Welcome to Nightpixels, a visual blog about investing, business, and technology.

Nightpixels is published each week by Nightview Capital Research Analyst Cameron Tierney. Follow him here on X and Linkedin.

Sign up to receive weekly Nightview Capital updates below.

Error: Contact form not found.

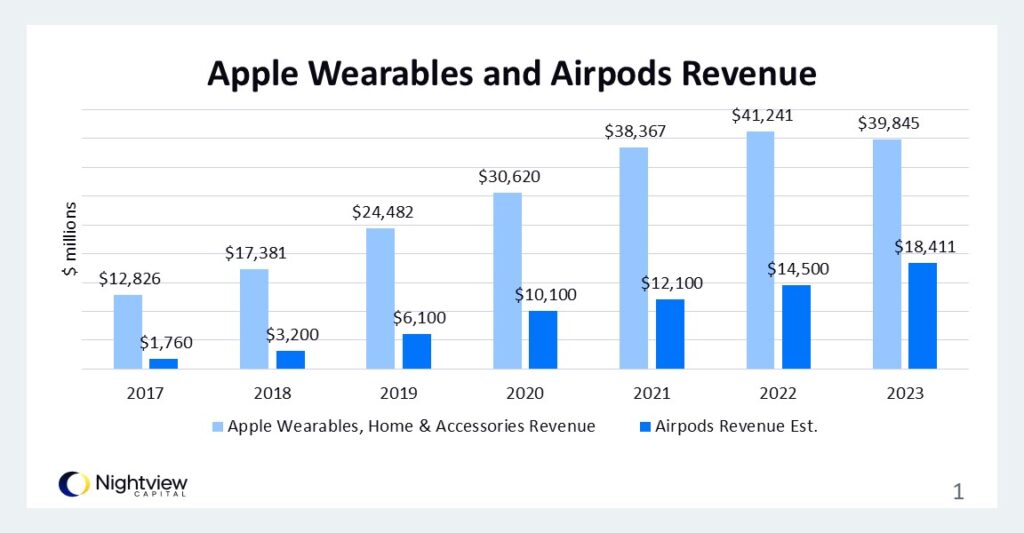

Airpods are a bright spot in Apple’s wearables division

Apple’s wearables segment has grown from $12.8 billion in revenue in 2017 to $40 billion in 2023. The segment primarily includes Apple Watch and Airpods, but also Apple TV and Homepod hardware. Software services sold via these devices is accounted for in a different segment of Apple’s business. Apple does not break out Airpods revenue itself, but estimates from third parties indicate the business has grown from under $2 billion in 2017 to over $18 billion in 2023, outpacing the growth of Apple’s broader wearables business. Airpods house specialize chips to communicate seamlessly with other Apple ecosystem devices like iPhones and Macs. Users can seamlessly play and pause audio as well as converse with the soon-to-be-AI-upgraded Siri.

Source 1: Bloomberg

Source 2

Source 3

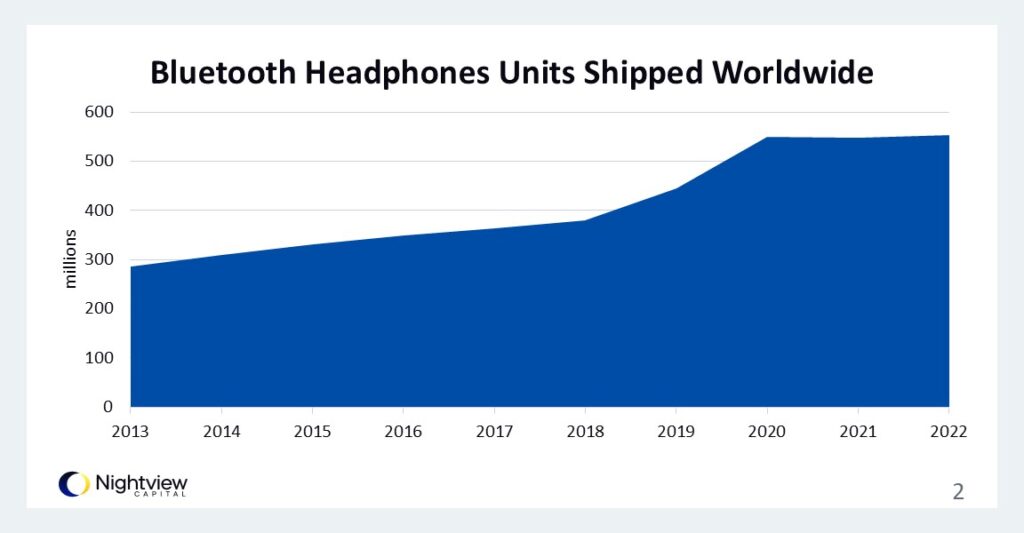

Bluetooth headphone shipments have plateaued

Interestingly, where Airpods are a bright spot for Apple’s wearables business, the broader Bluetooth headphones market has largely plateaued. Rising from under 300 million global units shipped in 2013 to a steady state 500 million units in 2020-2022, the market looks to have matured. If we compare this to Apple’s Airpods continuing to compound growth, a hypothesis we could derive from the data is that consumers want smart wearables and those devices are winning out. Basic Bluetooth headphones are a simple version of wearable consumer technology. But ultimately they’re not very smart pieces of tech. Airpods aren’t groundbreaking in that regard, but they do seamlessly integrate with iOS and Siri, providing a smart wearable feel.

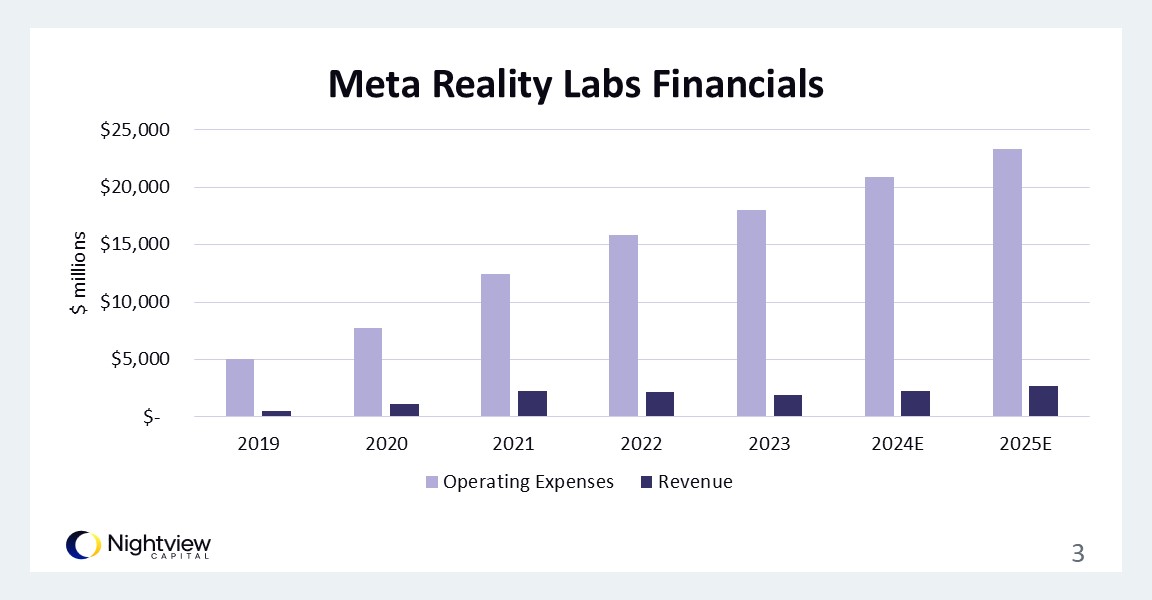

Meta is expecting to spend over $10 billion on AR in 2024

Meta’s Reality Labs division primarily includes its Quest VR headsets and Meta Ray Ban AI glasses. While revenue in the division has been relatively lackluster, especially considering the amount of capital expenditures the company has invested in the segment, the real story here is investment in a high-tech future. There are early signs that Meta’s AI Ray Ban glasses are a hit with consumers. Meta founder and CEO Mark Zuckerberg said on the company’s Q1 2024 earnings call that he initially thought the glasses form factor would not take off as a computing platform until holographic displays could be integrated into the hardware fashionably. Now, though, he says early indications are that a healthy niche of consumers are demanding a fashionable AI smart glasses product. To that end, Meta launched its Meta-AI-integrated smart glasses with Ray Ban housing in April of 2024. The glasses were initially launched in 2021 without AI features. Meta has said that it expects 50% of operating expenses within its Reality Labs division to go towards development of AR – i.e. smart glasses.

Source: Bloomberg

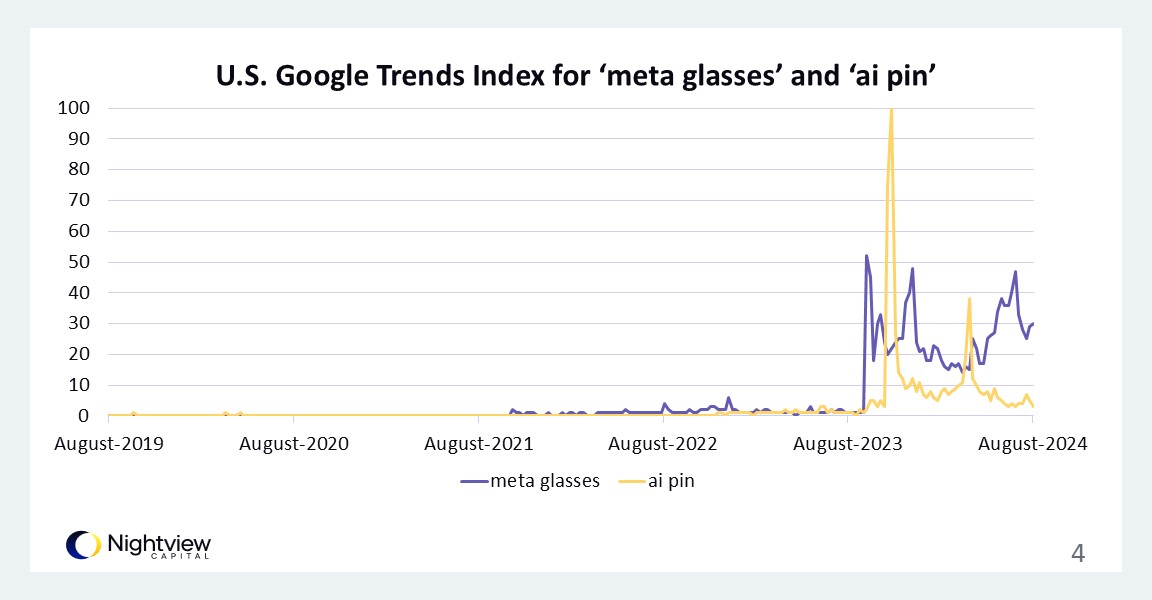

Consumer interest in AI wearables has spiked

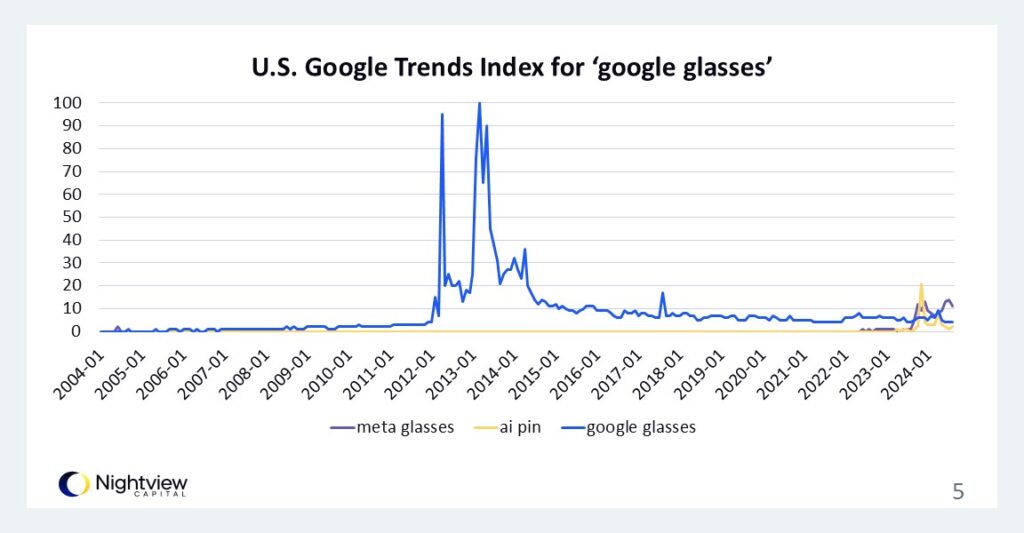

To further investigate consumer interest in smart wearables, this chart tracks Google Trends indexed search data for ‘meta glasses’ in purple and ‘ai pin’ in yellow. AI pins are small, wearable computing devices integrated with generative AI models and two-way audio meant to allow users to query AI hands-free. They burst onto the consumer tech scene last summer with several tech startups announcing products, hence the massive spike in the Trends data. However, as consumers and reviewers increasingly got their hands on the products, it became apparent they were likely not ready for prime time commercialization.

Devices were plagued by connectivity and functionality issues, falling short of delivering on a new customer value proposition. As such, consumer interest dwindled as depicted in the Trends data. Conversely, Meta launched version two of its smart glasses last summer, and updated them with AI functionality in April of this year. Consumer interest in this device has been much more sustained since the v2 launch. This contrast in consumer interest could indicate that consumers are absolutely ready for wearable smart devices as enabled by AI, but they’re going to gravitate towards devices that can actually deliver differentiated value over the existing suite of consumer devices. Hence, Meta investing 50% of Reality Labs’ operating expenses primarily in its glasses product.

Consumers are ready for new tech form factors: Google Glasses as a case study

Finally, this chart includes data from the previous chart’s search queries, but layers on trends data for ‘google glasses’. For readers who have not been following the consumer tech wearables market for over a decade, Google Glasses were an AR glasses prototype product introduced by Google around 2012-2013. They never were fully commercialized via widespread release, but they certainly generated a lot of buzz at a time when the world began reaching smartphone saturation. This was a time before LLMs and transformer models came onto the tech scene, so the functionality was similar to a smartphone. Still, the Trends data for Google Glasses trounces the index for Meta glasses and AI pin devices today, indicating that consumers are more than ready for new device form factors if tech companies can deliver.

Wrap-up

In wrapping up, the evolution of wearables, particularly within Apple’s ecosystem, showcases the importance of integrating smart technology into everyday devices. Apple’s success with AirPods, which have significantly outpaced the growth of the broader wearables market, is a testament to the consumer demand for devices that offer seamless functionality and smart capabilities. While the overall Bluetooth headphone market may have reached a plateau, AirPods continue to thrive, highlighting a shift towards more advanced, integrated devices.

On the other hand, Meta’s journey with its Reality Labs division offers a glimpse into the future of wearable technology, where AI plays a crucial role. The sustained interest in Meta’s AI-integrated smart glasses, despite the broader challenges faced by other wearable tech, signals that consumers are not just looking for new gadgets—they’re seeking meaningful, functional innovation. The contrasting trends between Meta’s glasses and the fleeting popularity of AI pins underscore the critical need for technology that not only intrigues but also delivers on its promises.

As we look forward, the intersection of AI and wearables will likely be a defining trend in consumer technology. Companies that can successfully blend smart functionality with practical, user-friendly design are poised to lead the next wave of innovation. Apple’s wearables success and Meta’s focused investment in AR glasses are just the beginning of what could be a transformative era for smart devices, where the emphasis shifts from merely wearable to truly indispensable.