Welcome to Nightpixels, a visual blog about investing, business, and technology.

Nightpixels is published each week by Nightview Capital Research Analyst Cameron Tierney. Follow him here on X and Linkedin.

Sign up to receive weekly Nightview Capital updates below.

Error: Contact form not found.

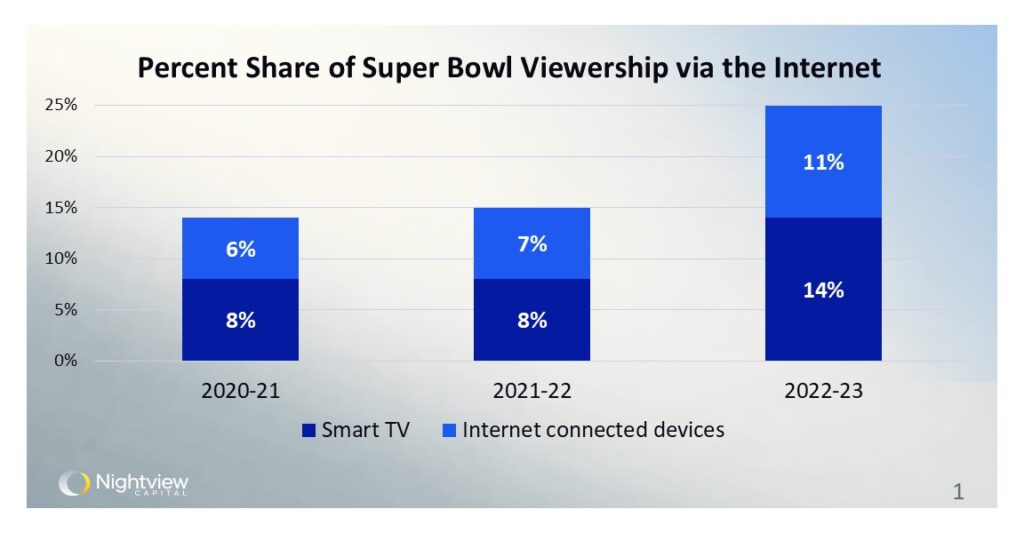

More people are streaming the Super Bowl over the Internet

First, let’s look at how a narrow slice of Super Bowl viewership has grown over time. In 2021, approximately 14% of viewers streamed the Super Bowl via the Internet as opposed to watching it on linear TV. By 2023, this figure had nearly doubled to 25%. This growth underscores the increasing acceptance and preference for streaming live events over the Internet, even for premier events like the Super Bowl. It highlights a broader trend where digital streaming is no longer just for on-demand content but is also becoming a primary medium for live broadcasts.

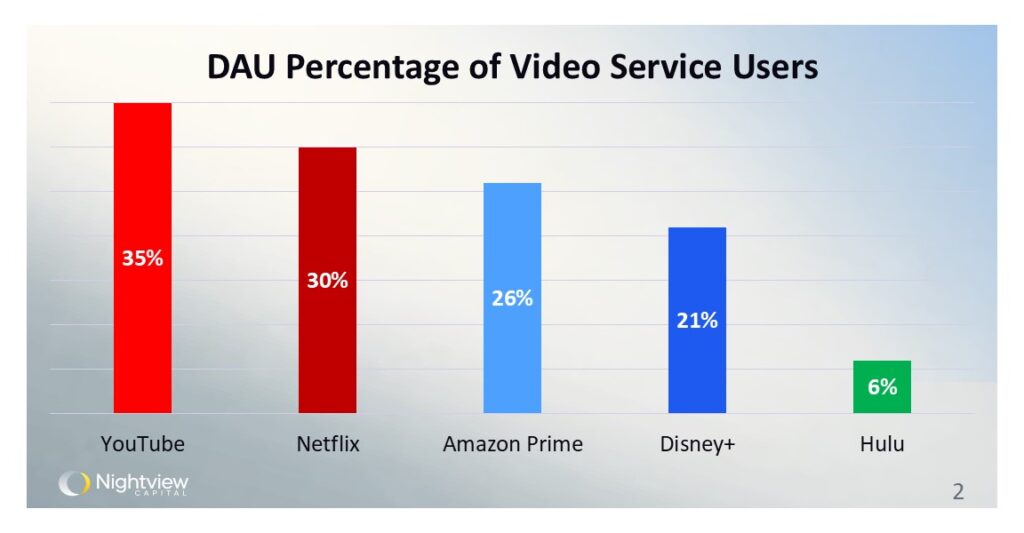

Engaged users might help build the best ads businesses

The next chart presents data on the daily active users (DAUs) across five digital video services, including four premium streaming services and YouTube, whose content is user-generated. YouTube, Netflix, and Amazon Prime lead the pack, with over 25% of their users engaging daily. In contrast, Disney+ and Hulu show lower daily engagement. This data emphasizes the dominant position of platforms like YouTube and Netflix in maintaining high daily user activity, which is crucial for sustained ad revenue. YouTube alone boasted a massive $31B ad business in 2023. As premium video streaming services like those in this chart look to build strong advertising businesses, engaged user bases are crucial.

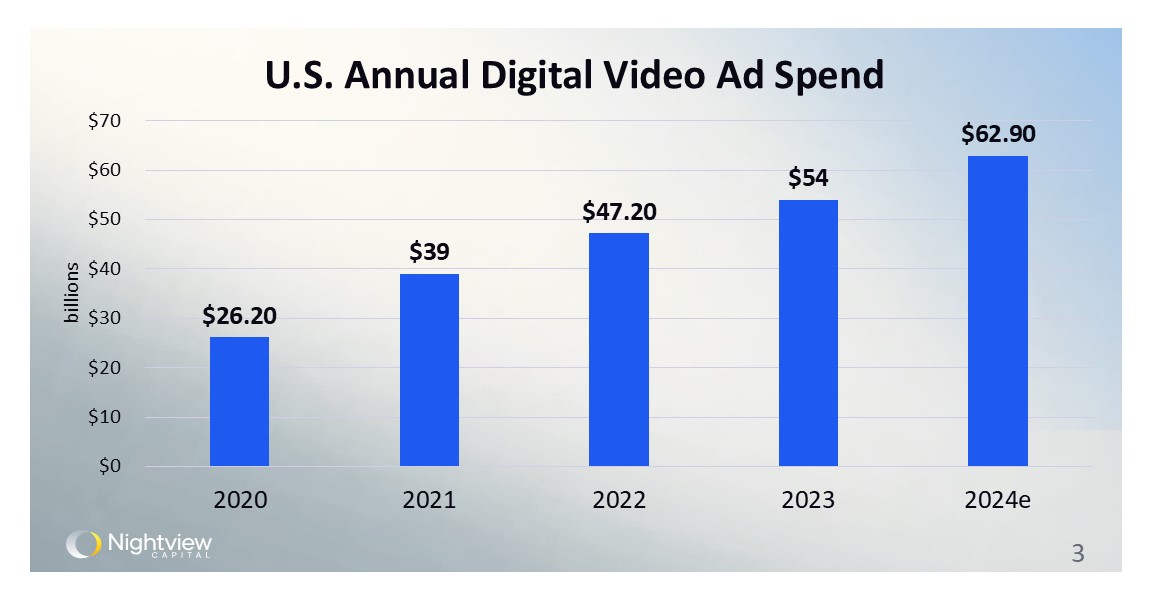

Digital video ad spend is on the rise

The third chart highlights the surge in digital video ad spending in the U.S., which grew from $26 billion in 2020 to an expected $63 billion in 2024. This rapid increase reflects the broader shift of consumer attention to digital platforms, creating more opportunities for advertisers to reach their target audiences. The growth in ad spending could be closely linked to the prominent daily usage of video apps, offering more eyeballs for advertisers and justifying higher CPMs (cost per thousand impressions).

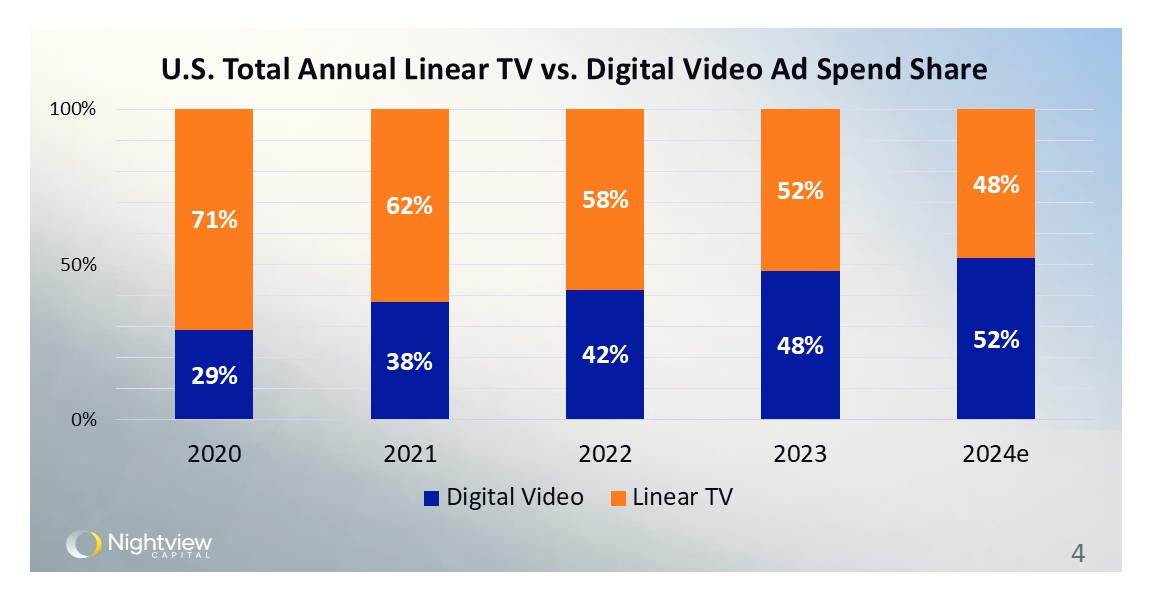

Digital video ad spend could overtake linear TV for the first time this year

Digital video ad spending is poised to surpass linear TV ad spending for the first time in 2024. In 2020, digital video accounted for only 29% of total video ad spend. By 2024, it is projected to exceed 50%. This transition marks a significant change in the advertising industry, where digital platforms are becoming the primary avenue for video ad investments. The cultural significance of linear TV, especially during events like the Super Bowl, may diminish as advertisers shift their budgets more to more targeted digital ads.

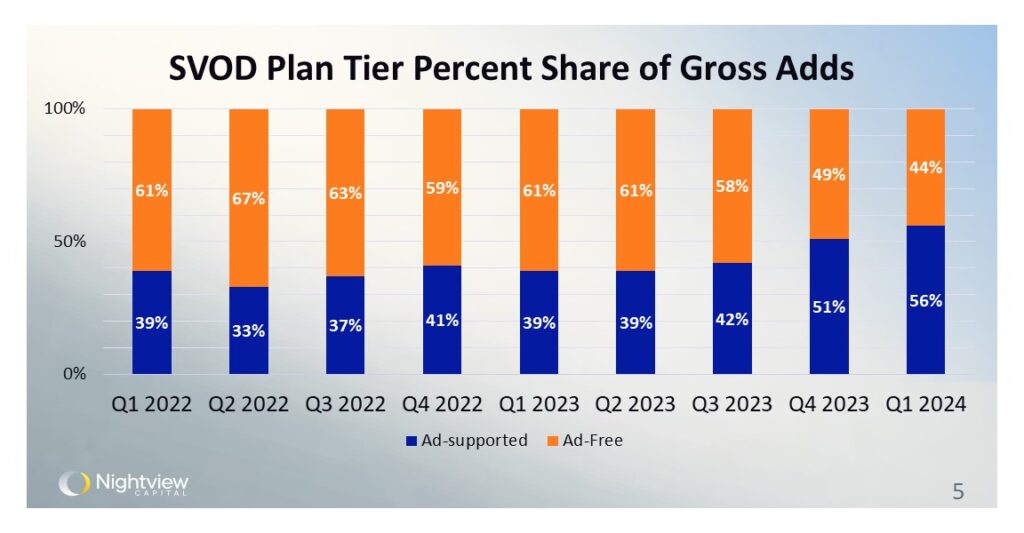

Premium video services are now adding more ad-supported users than ad-free subscribers

Finally, let’s investigate the rise of ad-supported streaming tiers. Back in Q1 2022, the majority of new subscribers were opting for premium, ad-free plans. However, by Q1 2024, over 50% of new subscribers chose ad-supported plans, reaching 56%. This trend indicates a growing consumer acceptance of ad-supported models, driven by the lower subscription costs. The increase in ad-supported subscriptions translates into more ad impressions, further fueling the growth of digital video ad revenue.

Wrap-up

In summary, the video streaming landscape is undergoing transformative changes. From the doubling of Super Bowl streaming viewership to the rise of daily active users on major platforms, digital streaming is becoming the new norm. The substantial increase in digital video ad spending, poised to overtake linear TV, highlights the shifting priorities of advertisers. Furthermore, the growing preference for ad-supported streaming tiers demonstrates a balance between cost-conscious consumers and the need for ad revenue to support subscription revenue. Together, these trends paint a picture of a future where digital video dominates, offering more opportunities for advertisers and more choices for viewers.