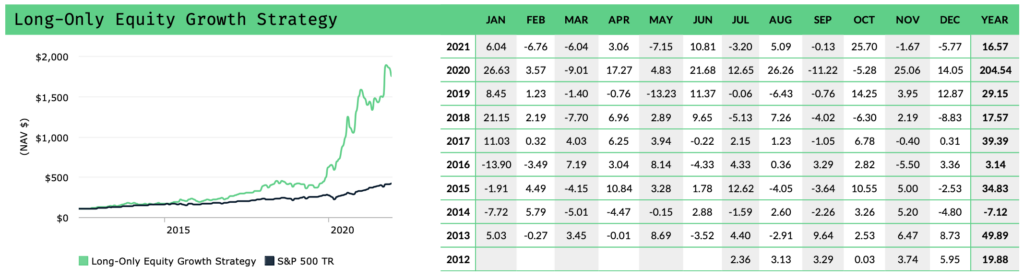

This past year certainly had its challenges, but we increasingly like the setup heading into 2022.

At the end of 2020 and early 2021, there was a considerable amount of froth in certain pockets of the market that appeared to drive up asset prices across the board, almost indiscriminately. That froth needed to be flushed out, and over the past year, prices across pockets of the equity markets consolidated and normalized. In our experience, this sort of consolidation is actually quite good: It bodes well for the next leg up, but only for the deserving stocks—of which, we’d argue, there are only very few.

This is why we think 2022 and the years beyond could be a stock picker’s market—compared to the last couple of years, we could see a significant dispersion in the relative performance of specific companies.

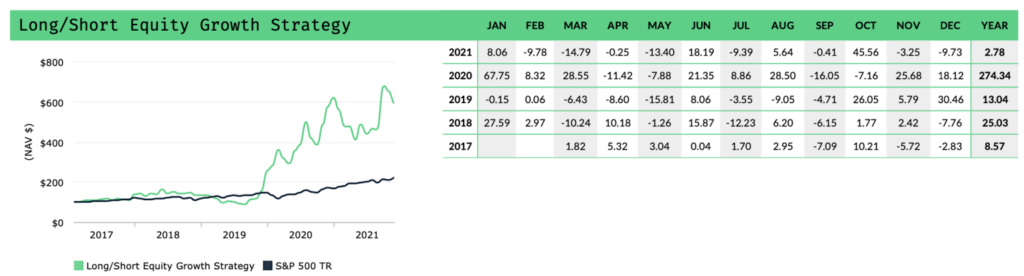

Clearly, our style of investing—deep research, concentration in our best ideas—will not yield linear or “smooth” returns. As we’ve often counseled, this lumpiness is a feature, not a bug, of our process. To attempt to deliver outperformance over a multi-year time frame, we must—must—be positioned in only our best ideas. Concentration in a hyper-elite selection of flourishing business models is risk management. However, concentration leads to volatility—but this oscillation is perfectly healthy.

Over the last year, we’ve gained more conviction in the businesses that we own, based on their execution, improving fundamentals, margin expansion, and velocity of innovation. On several occasions throughout the year, we’ve raised our internal price targets on our portfolio companies, even as their stock prices stayed flat (or even declined).

Historically, this sort of fundamental business growth paired with a lagging stock price sets us up for what we call the “rubber band” effect, where a stock will snap back to the upside (sometimes in a hurry) when weak hands are flushed out, and the market re-rates the company back to a higher multiple.

As some of you may recall, this dynamic has happened multiple times throughout our strategy’s inception. For example, Amazon’s share price declined precipitously in 2014, at one point being down over 28%. In 2019, Tesla went through a similar phase. Occasionally, we choose to lean into these scenarios to help maximize the potential rewards of our conviction and research process.

Specifically, in these situations—i.e., when we gain conviction in a company while the stock price lags or declines for non-fundamental reasons—we can occasionally find attractive risk/reward opportunities in LEAPS. This year was no exception, and we continue to own a fair amount of these option contracts in the long/short strategy, which could offer a leveraged return for the Partnership throughout 2022 and 2023 if and when prices bounce back.

In Q4, we did not make any material changes to the portfolio. We are going full steam ahead. We foresee a few significant catalysts heading into the new year that could reset expectations— and surprise to the upside. As always, we appreciate your patience and resilience—it’s your trust that gives us the ability to let our investment theses play out.

We believe we’re in the very early innings here, and our firm’s partners are committed and invested right alongside you.

Our core positions continue to be focused on the disruption of transportation, renewable energy, e-commerce, automation/AI, and entertainment. Our view of the opportunity set is expanding: We are allocating research efforts on areas like AR/VR, healthcare innovation, and new technologies that could upend the traditional financial sector.

We are also growing our own organization to be well-positioned, from a research perspective, to be early in these shifts. This month, we are welcoming Cam Tierney, a research analyst, to the Nightview Capital team. Cam is a recent graduate of Bentley University, and he will work with Eric Markowitz, Director of Research, on new areas of disruptive innovation.

Five years ago, we wrote about our general view that we were on the cusp of enormous industrial change and upheaval, which created a stock picker’s market. “You have to approach the market right now with a particular mantra in mind: Everything is up for grabs,” we wrote. “Repeat that to yourself if you must. Everything is up for grabs.[4]”

We want to double-down on this view. While stock quotes can and will diverge from reality in the short-term, over the long-run—over multiple years—prices will reflect value. Always.

And so all that matters, really, is getting into position—and finding value. As investors—as analysts—that’s where we stay focused. The businesses that we own are thriving, and, in several cases, innovating far faster than we could have anticipated at the launch of our strategy.

At a high level, we think we’re incredibly early on our journey. We’re excited and ready to meet the challenges ahead. As always, please get in touch if you have any questions, and we wish you a happy and healthy start to the new year.

Sincerely,

Nightview Capital

Arne Alsin – Founder, CIO + Portfolio Manager

Zak Lash, CFA – COO

Daniel Crowley, CFA – Director of Portfolio Management

Eric Markowitz – Director of Research

Philip Bland – Director of Investor Relations

Emily Bullock – Head of Compliance

Cam Tierney – Research Analyst

[1] https://finance.yahoo.com/news/5-giant-stocks-are-driving-the-sp-500-to-records-goldman-144836651.html

[2] https://wpcarey.asu.edu/department-finance/faculty-research/do-stocks-outperform-treasury-bills

[3] https://www.imd.org/research-knowledge/articles/why-you-will-probably-live-longer-than-most-big-companies/

[4] Why It’s a Great Time to be a Stock Picker

**Disclosures

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request. Past performance Is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index. Nightview Capital, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-22-02