Get our latest thinking straight to your inbox.

Nightview Capital is an investment management firm focused solely on publicly traded equities. Our approach is based on in-depth, fundamental research and a forward-looking, long-term perspective.

While primarily focused on identifying growth companies that can be held for prolonged periods, we will also invest in traditional value stocks or other unique opportunities.

As an active manager our collective mission is simple: to outperform the S&P 500 Total Return Index over a rolling 5-year period by uncovering and capitalizing on what we believe to be the best risk-adjusted opportunities in the market.

01

Seek Long-Term Outperformance

02

Desire Liquidity, Tax-Efficiency, Transparency

03

Have a 5+ Year Time Horizon

We believe achieving long-term outperformance is possible with the right approach and mindset. Deep research, unconventional thinking, and strong conviction are the cornerstones of our philosophy. Reliable and repeatable outperformance over a multi-year period is what we seek to accomplish.

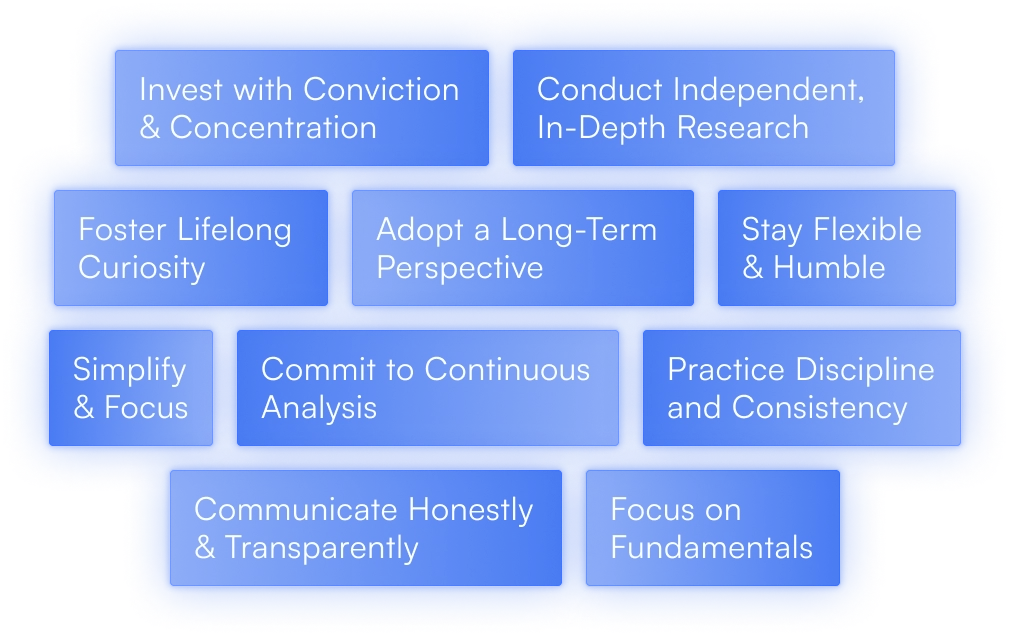

Ten core principles guide our philosophy, influencing every step of our process, from research to portfolio decisions.

As investors, we operate on a simple belief: the stock market makes mistakes, and all companies are mispriced to some degree. Our goal is to capitalize on its biggest—and often less obvious—errors.

To do so we believe it is imperative to have an edge, and we seek to obtain one in two main areas:

To do so we believe it is imperative to have an edge, and we seek to obtain one in two main areas:

Our research methodology is underpinned by sustainability, accountability, and continuous learning. We seek to generate long-term outperformance through a system that proactively identifies both opportunities and potential risks.

We utilize a structured, deliberate, and collaborative process that employs a thematic, top-down approach to identify potentially attractive sectors to research, and a fundamental, bottom-up approach to identify individual securities to ultimately invest in.

Identify segments believed to offer compelling long-term opportunities, emphasizing secular trends, new technologies, cyclical sectors entering recovery, and innovative business models.

Gain a comprehensive understanding of segment by mapping the value chain, identifying all players, assessing margin structures, and evaluating growth potential alongside associated risks/rewards.

Employ rigorous quantitative and qualitative research to discern companies most likely to benefit, focusing on growth rates, competitive advantages, value propositions, and management quality.

Perform forward looking valuations grounded in proprietary research, focusing where our expectations materially diverge from consensus to uncover potentially undervalued opportunities.

Investment team scrutinizes assumptions, evaluates risk/return potential, and determines conviction level with CIO having final say on decisions, position sizing, and strategic execution.

Maintain vigilant oversight of investments and industry developments, continually refining assumptions and valuations in response to new data or emerging trends.

After many years of studying businesses, we have come to believe that certain key traits consistently form the foundation for long-term success. While no company embodies every ideal characteristic, these attributes guide our evaluation process and investment decisions.

Relentless focus on customer-centricity and continuous enhancement of their products and/or services.

Capable of scaling efficiently to meet demand with the potential for rapid global expansion.

Function as critical conduits, bridging the gap between mass consumers and product or service providers.

Leadership with integrity, personal stakes in the business, and a demonstrated ability to allocate capital effectively.

Supported by secular growth trends or possessing unique advantages that can facilitate indefinite expansion.

Diversified revenue streams and/or clear strategies to branch into new business lines.

In line with Warren Buffett’s philosophy: “What is smart at one price is stupid at another”.

Our goal is to position the portfolio based on where we believe company values will be over a five-year period, avoiding market timing or sentiment-driven decisions. We prioritize long-term returns over short-term price movements and are willing to accept temporary underperformance to achieve asymmetric outcomes.

We define risk as the mismatch between our conviction in an investment and its actual long-term outcomes. Instead of relying on volatility or backward-looking metrics, we take a forward-looking approach, balancing conviction with the potential upside and downside of each position. At the portfolio level, this means managing concentrated conviction to capture outsized returns.

Return Generation

We seek to add value and drive returns in three ways:

Segment Selection

Through the “top down” phase of our research process we seek to identify industries, sectors, or subsectors we believe are attractive and provide compelling returns on a forward-looking basis.

Individual Security Selection

Through the “bottom up” phase we seek to invest in what we believe are the most compelling individual stocks within a given segment we target.

Position Weightings

Based on our analysis and valuation, we overweight positions we believe provide the most compelling risk-adjusted opportunities.

Self Discipline

[ 01 ]

The position is approaching, meeting, or exceeding our valuation target

[ 02 ]

We believe we made a mistake in our evaluation and analysis

[ 03 ]

We believe there is better use for the capital

Arne Alsin

Chief Investment

Officer

Daniel F. Crowley, CFA

Portfolio Manager,

Managing Partner

Eric Markowitz

Director of Research,

Managing Partner

Zak Lash, CFA

COO,

Managing Partner

The strategy is growth oriented and concentrated. Position weightings are based on the firm’s analysis and assessment of potential upside and level of conviction in each. A material percentage of strategy assets may be invested in its top 5-10 holdings.

Focus

Domestic (U.S.)

Strategy AUM

$30 mm

Market Cap

& Sector

Agnostic

# of Holdings

20

Leverage

N/A

Management Fee

1.25%

Annualized Performance | Inception July 1, 2012

The strategy seeks long-term capital appreciation with the goal of outperforming the S&P 500 Total Return Index over a rolling 5-year period.

As of September 30, 2025 | Past performance is not indicative of future results. See below for additional disclosures.

Click the button above for additional disclosures.

Top 10 Holdings

AS OF 09/30/2025 Updated quarterly, subject to change.

| Company Name | Sector | % of Net Assets | |

| 1 | TESLA INC. | Clean Energy/EV, AI | 15.46% |

| 2 | AMAZON | E-commerce, Cloud | 10.70% |

| 3 | ALIBABA | E-commerce, Cloud | 9.88% |

| 4 | WYNN RESORTS LTD. | Resorts, Casinos | 6.18% |

| 5 | ALPHABET INC. | AI, Search, Cloud | 4.30% |

| 6 | TAIWAN SEMICONDUCTOR MFG. CO. | Semiconductors | 3.87% |

| 7 | ADVANCED MICRO DEVICES INC. | Semiconductors | 3.81% |

| 8 | GOLDMAN SACHS | Financial Services | 3.78% |

| 9 | LAS VEGAS SANDS | Resorts, Casinos | 3.78% |

| 10 | MGM RESORTS | Resorts, Casinos | 3.61% |

| Total Top 10 Holdings | 65.37% | ||

As of September 30, 2025. Past performance is no guarantee of future results. Returns for periods greater than one year are annualized. Please see below and click the button for Fact Sheet containing Composite Performance Presentation and additional information and disclosures.

Past performance is not a guarantee or indicator of future results. The performance information shown for Long Only Equity Growth Fund is calculated net of fees and expenses. The performance figures are for investments made at the inception of the Fund and include the reinvestment of dividends, interest, and other earnings. An individual investor’s actual returns may differ from the results shown above for reasons such as the timing of subscriptions and redemptions. Past performance is not an indication of future performance and there can be no assurance that either Fund will meet its investment objectives or achieve results in line with those presented in these materials. The performance results are unaudited and subject to change. These materials are for informational use only and should not be considered investment advice or an offer to sell any product. The information discussed and shown here is not a recommendation to buy or sell a particular security or to invest in any particular sector. Forward-looking statements are not guaranteed. You should not assume that any of the securities transactions, sectors or holdings discussed in these reports are or will be profitable, or that recommendations Nightview make in the future will be profitable or equal the performance of the securities discussed. There is no assurance that any securities, sectors or industries discussed herein will be included or excluded from a client’s portfolio. Nightview reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The discussions, outlooks and viewpoints featured are not intended to be investment advice and do not take into account specific client investment objectives. The S&P 500 TR is provided for illustrative purposes only, is unmanaged, reflects reinvestment of income and dividends and does not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund. For example, a fund may typically hold substantially fewer securities than are contained in an index. Indices also may contain securities or types of securities that are not comparable to those traded by a hedge fund. Therefore, a hedge fund’s performance may differ substantially from the performance of an index. Because of these differences, indices should not be relied upon as an accurate measure of comparison. In addition, data used in the benchmarks are obtained from sources considered to be reliable, but Nightview makes no representations or guarantees with regard to the accuracy of such data.