Welcome to Nightpixels, a visual blog about investing, business, and technology.

Nightpixels is published each week by Nightview Capital Research Analyst Cameron Tierney. Follow him here on X and Linkedin.

Sign up to receive weekly Nightview Capital updates below.

Error: Contact form not found.

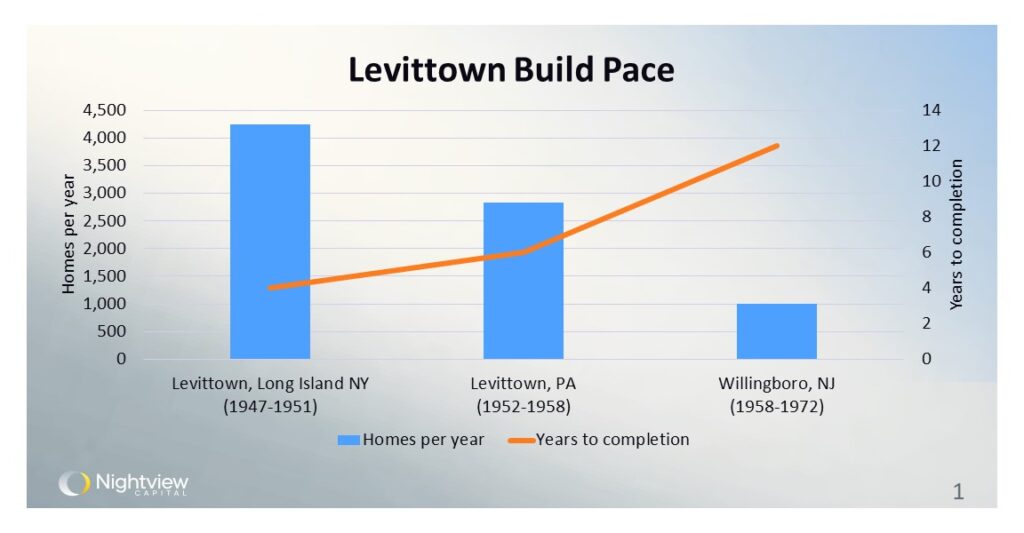

The rise and fall of Levittown build rates

In the wake of World War II, the iconic Levittown communities emerged as symbols of American suburban expansion and the baby boom. Spearheaded by Levitt & Sons, founded by Andrew Levitt, these projects set out to revolutionize home construction. The first Levittown on Long Island, New York (1947-1951), saw an impressive production rate of over 4,000+ homes per year, completed in just four years. However, subsequent projects in Levittown, Pennsylvania, and Willingboro, New Jersey, experienced declining build rates. The Pennsylvania project (1952-1958) averaged just under 3,000 homes per year over six years, and the New Jersey project (1958-1972) saw a drastic reduction to about 1,000 homes per year over 12 years. This decline reflects not only operational challenges but also the increasing impact of land use regulations in the 1960s, marking a complex history of attempts to accelerate home production with mixed success.

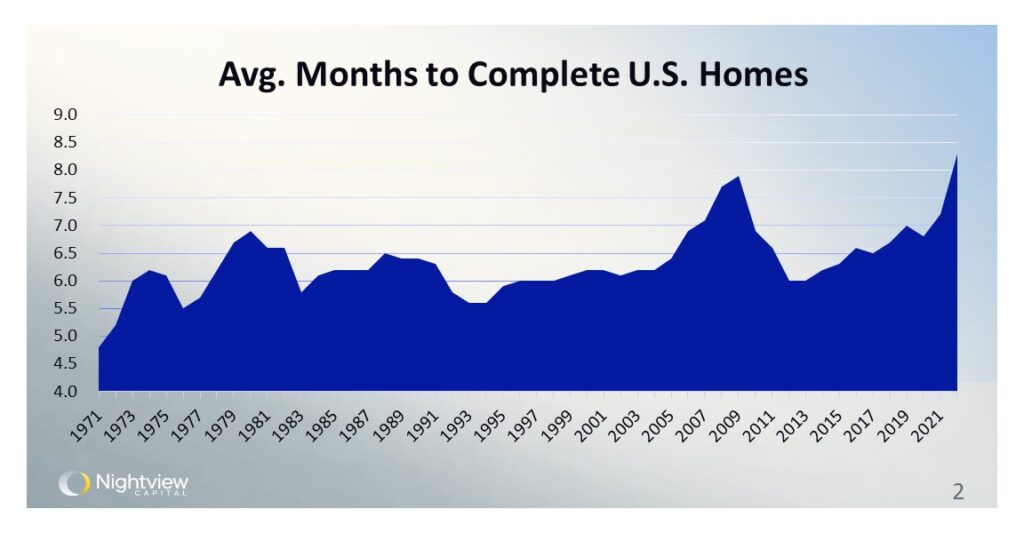

It’s taking longer to build homes in the U.S.

Looking at more recent data, the average time to complete a home in the U.S. has fluctuated significantly, mirroring the housing market’s ebbs and flows. From 1971 to 2022, the time to build a home has generally increased from under five months to nearly eight months. A notable dip occurred around 2013-2014, following the 2008 housing crisis, when build times briefly fell to around six months. However, as we navigate another period of housing market volatility, it becomes evident that modern construction practices have not drastically reduced the time required to build homes, maintaining prolonged completion periods.

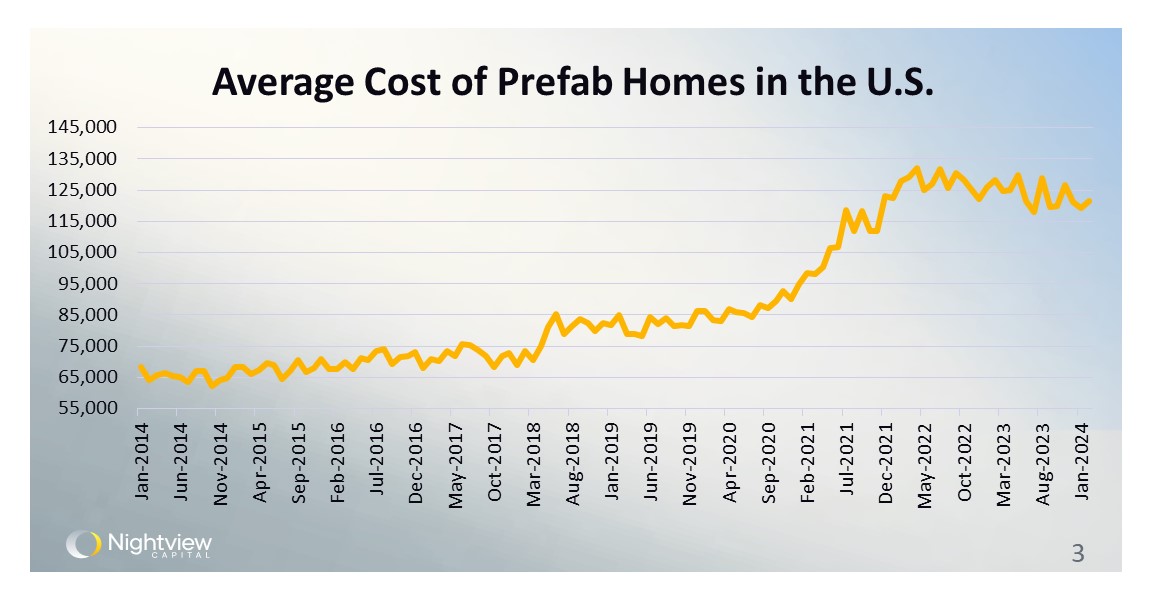

The cost of prefabricated homes are on the rise

Prolonged build times for new homes are a problem in such a tight housing market. Prefabricated homes, once hailed as a cost-effective quick-build solution, have seen their prices surge over the past decade. In 2014, the average cost of a single-family prefabricated home was around $65,000. By 2021, this figure had nearly doubled to approximately $125,000, a trend that has persisted into 2024. These prices are simply for the structures themselves and do not include land value. This escalation far outpaces inflation, underscoring a lack of significant innovation in reducing prefabricated home costs amidst increasing demand and economic pressures.

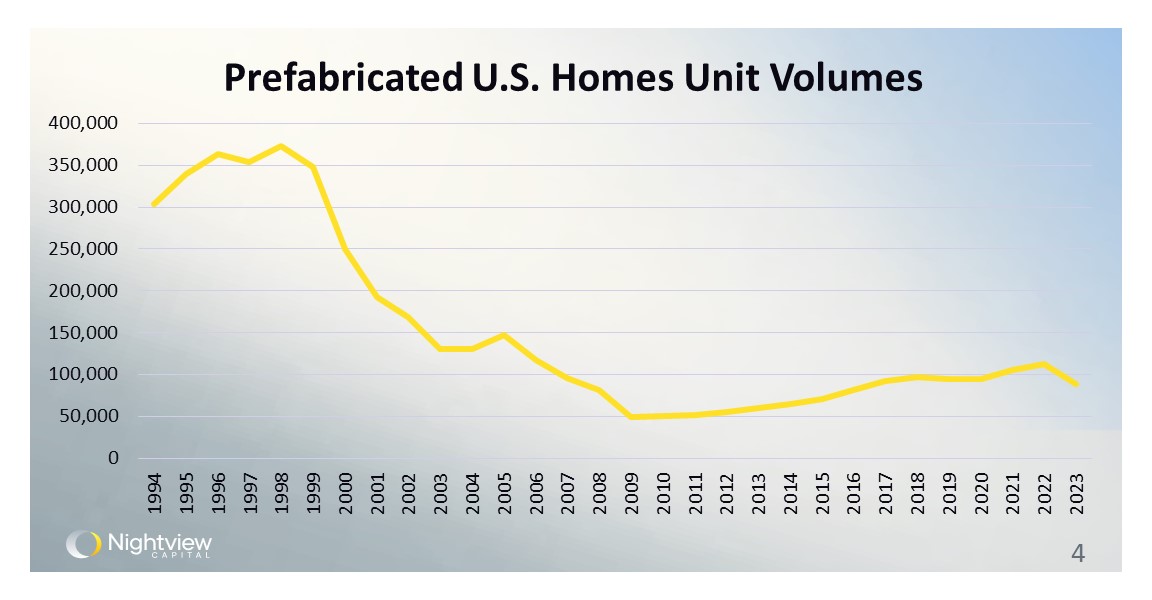

And prefabricated homes are getting shipped less

The fourth chart highlights a dramatic decline in the volume of prefabricated homes built annually in the U.S. In the late 1990s, the industry peaked with over 350,000 units per year. Fast forward to 2023, and that number has plummeted to under 100,000 units. Factors contributing to this decline include rising costs, market dynamics, and possibly a shift in consumer preferences. The stark reduction in prefabricated home production signifies broader challenges within the housing market, calling for innovative solutions to meet contemporary housing needs.

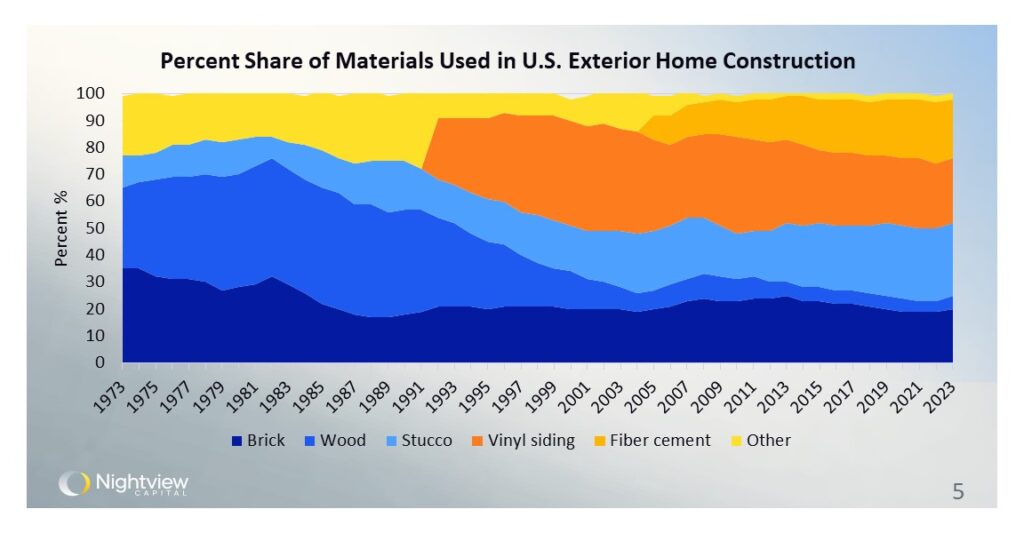

More homes are built with cheaper exterior materials, but it’s not moving the needle

The final chart examines the evolving landscape of materials used in U.S. home construction. Historically, homes were predominantly built with wood and brick. Today, vinyl siding and fiber cement have become increasingly popular. These modern materials offer distinct advantages in durability and maintenance, but don’t move the needle in terms of construction time. Vinyl siding is generally lower cost, but a further rethink of housing may be necessary to increase housing supply in the United States.

Wrap-up

The exploration of U.S. housing build rates through these five charts reveals a multifaceted and evolving narrative. From the rapid expansion of post-war Levittowns to the current landscape of extended build times, rising costs, and declining prefabricated home volumes, the data highlights significant challenges within the housing market. Historical trends showcase both the potential for rapid development and that the operational and regulatory hurdles that have slowed progress over time. The persistent increase in the cost of prefabricated homes, despite their initial promise as an affordable solution, underscores the need for innovation in housing construction.

Moreover, the shift towards modern construction materials like vinyl siding and fiber cement, while beneficial in terms of durability and maintenance, hasn’t effectively addressed the prolonged completion periods. As we navigate contemporary housing demands, it’s clear that addressing these issues will require not only innovative materials but also new approaches to construction practices and regulatory frameworks.