Welcome to Nightpixels, a visual blog about investing, business, and technology. Each week the blog explores data-driven insights across five focus areas: Market Revolutions, AI Transformations, Future Hard Tech, Energy 2.0, and the Next-Gen Consumer.

Nightpixels is published each week by Nightview Capital Research Analyst Cameron Tierney. Follow him here on X and Linkedin.

Sign up to receive Nightview Capital updates below.

Error: Contact form not found.

The ten greatest acquisitions of all time

Market Revolutions

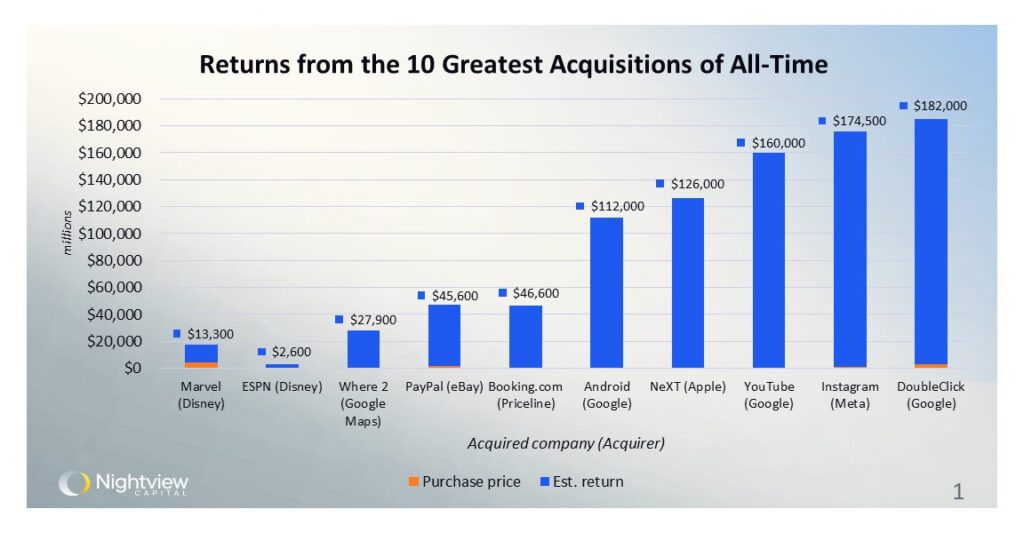

This data is charted from the Acquired podcast Season 6, Episode 3 and it showcases (arguably) the greatest corporate acquisitions of all time. The acquired company is labeled first, with the acquirer in parentheses. The full bars for each acquisition depict estimations for market value as of 2022 numbers, with the blue portion indicating the estimated equity return on the acquisition and the orange the original purchase price. The numerical labels on the top of each bar are only the equity return in millions. Unsurprisingly, YouTube, Instagram, and DoubleClick (precursor to Google’s ad platform) top the list. NeXT, which brought Steve Jobs back to Apple, is another significant highlight with $126 billion in returns.

Source

OpenAI revenue: $0 to $3B ARR in <2 years

AI Transformations

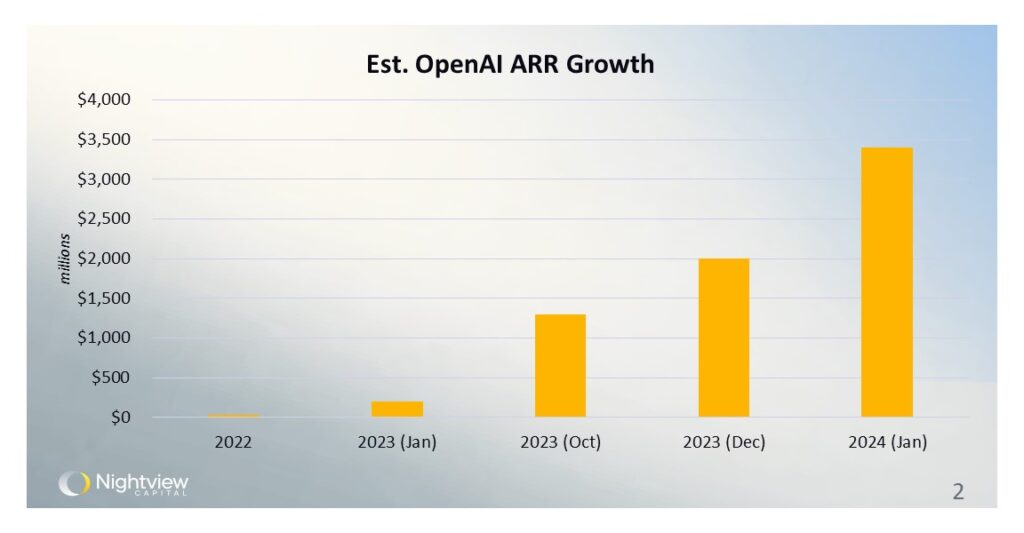

The chart illustrates OpenAI’s astounding reported revenue growth trajectory from 2022 to 2024. Starting with a modest $28 million in 2022, OpenAI’s annual recurring revenue surged to $3.4 billion by January 2024, reflecting an exponential growth rate since the consumer release of ChatGPT. The data underscores OpenAI’s expanding influence in the tech industry and its successful commercialization strategy, making it a pivotal player in the AI revolution. This growth trajectory is particularly notable given the relatively short time frame, but there are questions over the durability of this revenue as other LLMs catch up to GPT in performance.

Source

Video is the main driver of Apple Vision Pro sales (but product-market-fit is elusive)

Future Hard Tech

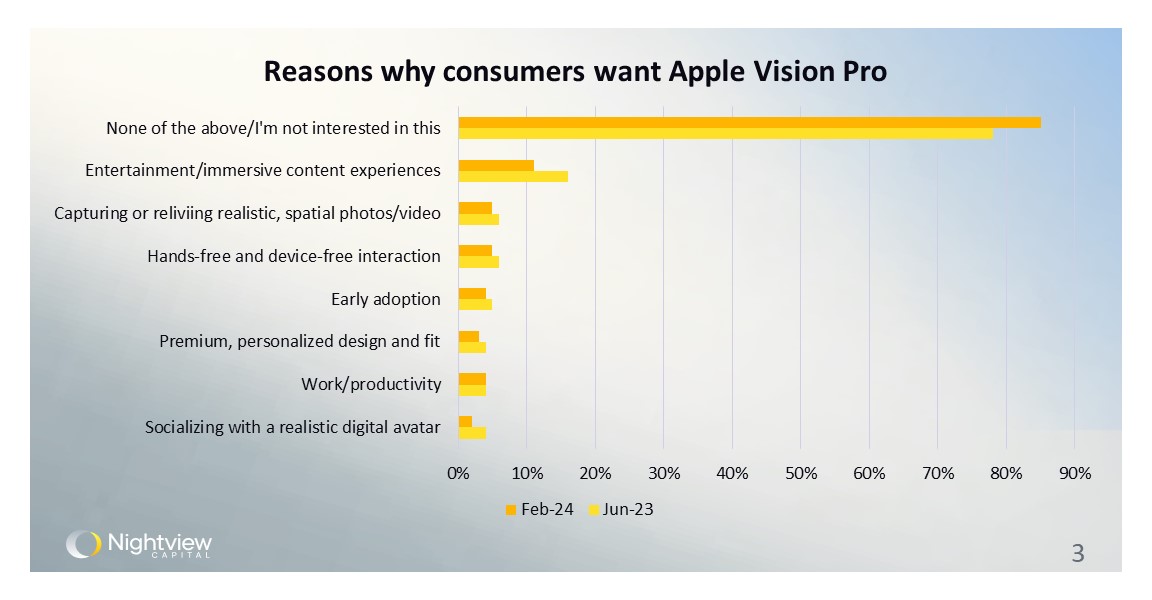

This chart details consumer interest in Apple’s $3,500 XR headset, Vision Pro. Notably, a significant portion of consumers (85% in February 2024) are not interested in purchasing the product. Of consumers who are interested in the product, entertainment and immersive content experiences (primarily immersive video) are the main drivers of interest in the product—as opposed to productivity or other functions. In June 2023, 16% of consumers surveyed said they were interested in the product for immersive entertainment experiences, which declined to 11% in February 2024. Another key takeaway is that as consumers have digested the release and reviews of the product, interest in it has declined. 78% of consumers surveyed initially said they weren’t interested in June 2023, and this number increased to 85% by February of 2024.

Source

U.S. EV inventory is concentrated in a select few states

Energy 2.0

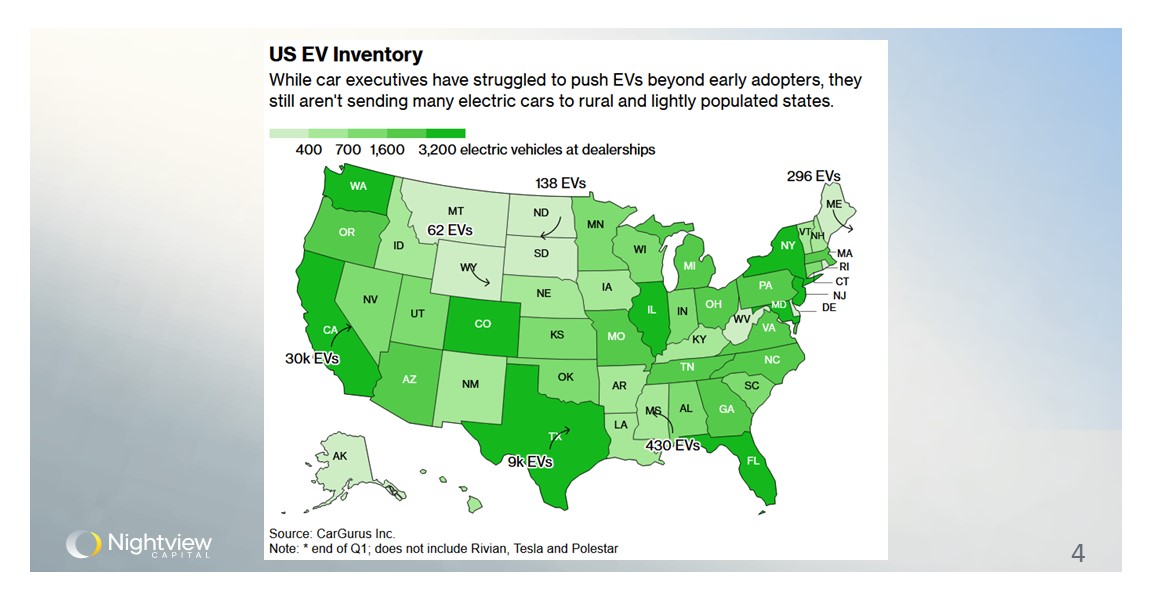

This map highlights the distribution of electric vehicle (EV) inventories at dealerships across the United States. California leads with 30,000 EVs, reflecting its strong market and supportive policies for green technology. In contrast, states like Wyoming and North Dakota have significantly fewer EVs, indicating a disparity in EV adoption across different regions. This uneven distribution points to challenges in expanding EV infrastructure and market penetration in less densely populated and rural areas. EV inventories are ultimately concentrated in just a few large, well-populated and generally wealthy states.

Source

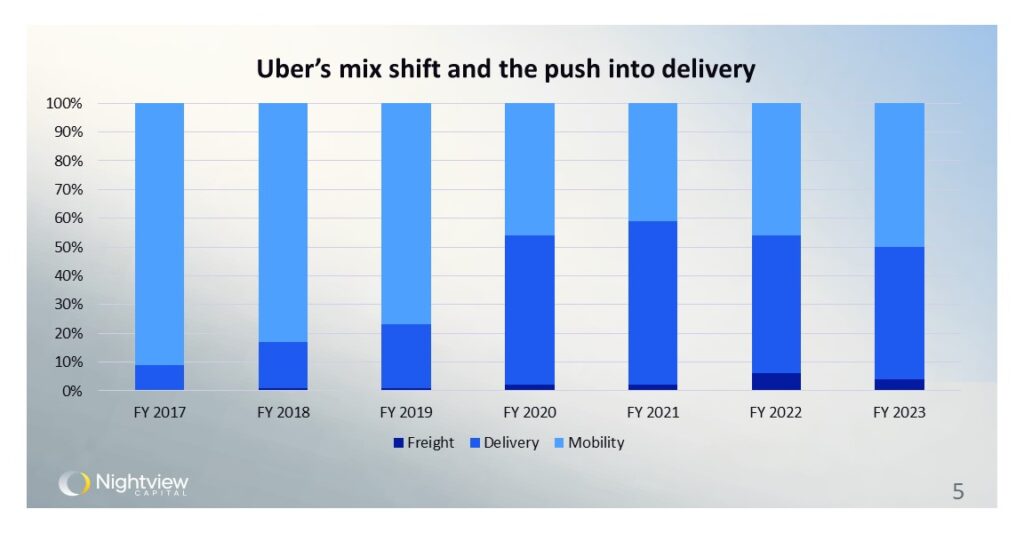

Uber’s expansion from mobility into delivery

Next Gen Consumer

This slide examines Uber’s evolving business model, showing a significant shift in its revenue mix from mobility to delivery services. From FY 2017 to FY 2023, the proportion of Uber’s revenue from mobility decreased from 91% to 50%, while delivery services surged to 46%, and freight services emerged at 4%. This diversification reflects Uber’s strategic pivot to capitalize on the growing demand for delivery services, particularly boosted by the pandemic. This diversification in revenue is an important benefit for Uber, which is no longer at the whims of a single business line for 90%+ of its revenue.

Source