Welcome to Nightpixels, a visual blog about investing, business, and technology.

Nightpixels is published each week by Nightview Capital Research Analyst Cameron Tierney. Follow him here on X and Linkedin.

Sign up to receive weekly Nightview Capital updates below.

Error: Contact form not found.

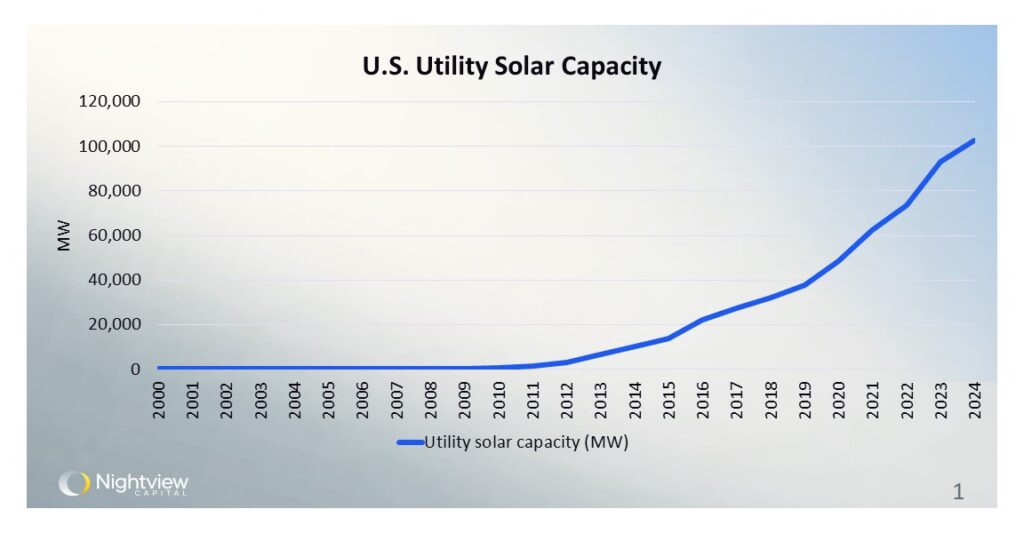

U.S. power utilities dramatically increased investment in solar over the last decade

Over the last decade, U.S. power utilities have significantly invested in solar capacity. As analysis of this chart indicates, around 2012, utility investment in solar energy generation assets exploded upward. As energy demands continue to soar due to exponential growth in computing needs from new workloads in AI, as well as increased electrification from vehicles to stoves, utilities will need to continue to expand their generation capacity. Continued investment in solar could provide the low-cost power they need to serve the grid.

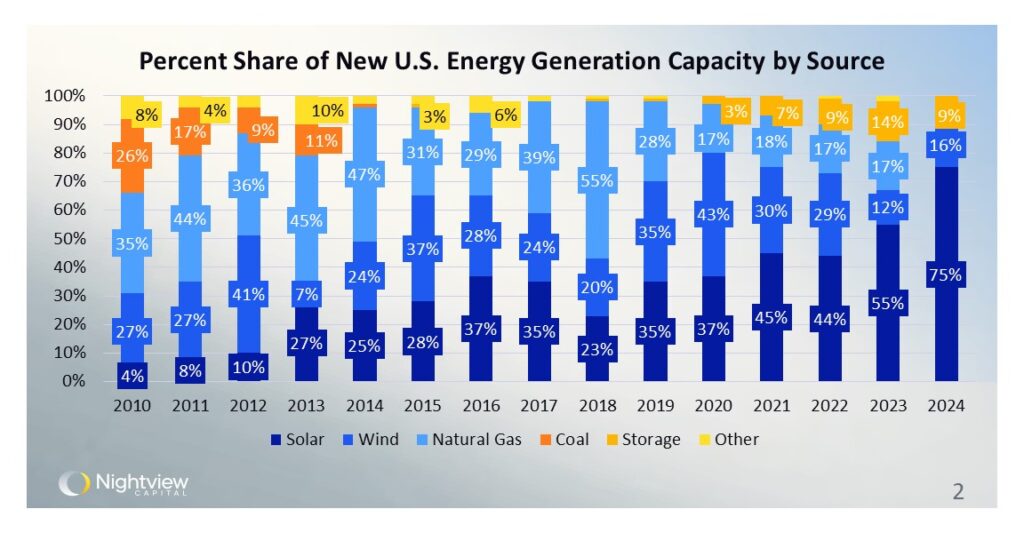

New U.S. energy generation projects are skewing heavily to solar

The trend in U.S. utility solar investment could have legs as in Q1, 75% of new energy generation capacity that came online was from solar photovoltaic generation assets. The data in this chart compliments the previous one nicely, showing how the annual U.S. deployment of energy generation assets has evolved over time. As solar first began gaining momentum in 2010, its share of new generation deployed was small at 4%. Over time, this has steadily crept up to the 75% figure in Q1 2024. A quick note on the data here: all data in this chart is annual, except for the 2024 figures, which reflect Q1 deployment data. According to this data source, new coal power plants are effectively nonexistent in the U.S. Additionally, battery storage is increasingly becoming a relevant part of the energy generation equation, nabbing nearly 10% share of energy assets deployed in Q1.

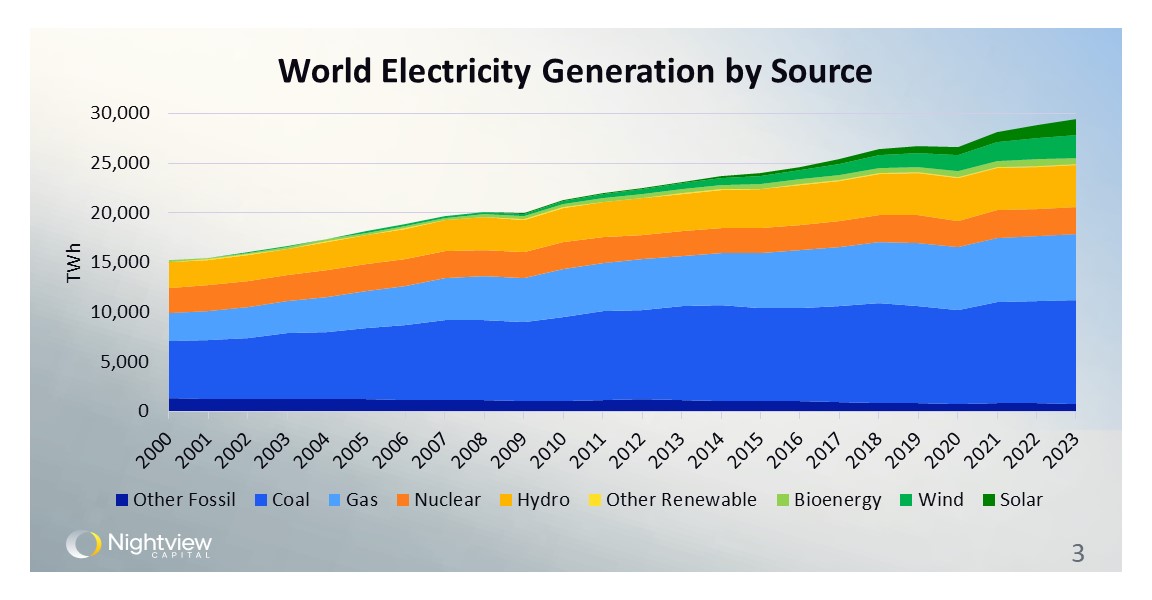

The world is still heavily reliant on fossil fuels

Zooming out, this data depicts the source of the entire globe’s energy generation needs over time. Again, solar has grown markedly in the last decade, but this global view demonstrates that the world still relies heavily on fossil fuels. Most sources of energy generation are growing globally — even coal and natural gas. Still, solar provides a low-cost, safe, clean technology for producing electricity, and we believe it will continue outpacing the growth of most other energy sources.

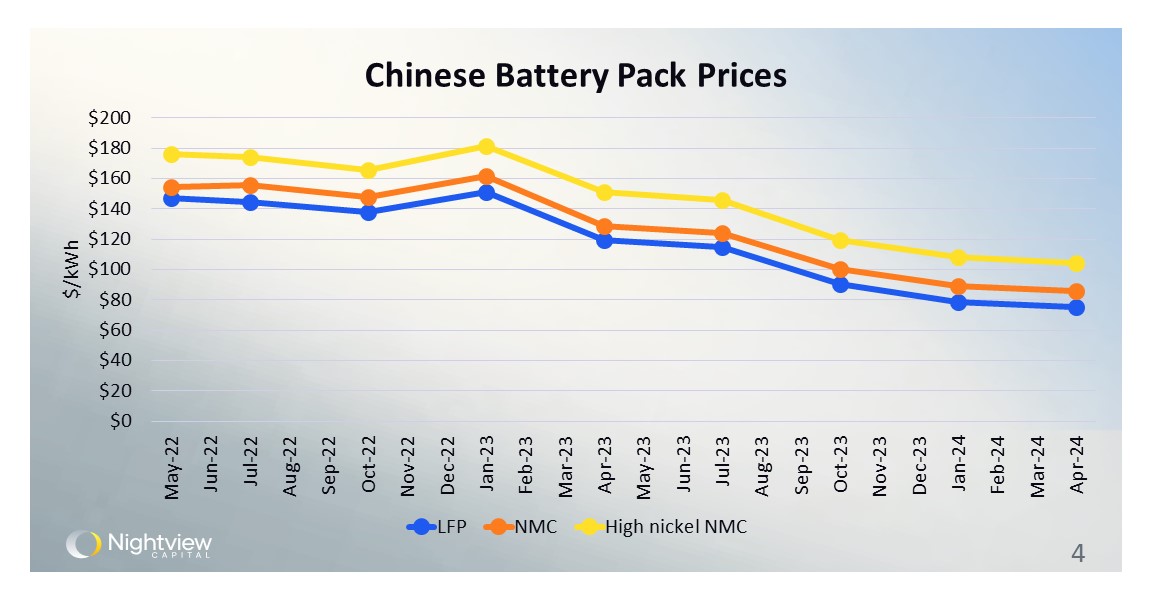

Battery pack prices are falling, which could help boost solar investment

Battery costs are also coming down, as depicted by the data in this graph. Depending on the measure, over 80% of the world’s batteries are produced in China, so Chinese battery pack costs are the most critical in the industry today. The chart is a more short-term look at battery pack prices as partitioned by cathode chemistry, but long-term cost reductions are also in play. In the context of the growth of solar energy generation, batteries play a huge role. Some estimates state that a solar + battery storage energy generation system can output double the amount of electricity as the same solar setup less the battery storage component. In other words, batteries increase the efficiency of solar systems and are key to getting the most out of them.

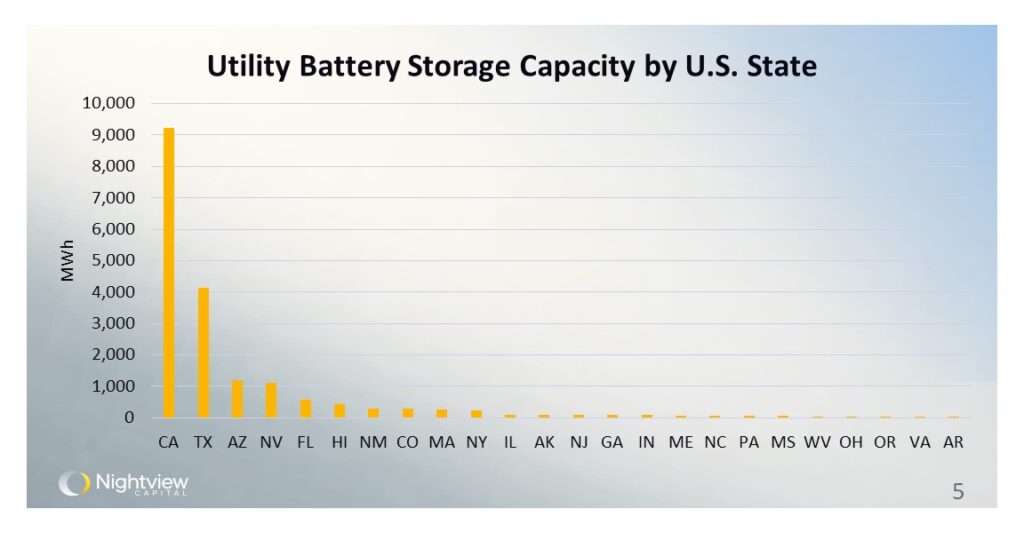

A handful of states have invested in significant utility-scale battery storage projects

Utilities in a handful of U.S. states have invested significantly in battery storage systems. As shown in this chart, California utilities unsurprisingly lead the pack. This data is cumulative across time, and is current as of Q1 2024. Although some states have outsize energy needs (like CA and TX), there is still lots tons of room for growth in commercial battery storage. As the prices of battery packs continues to come down, the financial calculus for power utilities could become too compelling to ignore. A combination of battery storage and solar could help address the growing power needs of the U.S. and the world.