(Hint: Look at Tesla and Google.)

By: Daniel Crowley, CFA | Partner at Nightview Capital

Sequoia “AI’s $600B Question” essay went viral for a reason.

It raises smart concerns about the value behind the AI boom—or bubble, depending on your take.

The question posed at the center of the piece is essentially about evaluating the actual financial return AI could generate. We’d agree there’s a great deal of AI speculation in the market. In any boom, there is of course some bust.

But we think Sequoia is missing the big picture. They’re too focused on short-term returns—and the wrong kind of AI.

In the piece, Sequoia asks, “Outside of ChatGPT, how many AI products are consumers really using today?”

Our answer: look outside. Self-driving cars are already on the road. Autonomous vehicles are the ultimate AI product—a robot on wheels—that consumers are using (and paying for) today. By 2030, we believe autonomy could generate trillions in revenue through multiple income streams (more on that below).

On October 10th, we believe Tesla could unveil plans for a commercially-viable Robotaxi and ride-hailing network. When launched, the resulting value creation—both in terms of new revenue streams and a redistribution of old models—could be astronomical.

Sign up for our weekly insights below.

Error: Contact form not found.

Autonomy is no longer a theory—it’s real. Hop in a Waymo in San Francisco—or test out Tesla’s latest version of FSD V12.5. We have. In fact, we have been FSD Beta testers since the program first rolled out three years ago. In our experience, the progress—especially in the last six months—has been extraordinary.

So, yes, it’s early days. And we acknowledge the technology isn’t perfect. Yet. But the pace of improvement is accelerating, and the destination to full autonomy is very clear. In our view, it’s just a matter of scaling the solution.

Which, we think, could happen on an exponential curve like the below.

(Disclosure: We own both Tesla and Alphabet in our portfolio.)

A 100x difference in opinion

In the original piece, Sequoia “generously” assumes that Google could generate $10 billion in AI revenue annually, while Tesla could generate $5 billion annually from AI.

We believe these numbers may be off by multiple orders of magnitude—a potentially 100x difference in viewpoints. This is a very exciting moment. Rarely in markets do we see opportunities where two investors, faced with the same information, can draw two wildly different conclusions. It’s also very clear that one of us is right—and one is wrong.

In a situation like this, there’s likely very little middle ground.

As investors, it’s good to be skeptical. And we agree with Sequoia that it’s smart to be realistic about the gap between what’s being spent on AI—and the revenue being generated, especially in the short-term.

But there’s a thin line between skepticism and outright pessimism. In times of technological sea change, we feel one needs to broaden the aperture, think in probabilities, and play the long game.

It’s not about where the technology is today; it’s about where it could be in a few years from now. We subscribe to the William Gibson philosophy: “The future is already here – it’s just not very evenly distributed.”

Exponential growth rates

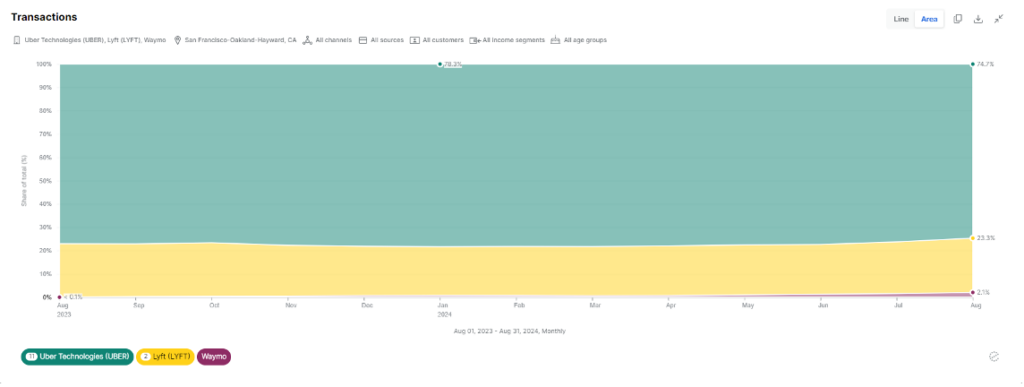

Consider the following graph of ride-hailing market share in San Francisco, from data provider Earnest. A year ago, Waymo accounted for less than 0.1%. A year later, that figure is at 2.1%. That’s a 2,000% increase in market share.

Keep in mind that when someone books a Waymo via the Uber app, it bills as an Uber transaction, according to Earnest. So the number is likely even higher.

Again: the base rate is small. But the growth could be exponential. What will this chart look like in five years? That’s the trillion-dollar question.

It’s surprising to us that Sequoia didn’t mention autonomous vehicles or robotics in their piece about artificial intelligence. Perhaps they view autonomy as a distant science fiction that doesn’t generate current revenue. Or a problem too complex to solve.

But in our view, it’s not an intractable problem, nor is it a distant reality. Waymo is now doing 100,000 paid rides per week, as of August 2024, per a company announcement.

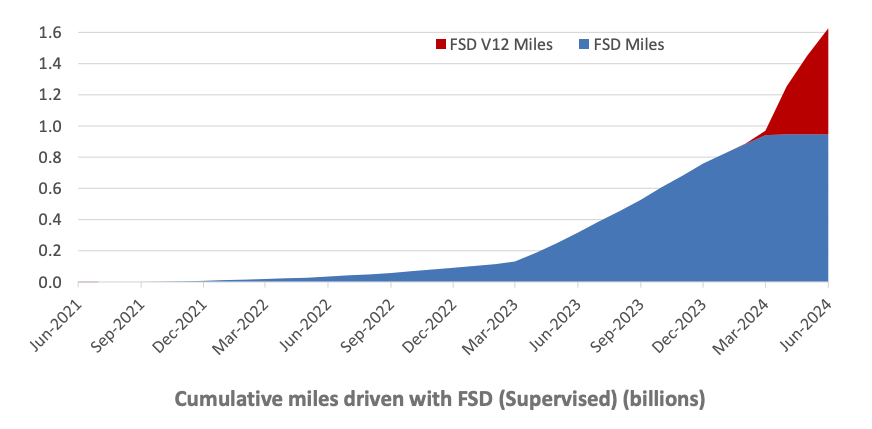

Tesla, meanwhile, has logged over 1.6 billion miles of Full Self-Driving (FSD) engaged driving, as of June 2024. It sells FSD packages for $99 per month, or $8,000 up front. And while it took roughly four years for Tesla to achieve one billion miles of accumulated FSD data, the next billion could accumulate in a matter of months.

(See below for additional technical notes on Tesla and Waymo’s approach to self-driving.)

The ROI from Nvidia GPUs

In 2024, Tesla is set to spend $3 to $4 billion on Nvidia hardware to build out Tesla’s AI training superclusters. In our view, the long-term return on these investments could be extraordinary.

And their rate of improvement won’t be linear: it is accelerating.

Where the revenue could come from

In our opinion, an investor needs to extend the time frame—and think through the implications of when, not if, autonomous vehicles scale.

By 2030, we believe autonomy could be ubiquitous, ushering in a Cambrian era of new revenue streams—and a demolition of old models.

In particular, we envision three key revenue streams:

- Revenue from Direct Software Sales to Consumers: As the utility of autonomous driving features increases, direct software sales to consumers could increase dramatically. These sales could encompass one-time purchases, subscriptions, or pay-per-use models for autonomous capabilities and continuous software updates.

- Revenue from Licensing Fees to Other OEMs / Fleet Operators: OEMs with proprietary autonomous technologies—especially Tesla, in our view—stand to gain substantial revenues through licensing these technologies to other manufacturers and/or fleet operators. Our view is that Tesla, specifically, has a ripe business opportunity through licensing its FSD software—a subject we covered in depth here. At a high level, we believe Tesla is the ultimate real-world AI robotics company.

- Revenue from Ride-Hailing Services: By eliminating driver costs and optimizing fleet operations, autonomous ride-hailing services could drastically reduce operating costs—and increase profitability of AV ride-sharing services, which we believe could generate multiple trillions in revenue annually.

Expecting an immediate return on AI investments is unrealistic. The full impact may take many years to materialize, and it could occur unevenly across industries and regions.

But we’ve come to believe that taking drivers out of cars, buses and trucks could transform everything from logistics to healthcare to retail. Certain business models could become far more efficient and profitable, as their input costs (labor) would decline, while output could increase through higher utilization rates.

A few key features of autonomy:

- 2-3x current utilization rates vs average vehicles today = greater efficiency and higher productivity

- Significant drop in transportation input costs (labor, energy, insurance costs)

- New platforms for emergent business models

Here’s the bottom line: autonomy is the killer app for real-world artificial intelligence. A colossal transformation. Machines that think, move, and transport goods and people are a true game-changer.

Focusing on a current lack of mobile or desktop-based AI software misses the bigger opportunity: an overhaul of the global economy and how goods and services are delivered to individuals.

Tesla and Waymo, in our view, are quite literally driving the next great transformation across transportation. It’s one that we believe could reshape industries, disrupt traditional business models, and create unimaginable value.

As investors, we want to participate.

Some additional notes on Tesla / Waymo:

Tesla’s Approach: Vision-Based, Scalable, and Data-Driven

- Vision-based system: Relies on cameras and AI, eliminating costly sensors like lidar and radar.

- Cost-efficient hardware: Hardware costs are about $1,500 per vehicle, significantly reducing expenses compared to sensor-heavy systems.

- Real-time data collection: Tesla’s fleet of over 5 million vehicles gathers driving data continuously, refining its AI models.

- In-house development: Tesla develops Full Self-Driving (FSD) technology internally for use in cars it manufactures, after initially partnering with Mobileye.

- Neural processing advancements: Tesla’s in-house designed inference computer and Dojo chips illustrate Tesla’s focus on AI processing for autonomy.

- Scalability: Tesla’s low-cost, vision-first model enables rapid deployment in new markets.

- Challenges: Missed timelines and struggles with edge cases, such as complex weather and road conditions, have raised concerns.

Waymo’s Approach: Sensor-Rich, Methodical, and Safety-First

- Comprehensive sensor suite: Uses lidar, radar, and cameras to create detailed 3D maps of the environment.

- High hardware costs: A fully equipped Waymo vehicle costs about $120,000 due to reliance on expensive sensors.

- Controlled deployment: Focuses on geofenced areas, such as Phoenix and San Francisco, to ensure safety and reliability.

- Safety-first methodology: Over 20 million autonomous miles driven, with a strong emphasis on precision and safety in urban areas.

- Gradual expansion: Expanding slowly into new urban markets to build trust and ensure regulatory compliance.

- Alphabet’s AI support: Waymo benefits from Alphabet’s advanced AI capabilities, including the full suite of GCP AI and Google’s custom training chips – TPUs, as well as Google’s recently rejiggered AI software development teams.

- Challenges: High costs and the need for extensive mapping slow down scaling, limiting rapid expansion compared to Tesla.

Disclosures

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.